Do you have difficulty recognizing high-probability trading setups? Do you want to increase your win ratio and trade like a professional? If yes, then mastering the ICT Bearish Order Block is a game-changer for you!

In this article, we will discuss everything you need to know about the ICT Bearish Order Block. How it is formed and identified and implementable trading strategies. By the end of this article, you will feel confident and precise about spotting bearish order blocks and trading them. Let’s get started!

What is an ICT Bearish Order Block?

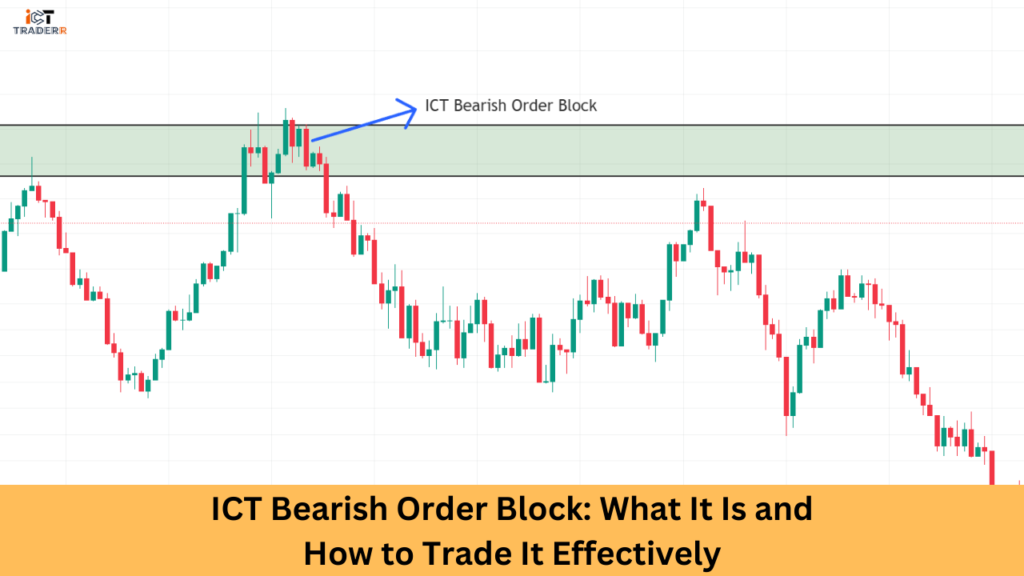

An ICT Bearish Order Block is a specific area on a price chart where smart money (major institutions like banks) put in many large sell orders that lead to a strong, sudden bear move in the market. Retail traders can follow these footprints of smart money and match their trades with the leading direction of the market.

In simple words, a bearish order block is a bullish candle followed by a strong bearish engulfing candle. This pattern shows a shift in market sentiment from bullish to bearish, creating a high-probability trading opportunity for you.

How to Identify an ICT Bearish Order Block

Identifying a valid bearish order block requires attention to detail. Here’s a step-by-step breakdown:

The first candle is bullish and the second candle is bearish and engulfs the first candle (the body and the wicks).

A bearish candle must close below the low of a bullish candle.

The Bearish candle should grab the high of the previous Bullish candle, showing that there was strong selling pressure.

Go down to lower timeframes (5-minute, 15-minute charts) and look for an imbalance or structure shift to confirm.

Bearish order blocks are trusted best during a bearish market trend. They may enter into a phase of temporary retracement during a bullish trend.

How to Trade Bearish Order Block Effectively

To maximize profits and minimize risks for trading ICT bearish order blocks, follow these steps:

- Confirm that the market is on a bearish trend. Increased reliability of the bearish order block is possible.

- Look at the earlier explanation, it has a two-candle pattern (bullish followed by bearish engulfing).

- After identifying the bearish order block, you will have to wait for the price to retest it. This will be your entry opportunity.

- Consider entering a sell trade around 50% retracement levels of the bearish order block.

Also, add other confirmations like ICT Market Structure Shift or imbalance in lower timeframes.

- Place your stop loss 10-20 pips above the high of the bearish order block.

- Take your profit to the next significant liquidity zone, or use a 1:2 or 1:3 risk-to-reward ratio.

Common Mistakes Traders Make with Bearish

Avoiding these common mistakes can improve your trading success rate:

Ignoring the Market Context

Trading against the bearish order blocks in a bullish trend can lead one to losses. Therefore Confirm the trend of the entire market.

Neglecting Confirmations

Order blocks should not be traded without other confirmations such as a market structure shift or an imbalance that can reduce accuracy.

Poor Risk Management

Setting stop loss and take profit levels should be to avoid disastrous losses.

Overtrading

Not every order block gives a trading opportunity. Be patient and wait for the setups with the highest probabilities.

Conclusion

The ICT Bearish Order Block is a powerful trading tool for a trader wishing to make money in trading by aligning with smart money. Master its identification and application, and you will increase your winning ratio and trade with greater confidence.

Remember, practice is key. Dedicate time to study charts, back-test strategies, and hone your skills. Soon, you will be using bearish order blocks like a pro!

FAQs

What is the best timeframe to trade bearish order blocks?

Higher timeframes (daily, 4-hour) are ideal for identifying order blocks, while lower timeframes (15-minute, 5-minute) can be used for precise entries.

Can I use bearish order blocks in a bullish trend?

While possible, bearish order blocks are less reliable in bullish trends. They may act as liquidity zones rather than reversal points.

How do I confirm a bearish order block?

Look for additional confirmations like market structure shifts, imbalances, or lower timeframe signals.