In trading, understanding market inefficiencies and price discrepancies is important in making the right trading decisions. One such idea that has grown wings among traders, especially following the ICT or Inner Circle Trader method, is the Implied Fair Value Gap (IFVG). In this article we will explain the nature of IFVG, how to spot and trade it correctly, how it differs from the traditional fair value gap, mistakes traders make, and others. After reading this article, you will have everything you need to understand what IFVG means and how to implement it in the trading strategy you apply.

So let’s dive into the Implied Fair Value Gap in ICT trading and catch it on smart trades.

What is ICT Implied Fair value Gap (IFVG)

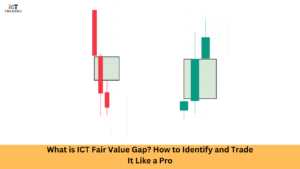

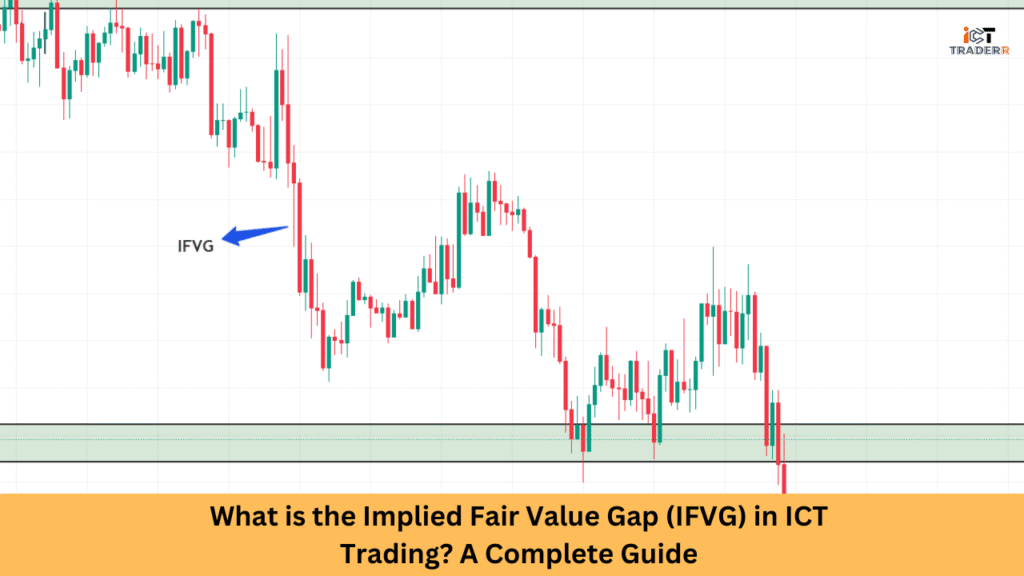

The Implied Fair Value Gap (IFVG) is a concept in the ICT (Inner Circle Trader) methodology defined by Michael J. Huddleston it concerns price imbalances, which are not visually evident on the chart, contrary to its conventional Fair Value Gap (FVG) forms which usually provide itself in form of candle formations.

In simple words, an IFVG is when the market has moved too fast from one level to the next thus leaving an untraded price level whose associated volume and market efficiency are not creating an imbalance. Thus this gap indicates a region where the price should return to “rebalance” the inefficiency.

Why It Matters:

IFVGs are hidden clues in the behavior of institutions regarding trading.

They can predict potential reversal zones or continuation trades.

They are part of smart money concepts that help create high-probability setups of trades.

How to Identify ICT Implied Fair Value Gap (IFVG) Like a Professional Trader

Unlike standard FVGs, IFVGs require a lot of experience and a good level of skill to spot. Here is how to get the trained to spot them like a pro:

Order flow analysis

Search for impulsive or sudden expansion movements in the market since most of these bring the idea of an institutional involvement creating possible IFVG zones for you.

Look for hidden inefficiencies.

Normally, there are gaps within candles. An IFVG will require observation of the price delivery and indicate areas where the market came into being without proper structure.

Use lower timeframes for confirmation.

Zoom in to either 1-minute or 5-minute time frames to find micro-imbalances that are not visible on higher timeframes.

Observe Price Reaction

Once the price nears a suspected IFVG zone monitor for rejection or consolidation, confirming the validity of the gap.

Combine with Liquidity Zones

Most often, an IFVG coincides with a liquidity pool like previous highs/lows or equal highs/lows.

