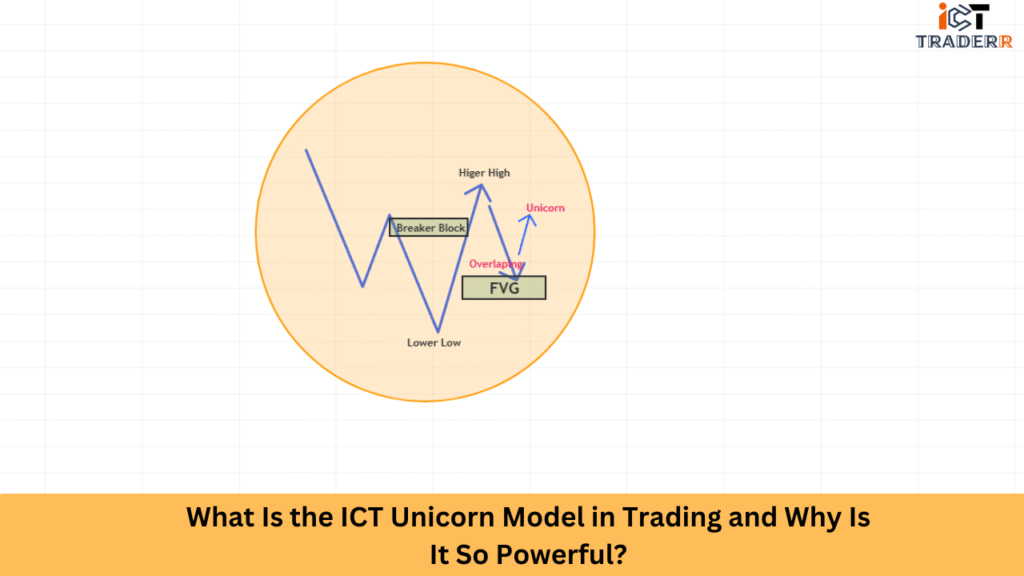

In this whole complex world of financial markets, traders are looking for reliable strategies to give them an edge in trading. One of the promising trading methodologies that has garnered much attention over recent years is the ICT Unicorn Model exceptionally powerful and systematic approach to market analysis. This model, developed by the Inner Circle Trader, has completely redesigned the way a lot of traders seek high-probability setups and execute successful trades in various financial instruments.

What Is the ICT Unicorn Model?

The ICT Unicorn Model is a highly specific and structured price action pattern within the realm of smart money trading strategies, developed through the concepts introduced by the Inner Circle Trader (ICT), also known as Michael J. Huddleston. It is called the “Unicorn” due to its rare and powerful formation that often signals high-probability trade setups.

This model combines market structure shifts, liquidity manipulation, and fair value gaps (FVGs) to detect optimal entry and exit points. The ICT Unicorn Model is used by you who follow institutional order flow, aiming to enter trades with the smart money rather than against it.

Core Components of the Unicorn Model

To master the ICT Unicorn Model, understanding its core components is essential:

Market Structure Break (MSB): The change from a bullish to bearish trend or vice versa. This is a key signal that the market direction is shifting.

Liquidity Grab: Also known as a “stop hunt,” this occurs when the market sweeps previous highs or lows to trigger stop-losses of retail traders before reversing.

Fair Value Gap (FVG): A gap between candles that indicates inefficiency in price delivery. These are often revisited by price, providing potential entry zones.

Order Blocks (OB): The last bullish or bearish candle before a significant price move. These areas represent institutional buying or selling activity.

Displacement: A strong and impulsive move away from the previous structure, indicating institutional involvement.

How to Identify the ICT Unicorn Model

Recognizing the ICT Unicorn Model requires a careful observation of price action and market behavior. Here’s how to identify it:

- Look for a clear liquidity sweep — either above a swing high (in bearish scenarios) or below a swing low (in bullish scenarios).

- Identify a market structure break following the liquidity grab.

- Wait for the price to return and retest a fair value gap or an order block created during the displacement.

- Confirm with additional ICT confluences such as time of day (like New York or London session) and internal liquidity levels.

Types of the ICT Unicorn Model

There are two major types of the ICT Unicorn Model: Bullish and Bearish. Each follows the same framework but in opposite directions.

