As you know in the ever-tough financial markets, successful traders are always in search of some price action pattern that would give them an extra edge. One of the strongest concepts introduced by the Inner Circle Trader (ICT) methodology is the Inverse Fair Value Gap (IFVG). In this blog, we will explain what an Inverse Fair Value gap is, how it is different from Fair Value Gaps, and how you can use them to improve your trading strategies. There are also different categories of IFVGs, along with information such as identification methods and common mistakes to avoid.

Let’s dive into what Fair Value Gaps and Inverse Fair Value Gaps are, how they work, and how you can use them to improve your trading outcomes.

What is a Fair Value Gap?

Before we go into the details of inverse fair value gaps, it is worthwhile to familiarize oneself with the basic concept known as fair value gaps.

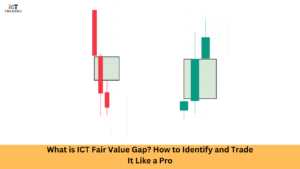

A Fair Value Gap (FVG) refers to an imbalance or inefficiency in price that occurs under the fast motion of markets, mostly under the exertion of institutional orders. In a candlestick chart, any FVG is created when the current candle moves so rapidly that its wicks are no longer overlapping with those of the preceding and successive ones-a visible gap in price.

These gaps often signal areas where smart money has entered or exited the market, indicating potential support and resistance levels, or liquidity voids.

For example:

- In an uptrend, an FVG appears between the low of candle 1 and the high of candle 3

- In a downtrend, it forms between the high of candle 1 and the low of candle 3

Traditionally, traders look to these gaps as potential retracement zones, anticipating that the price may return to “fill the gap” before continuing its trend.

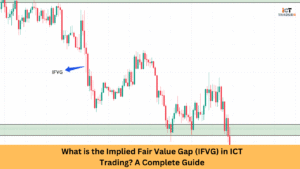

What is Inverse Fair Value Gap (IFVG) and How It Differs?

An Inverse Fair Value Gap (IFVG) represents the opposite side of the FVG spectrum. While regular FVGs anticipate price retracement, IFVGs focus on price continuation through imbalance when the market aggressively moves in one direction without returning to fill the gap.

Key Differences Between FVG and IFVG

| Feature | Fair Value Gap | Inverse Fair Value Gap |

| Direction | Retracement expected | Continuation expected |

| Trader’s Goal | Trade into the gap | Trade away from the gap |

| Behavior | Price returns to fill | Price skips the gap entirely |

IFVGs represent rejection zones where the market decisively moves away with strength, showing clear intent from institutional traders or smart money. These formations often align with order blocks and can serve as a key component in a high-probability price action trading strategy.

Identifying Inverse Fair Value Gaps Like a Pro

To spot an IFVG with precision, follow these step-by-step guidelines:

- Look for Aggressive Moves: Identify strong price movements (bullish or bearish) with large candles and minimal retracement

- Check for Unfilled Gaps: Confirm that price does not revisit the area between the first and third candles

- Use Confluence: Combine with other ICT concepts like liquidity sweeps, break of structure (BOS), or order blocks for high-probability setups

- Mark Zones: Highlight the IFVG zone between candle 1’s close and candle 3’s open

Pro Tip: For even stronger confirmation, combine IFVG analysis with volume profile or liquidity pools to verify the strength and intent behind the move.

Types of Inverse Fair Value Gap

There are two main types of IFVGs based on market direction:

1. Bullish Inverse Fair Value Gap

A bullish Inverse Fair Value Gap (IFVG) occurs when price rejects a downward Fair Value Gap and moves up with aggression. This generally suggests that a powerful bullish reversal or continuation is in play.

2. Bearish Inverse Fair Value Gap

A bearish Inverse Fair Value Gap occurs when the price rejects an upward Fair Value Gap and moves downwards with aggression. Such a signal indicates a strong bearish reversal or continuation.

Bullish vs. Bearish IFVG: How to Trade Both Scenarios

A Bullish IFVG Trade:

Entry: Look for a price rejection occurring at the Fair Value Gap followed by the emergence of a bullish candlestick pattern.

Stop Loss: Set a stop loss just below the low of the IFVG.

Take Profit: Go after the next resistance level or a risk-reward ratio of at least 1:2.

Bearish IFVG Trading:

Entry: Look for a price rejection occurring at the Fair Value Gap followed by the emergence of a bearish candlestick pattern.

Stop Loss: Set a stop loss just above the high of the IFG.

Take Profit: Go after the next support level or a risk-reward ratio of at least 1:2.

Trading Strategy: Bullish vs. Bearish IFVG

| Aspect | Bullish IFVG | Bearish IFVG |

| Entry Bias | Buy | Sell |

| Confluence | Below liquidity sweep | Above liquidity sweep |

| Confirmation | Bullish BOS | Bearish BOS |

| Entry Zones | Order blocks, Fibonacci | Order blocks, Fibonacci |

| Exit Strategy | Near resistance zones | Near support zones |

Best Timeframes and Assets for Trading IFVGs

While IFVGs can be found across most timeframes, certain combinations offer better accuracy and cleaner trading setups, and a structure shift may validate inverse gaps.

Optimal Timeframes:

- 15-Minute to 1-Hour: Ideal for intraday traders looking for quick opportunities

- 4-Hour to Daily: Perfect for swing trading setups with more reliable signals and less noise

Most Responsive Assets:

- Forex Pairs (e.g., EUR/USD, GBP/JPY): Highly liquid markets that respond well to IFVG structures

- Indices (e.g., S&P 500, NASDAQ): Heavily influenced by institutional money flow

- Cryptocurrencies (e.g., BTC, ETH): High volatility markets that frequently display IFVG setups

Common Mistakes Traders Make with IFVG (And How to Avoid Them)

Even experienced traders can struggle with IFVG implementation. Here are the most common mistakes and their solutions:

1. Confusing FVG with IFVG

Solution: Always confirm whether the price returns to the gap (FVG) or continues away from it (IFVG)

2. Ignoring Confluence

Solution: Don’t rely on IFVG alone combine it with Smart Money Concepts, order blocks, and market structure analysis

3. Overtrading Every Gap

Solution: Not every IFVG is tradable. Focus on those formed after liquidity sweeps or break of structure (BOS)

4. Poor Risk Management

Solution: Always define your stop-loss and take-profit levels before entering a trade based on clear IFVG parameters

5. Forcing Entries During Low Volume Times

Solution: Avoid trading IFVGs during news events or consolidation zones when institutional participation is limited

Conclusion

The Inverse Fair Value Gap (IFVG) is another important aspect of ICT trading that can help you identify higher-probability setups for reversals or continuations. By mastering the differences between a Fair Value Gap and an IFVG as well as the ability to recognize and trade both, you will understand how to increase your trading performance radically. Always keep the greater market context in mind and manage risk appropriately.

FAQs

What is the difference between FVG and IFVG?

FVG expects price retracement into the gap; IFVG expects price to continue in the same direction, avoiding the gap.

Can IFVG be used in crypto trading?

A: Yes, due to high volatility, IFVG works well in crypto markets like Bitcoin and Ethereum.

Is IFVG suitable for beginners?

It’s more of an advanced concept, but beginners can learn it gradually by studying ICT methods and combining it with basic price action.

What tools are best for spotting IFVGs?

Use candlestick charts, liquidity indicators, order blocks, and trading view zones for marking IFVGs.

Does IFVG work in all market conditions?

No, it’s best used during trending markets with strong institutional movement and clear BOS.