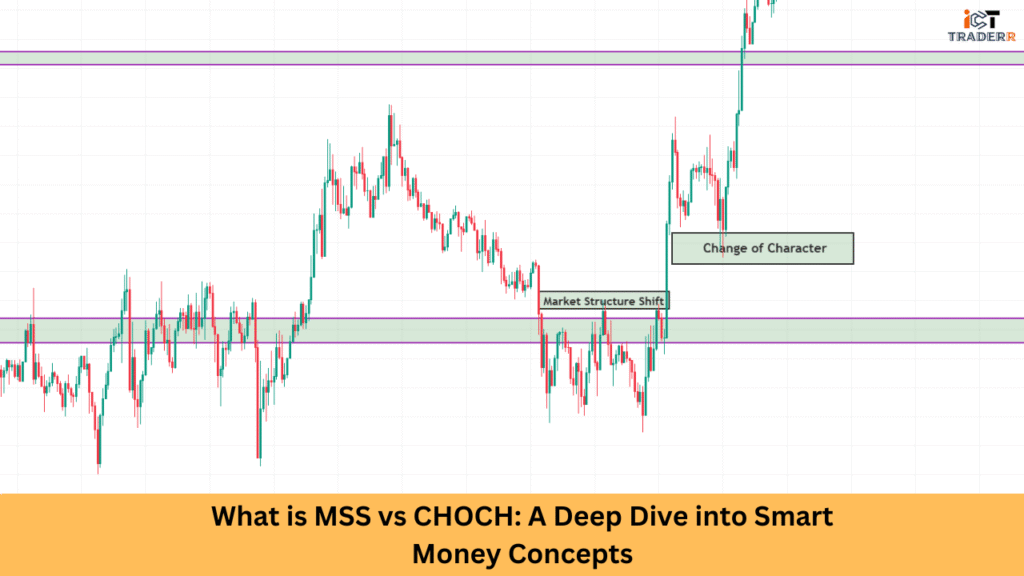

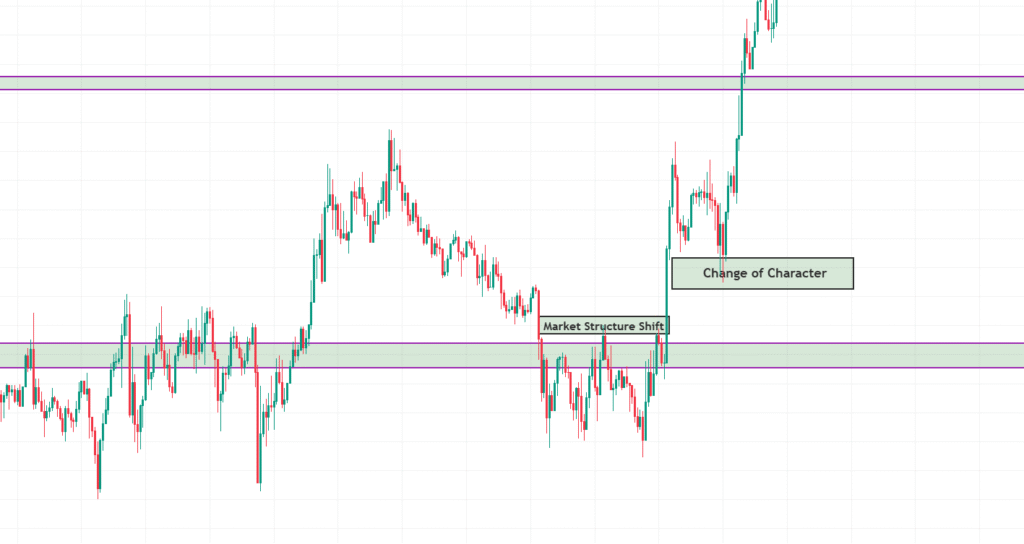

In the smart money trading world, a market structure shift (MSS) and change of character (CHOCH) have become pretty popular as assessment tools for those looking to align themselves with institutional order flow. With these concepts, you can spot early signs of a trend reversal and set up trading opportunities with high probabilities. So, what is the difference between MSS and CHOCH, and how can they be used together with more effect? We are going deep into the mindset, implementation, and importance of MSS vs CHOCH in the smart money concept.

What is Market Structure Shift (MSS)?

