Institutional trading often includes discovering some important price patterns that indicate strong momentum shifts. One of the most powerful patterns is the ICT Breakaway Gap, a derivation from the Inner Circle Trader (ICT) methodology. A breakaway gap occurs when the price breaks away from a consolidation phase with a significant amount of momentum; it usually indicates the start of an entirely new trend.

Traders who master the skills of the ICT Breakaway Gap can catch high-probability setups that possess very strong risk-reward ratios. In this article, we will explain what an ICT breakaway gap is, how to recognize it, and a complete trading strategy that’s going to cover both bullish and bearish scenarios to trade this mythical-type formation.

What Is an ICT Breakaway Gap?

An ICT Breakaway Gap is a price gap right after a period of consolidation, indicating a strong change in market sentiment. And while the common gaps are mostly ended by the retail traders, breakaway gaps usually indicate institutional participation in the markets and often lead to continued trends.

Characteristics:

It comes after a consolidation or a range-bound market.

It comes with high trading volume, confirming institutional interest.

There are generally is near key support/resistance or liquidity zones.

Their accounts point to a strong directional movement (bullish or bearish).

This is much revered in ICT Trading strategies since it follows the lines of smart money that institutional you enter positions with aggression, leaving retail you stranded.

How to Identify an ICT Breakaway Gap

Recognizing a true ICT Breakaway Gap requires understanding its structure and context within the market. Follow these steps:

- Observe the Market Open: A breakaway gap typically forms during the opening hours of major sessions (especially London and New York).

- Look for a Significant Price Gap: If the open is higher or lower than the previous high/low, note the difference.

- Analyze Volume and Momentum: Strong movement with high volume often confirms institutional activity.

- Confirm Support/Resistance Breach: Has the price broken a key support or resistance zone? This validates the gap as a breakaway.

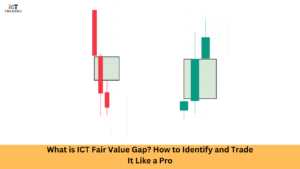

- Assess Context Using Smart Money Concepts: Use ICT tools like FVGs (Fair Value Gaps), liquidity sweeps, and order blocks for further confirmation.

By combining technical indicators and price action trading tools, you can isolate authentic ICT breakaway gaps from false moves.

Bullish Breakaway Gap in ICT Trading

In this case, Bullish ICT Breakaway Gaps may indicate strong upwards momentum and serve as a useful marker for the initiation of an uptrend. Traders can look for such gaps to find their entry points to capture the upside.

Characteristics of Bullish Breakaway Gaps:

- A gap appears above a consolidation zone or resistance level

- Price opens significantly higher than the previous close

- Strong buying volume accompanies the gap

- Previous resistance levels are decisively broken

- Price continues moving upward after the gap forms

Trading Approach:

When identifying a bullish breakaway gap, strategically you look for confirmation before entering positions. This might include waiting for the first pullback that respects the gap as new support, or entering once the post-gap candle closes strongly in the direction of the gap.

It should be considered that placing stop-loss orders just below the gap will protect you from false breakouts. Profit targets can be set using Fibonacci extensions, measured moves based on the previous range, or by trailing stops as the new trend develops.

Bearish Breakaway Gap in ICT Trading

Conversely, bearish ICT Breakaway Gaps signal potential downward momentum and often mark the beginning of downtrends. These gaps provide entry signals for short positions or warnings to exit long positions.

Characteristics of Bearish Breakaway Gaps:

- The gap appears below a consolidation zone or support level

- Price opens significantly lower than the previous close

- Strong selling volume accompanies the gap

- Previous support levels are decisively broken

- Price continues moving downward after the gap forms

Trading Approach:

For bearish breakaway gaps, you may enter short positions after confirmation, such as a failed attempt to close the gap or a continuation candle in the gap direction. Stops should be placed traditionally above the gap’s extreme, while targets on the gap are derived from the same techniques used for targets to the downside on bullish gaps.

Risk management assumes even greater importance when an index is in a bearish market, as it is known that at times down markets can just be more vicious than bullish markets. Consider using smaller position sizes or tighter stops when trading bearish breakaway gaps.

How to Trade ICT Breakaway Gaps: Step-by-Step Strategy

Here’s a systematic approach to trading ICT Breakaway Gaps effectively:

1. Gap Identification and Validation

- Look for price gaps that occur after periods of consolidation

- Confirm higher-than-normal volume during gap formation

- Ensure the gap breaks the significant market structure

- Validate that the gap size is larger than the average daily ranges

- Check multiple timeframes to confirm the significance of the gap

2. Entry Strategy

Conservative Entry: Wait for a retest of the gap area. If price respects the gap as support (bullish) or resistance (bearish), enter in the direction of the gap.

Aggressive Entry: Enter immediately after the gap forms if accompanied by strong momentum candles and volume confirmation.

Breakout Entry: Wait for price to break above the high (bullish) or below the low (bearish) of the post-gap candle.

3. Stop Loss Placement

- For bullish gaps: Place stops below the bottom of the gap or the nearest significant support

- For bearish gaps: Place stops above the top of the gap or the nearest significant resistance.

- Consider volatility-based stops using ATR to account for market conditions.

4. Take Profit Targets

- First target: the previous swing point in the direction of the trade

- Second target: a measured move equal to the size of the pre-gap consolidation

- Final target: the major support/resistance level or Fibonacci extension levels

- Consider trailing stops after the price has moved 1:1 risk-reward

5. Position Sizing and Risk Management

- Consider scaling into positions as the new trend confirms

- Adjust position size based on gap clarity and market conditions

- Be prepared to hold trades longer for breakaway gaps, as they often signal new trends

6. Trade Management

- Monitor price action for signs of exhaustion or reversal

- Be alert for counter-gap moves, which may signal false breakouts

- Adjust stops as price moves favorably to lock in profits

- Consider taking partial profits at predetermined levels

7. Post-Trade Analysis

Document each breakaway gap trade to identify patterns in successful and unsuccessful trades. Look for commonalities in market conditions, timeframes, and sectors where your breakaway gap strategy performs best.

Conclusion

The ICT Breakaway Gap is a powerful tool in a trader’s arsenal when understood and executed properly. It reflects institutional intent, signaling that a new trend may be forming. A disciplined application of smart money concepts in identifying these gaps will increase the odds of winning significantly.

Breakaway gaps, whether bullish or bearish, show important aspects of market structure, momentum, and probable future price direction. Add this concept to your ICT trading strategy and watch your trading edge evolve.

“Always backtest your gap trading strategy and ensure it aligns with your overall trading plan. In ICT, context is everything, and the breakaway gap is one of its strongest signals.”

FAQs

Are breakaway gaps always left unfilled?

Not always. While breakaway gaps often remain unfilled for a long time, market dynamics can change, and gaps may eventually close. However, immediate fill is rare in a true ICT breakaway.

Can I use indicators to confirm ICT breakaway gaps?

Yes. Volume indicators, moving averages, and price action tools like FVGs and order blocks can help confirm gap strength and direction.

What timeframes work best for spotting ICT breakaway gaps?

The 15-minute to 1-hour timeframe works best during high-impact sessions like London and New York. Higher timeframes help validate the overall trend.

What pairs are best for trading breakaway gaps?

Highly liquid forex pairs like EUR/USD, GBP/USD, and indices like NASDAQ and S&P 500 show reliable gap behavior during session opens.

Is the ICT Breakaway Gap strategy suitable for beginners?

Yes, but with proper education. Beginners should first master support and resistance, liquidity, and basic ICT concepts before trading gap strategies.