“By understanding these strategies, you can enhance your entries and exits using utilities like a volume profile, imbalances, and premium/discount arrays

How to Trade ICT Implied Fair Value Gap (IFVG) Effectively

Having identified an IFVG, one would want to have a good disposition toward its trading. Here is how:

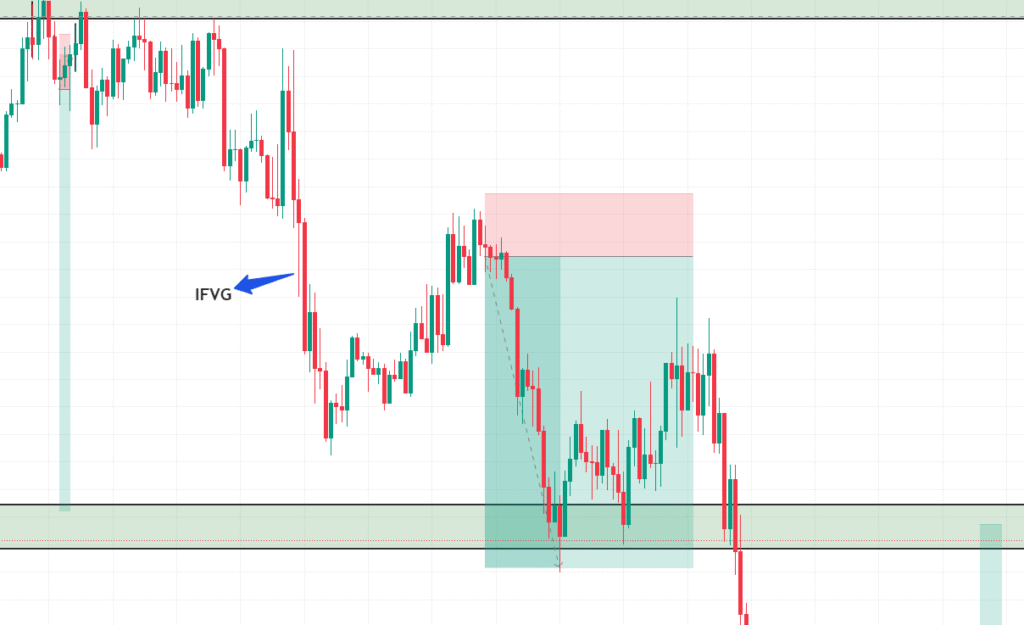

Step 1: The Entry

Enter once the price begins to move toward implied fair value.

Set limit orders for a good entry to ensure you get the best possible entry price.

Step 2: The Stop Loss

Stops are placed below the most recent swing low (for long trades) or above the most recent swing high (for short trades).

The stop loss should be placed where market noise can be allowed but your capital is protected.

Step 3: The Take Profit Target

Profit targets are set on key levels such as previous highs/lows, Fibonacci extensions, or trend lines.

Consider scaling out of your position as the price moves in your favor so you can lock in profit.

Step 4: Risk Management

Always risk a small percentage of your trading capital on each trade (about 1-2%).

Proper position sizing is used basically so that your risk corresponds to your trading plan.

In some setups, inverse FVG appears post-news.

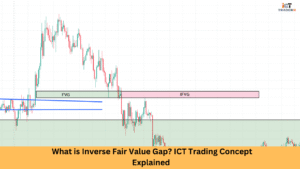

IFVG vs. Traditional Fair Value Gaps: Key Differences

| Feature | Traditional FVG | Implied Fair Value Gap (IFVG) |

| Visibility | Easily seen on charts | Hidden; requires advanced analysis |

| Identification | Based on candle gaps | Based on market inefficiencies |

| Trader Skill Level | Beginner to intermediate | Advanced / Professional level |

| Reaction Time | Often filled quickly | May take time for the price to rebalance |

| Reliability | Moderate | High (if used with confluence and context) |

| Tools Needed | Candlestick charts | Structure, volume, order flow analysis |

Both types are useful, but IFVGs offer deeper market insight, especially for traders using smart money concepts and liquidity-based strategies.

Common Mistakes Traders Make with IFVG

Even experienced traders sometimes misinterpret IFVGs. Avoid these common mistakes:

Wrong Market Structure Identified

These things work only in trendy markets, so using them during a time when the market is nowhere near that would produce false signals.

Trading Every IFVG You See

Not every available IFVG should be traded. Combine key levels liquidity zones, and market structure.

Neglecting Confluence

Using ONLY an IFVG without other confirmations like a BOS, FVG, or liquidity sweep will result in losses.

Poor Risk Management

Over-leverage or tight stop-loss will ruin whichever even the best IFVG setups.

Lack of Backtesting

Going into live markets with IFVG strategies and not having done backtesting translates directly into inconsistent results.

Conclusion

IFVG is an important concept in the ICT trade that enables traders to take advantage of temporary market inefficiencies. Thus If you know how to identify and trade IFVG on time, it should help you in the advancement of your trading performance and consistency in its results. Therefore it is pertinent to be on high-probability setups, risk management, and avoiding penny mistakes to be optimized for success.

FAQs

Is IFVG a beginner-friendly concept?

IFVG is one of the advanced techniques and is applicable for traders who have some previous level of understanding of the whole market structure and the ICT fundamentals.

Is it possible for IFVG to work on any timeframe?

Yes, interestingly they do, but mostly it certainly works on higher timeframes for trend bias and lower timeframes for entries.

Do IFVGs work in crypto or forex markets?

Yes, indeed! IFVGs belong to every market including but not limited to forex, crypto, indices, and stocks.

Name a few essential tools that may be used in identifying IFVG.

Price action, volume profile, market structure, and ICT concepts such as BOS/CHoCH may be useful.

What is the frequency by which IFVG is filled?

No rule for that. But many IFVGs certainly get revisited when liquidity zones are aligned.