When a significant shift in price direction occurs to signal a potential reversal in the prevailing market structure, this phenomenon is labeled a Market Structure Shift (MSS). It is mostly referred to among traders who have considered the smart money method of how institutions accumulate and distribute their positions.

In simple words, the MSS occurs when a price breaks a significant higher low (in an uptrend) or a lower high (in a downtrend). The change generally also indicates a shift in sentiment from bullish to bearish or vice versa.

Example:

- In an uptrend, the price creates higher highs and higher lows.

- When price breaks a key higher low, this signals that buyers are losing control hence, an MSS occurs.

This break of structure (BOS) is a clue that the market may be preparing for a reversal or at least a deeper retracement. MSS is often considered a confirmation-based tool used by experienced traders to validate the overall market direction.

What is a Change of Character (CHOCH)?

Another smart money strategy for spotting early trend reversals is Change of Character (CHOCH). It differs slightly from MSS in that it focuses on the first indication of a change in market sentiment. In other words, CHOCH is a precursor to MSS and is often the first signal that alerts traders of a potential trend change.

Example:

- A CHOCH occurs whenever the market, which is in a downtrend, makes lower highs and lower lows before suddenly making a higher high.

- It signifies a change in character or behavior of price action, suggesting that buyers may be stepping in.

CHOCH is particularly valuable for traders who want to anticipate market structure shifts before they are confirmed. It’s used to gain early entry points and can be especially powerful when combined with liquidity grabs or order blocks.

Key Differences Between MSS and CHOCH

Although MSS and CHOCH may appear similar, there are crucial differences between them:

| Feature | MSS (Market Structure Shift) | CHOCH (Change of Character) |

| Timing | Confirmation-based | Early signal |

| Purpose | Confirms trend reversal | Indicates potential shift |

| Use Case | Validates trade direction | Provides early entry alert |

| Risk | Lower (confirmation) | Higher (speculative) |

| Ideal For | Trend traders | Scalpers & intraday traders |

The key takeaway is that CHOCH occurs before MSS. If you spot a CHOCH, it’s worth watching the price action closely for a possible MSS to follow.

How to Use MSS and CHOCH Together in Trading

To develop a winning smart money trading strategy, traders often combine MSS and CHOCH for multi-step confirmations. Here’s how to apply both:

1. Identify the Trend

Start by recognizing whether the market is trending or ranging. Look for higher highs/lows in an uptrend or lower highs/lows in a downtrend.

2. Spot the CHOCH

The moment you see a break in pattern, such as a higher high in a downtrend, mark it as a potential CHOCH. This is your first sign of a possible trend reversal.

3. Wait for MSS Confirmation

Don’t enter the trade just yet. Wait for the price to break the last structural point that confirms a Market Structure Shift (MSS). This step aligns your trade with the dominant momentum.

4. Use Liquidity Zones & Order Blocks

Look for order blocks, supply and demand zones, or liquidity grabs in the area between the CHOCH and MSS. These zones often act as prime entry levels.

5. Plan Your Entry and Exit

Set your stop-loss below the order block or recent low (in bullish setups) and aim for higher time frame imbalances or previous swing highs as your target.

This approach helps you reduce false signals, improve trade accuracy, and align with institutional trading behaviors.

Conclusion

Understanding the difference between MSS and CHOCH is crucial for mastering smart money trading strategies. While CHOCH gives early insight into a market shift, MSS confirms the trend change. The combination of these tools gives you great leverage in price action trading. When woven into your strategy as it pertains to areas like liquidity zones, blocks of orders, and sound risk management, you improve your chances of trading in alignment with institutional flow rather than against it.

FAQs

Is CHOCH better than MSS?

Not necessarily. CHOCH provides an early signal, while MSS offers confirmation. They work best when used together for a balanced approach.

Can I use CHOCH and MSS on any time frame?

Yes, these concepts work across multiple time frames, but higher time frames generally provide more reliable signals.

Are CHOCH and MSS only for smart money trading?

Yes, these are smart money concepts rooted in understanding how institutional traders operate. However, they can be adapted to traditional price action strategies, too.

How do I avoid false CHOCH signals?

Always wait for additional confirmation, such as liquidity grabs, volume spikes, or candle confirmations, before entering a trade.

Is MSS the same as a Break of Structure (BOS)?

They are related but not identical. BOS generally refers to a continuation of the trend, while MSS often signals a trend reversal.