In the dynamic world of forex trading, one term has been gaining significant attention among smart traders — ICT Liquidity Sweep. Understanding how institutional traders operate can give retail traders a competitive edge. All traders wishing to trade profitably in the markets should understand how liquidity sweeps work so that they do not become prey to institutional traps.

In this article, we will explain the concept of liquidity in trading, explore what is a liquidity sweep, and learn how institutions use it to trap retail traders. Additionally, we’ll talk about practical strategies for successfully trading ICT liquidity sweeps.

Understanding Liquidity in Trading

Before diving into the concept of liquidity sweeps, it is important to understand liquidity itself. Liquidity is the extent to which an asset can go into or out of a market without a huge price change. The higher the liquidity, the more buyers and sellers there are, thus making it easier to execute trades at a faster pace. In contrast, low liquidity can have slippage and wider bid-ask spreads.

Institutional traders depend primarily on liquidity in executing large orders without making any drastic movement in the market. They attract liquid zones in their search because they are levels of high liquidity, like the support and resistance levels, where stop-loss orders are mostly consolidated. Knowing something about liquidity will help retail traders understand the indicators that would give them an idea of where institutions might come in and manipulate price action.

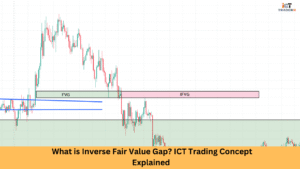

What is a Liquidity Sweep?

A liquidity sweep is a rapid price movement phenomenon in the market where price levels “sweep” out liquidity to turn in the opposite direction later. It is one of the strategies widely adopted by institutional traders to trigger stop-loss orders or take-profit levels of retail investors. Simply put, institutions create an artificial breakout to trap retail traders and then reverse the price to their advantage.

For example, if there happens to be a significant resistance level that has cluster-buy-stop orders accumulated above it, the institutions would most likely “burst” through the level to trigger those buy-stop orders. After sending the market running from that liquidity-swept price, it would come bouncing back down to leave retail traders trapped on the wrong side of the trade.

How Institutions Use Liquidity to Trap Retail Traders

Institutional traders are masters of market manipulation. They use liquidity sweeps to their advantage by:

Identifying Key Levels: Institutions look at the market to find places where retail traders have put their stop-loss or take-profit orders. Such levels correspond with technical levels like support resistance, or even trendlines.

Creating False Breakouts: By pushing the price over the key levels, the internal institutions trigger stop-loss orders that cascade into market orders that further drive the price.

Reversing the Price: After liquidity has been swept, institutions usually then reverse the price; a strong move in the other direction generally follows this. The unfortunate victim here would be the retail trader whose orders are left hanging in losing positions while institutions cash in on the price reversal.

Understanding this dynamic is important for retail traders to avoid being caught in these traps.

How to Identify a Liquidity Sweep?

Recognizing a liquidity sweep entails technical analysis and the grasping of market structure. Below are some of the important steps involved in identifying a liquidity sweep.

Look for Key Levels

Notice a level of support and resistance trends where stop-loss orders may be clustered, or trend lines or Fibonacci levels for that matter.

Look for Liquidity Sweeps on False Breakouts

The price breaking a key level and then quickly reversing could indicate a liquidity sweep. Watch for candlestick patterns that show clear rejection, turning wicks, or engulfing candles.

Volume Analysis

A big increase in volume at the time of a breakout means institutional activity was taking place. Buying suddenly dried up after the sweep occurred, giving further confirmation of a reversal.

Order Flow Tools

Using an order flow for analysis, more advanced traders track where big orders are going through, thereby suggesting institutional activity.

Understanding Buy-Side and Sell-Side Liquidity

To get into liquidity sweeps, it is important first to understand the concepts of buy-side liquidity and sell-side liquidity.

Buy-Side Liquidity

Buy-side liquidity is the pool of buy orders (or the stop-loss orders) set above a certain point. Institutions take up this buy-side liquidity and push the price up to trigger all those buy orders before they reverse the price move.

Sell-Side Liquidity

Sell-side liquidity is the pool of sell orders (or thus stop-loss orders) set below a certain point. For instance, the institutions would push the prices down to trigger these orders before reverting to push them back upwards.

Understanding where buy-side and sell-side liquidity is concentrated allows you to anticipate potential liquidity sweeps and position themselves accordingly.

Trading Strategies for ICT Liquidity Sweeps

What do liquidity-sweeping trading strategies require? An absolute data and wise trading for being incredibly disciplined and most importantly patient-growing enough in knowing how the market works through order blocks. Here are some strategies you can consider:

Step 1: Wait For Confirmation

Never enter the trade after a price breaks any significant level. Confirm, for example, with a reversal candlestick pattern or a break of structure before entering into a trade.

Step 2: Use Good Stop-Loss Order

Place your stop-loss orders outside the major liquidity zones to avoid being swept out through the manipulation of institutions.

Step 3: Trade the Reversal

Once a liquidity sweep occurs, seek an entry opportunity for trading following the reversal. It may be through a retracement or break of structure.

Step 4: Combine with Others

Use additional tools, such as moving averages, RSI, and volume profiles, to confirm his analysis and enhance his chances of success.

Conclusion

The ICT Liquidity Sweep is an interesting concept that exposes some of the huge, institutional trader ways in encapsulation. The basic idea is that by understanding liquidity and identifying liquidity sweeps, retail traders can avoid entrapments and even take advantage of market moves. Don’t forget that trading is not only about making predictions on price direction it is also about understanding the machinations of the market underneath and positioning oneself accordingly.

You can unlock the secrets of institutional trading and take your trading to the next level by understanding buy-side and sell-side liquidity, using technical analysis to identify key levels, and developing disciplined trading strategies.

FAQs

What is the difference between the liquidity sweep and stop hunt?

A liquidity sweep targets wholes in broader areas of liquidity. A stop hunt targets just firing off stop-loss orders without stopping there. Both are tactics employed by institutions to manipulate price action.

Can retail traders take advantage of liquidity sweeps?

Yes, they could take advantage of them because identifying liquidity zones and waiting for a confirmation sweep could help retail traders place orders to possibly benefit from the following reversal.

How do I know if the breakout is real or just a liquidity sweep?

Real breakouts usually occur with a strong volume behind them, followed by some follow-through; liquidity sweeps, on the other hand, tend to revert quickly with a lack of momentum behind them.

Which tools can I use to identify liquidity sweeps?

You could use tools to identify such liquidity sweeps as order flow analysis, volume profiles, and candlestick patterns to detect the possibility of liquidity sweeps.