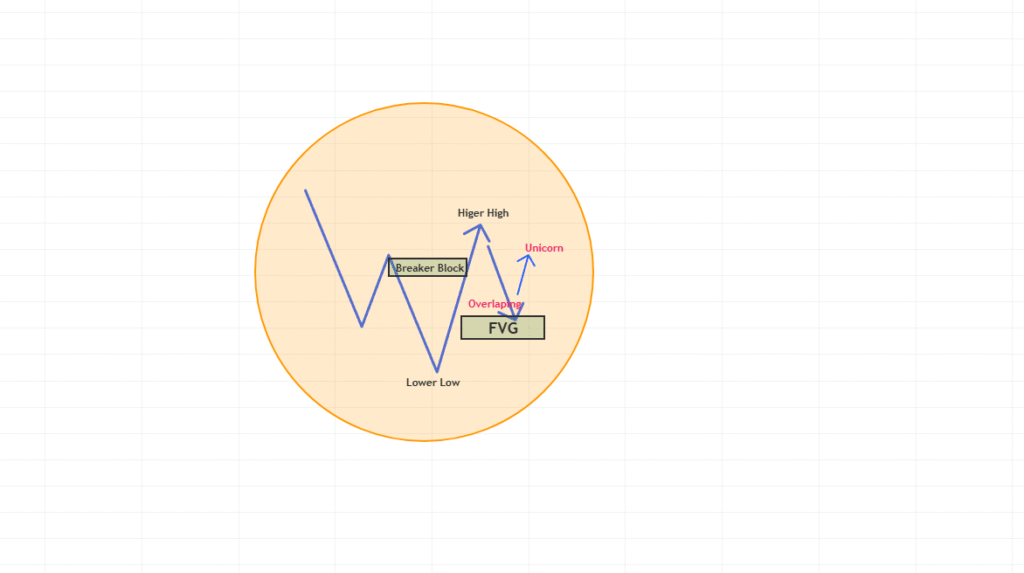

Bullish ICT Unicorn Model

In a bullish setup:

- Price sweeps sell-side liquidity (SSL) below a key support or swing low.

- A market structure shift happens as the price breaks a previous high.

- A bullish fair value gap or a bullish order block forms during the displacement.

- Price retraces into the FVG or OB and provides a long entry point.

- Ideal take profits are set at equal highs, liquidity pools, or premium zones.

Bearish ICT Unicorn Model

In a bearish setup:

- Price sweeps buy-side liquidity (BSL) above a previous resistance or swing high.

- A bearish market structure break occurs.

- A bearish fair value gap or bearish order block is created.

- Price retraces into the imbalance and gives a short entry.

- Profits are aimed at equal lows, liquidity voids, or discount zones.

When trading the Bearish Unicorn, you enter short positions after confirmation, placing stop losses above the recent swing high and targeting previous support levels or Fair Value Gaps below.

Step-by-Step ICT Unicorn Model Strategy

Here’s a simplified breakdown of how to use the ICT Unicorn Model in real trading:

Step 1: Identify the Trading Session

Focus on New York AM, London Open, or high-volatility news events, where smart money activity is typically present.

Step 2: Spot Liquidity

Watch for liquidity pools above or below recent swing highs/lows. This is where retail stop-losses often lie.

Step 3: Wait for the Sweep

Allow price to sweep liquidity and trap retail traders. Don’t enter yet.

Step 4: Market Structure Breakdown

After the sweep, wait for a clear break of structure (BOS) in the opposite direction. This signals intent from institutional traders.

Step 5: Identify Imbalance or OB

Mark the FVG or OB formed during the displacement. This is your entry zone.

Step 6: Entry and Stop-Loss

Enter the trade when the price returns to the imbalance. Place your stop-loss below/above the liquidity sweep.

Step 7: Target Logical TP

Set your target at opposing liquidity, equal highs/lows, or key Fibonacci levels.

This strategy allows you to ride institutional moves with precision and reduced risk.

Why Is the ICT Unicorn Model So Powerful?

The ICT Unicorn Model has gained popularity among serious traders for several compelling reasons:

- Institutional Alignment: The model is designed to align retail traders with institutional money flow rather than fighting against it. By focusing on where large players are likely to enter and exit, traders position themselves with the “smart money” rather than against it.

- High Probability Setups: When correctly identified, Unicorn patterns offer exceptional risk-to-reward ratios, often exceeding 1:3 or even 1:5. This favorable ratio means traders can be profitable even with a win rate below 50%.

- Reduced Indicator Dependence: By focusing on pure price action and market structure, the model reduces reliance on lagging indicators that often provide conflicting signals.

- Psychological Edge: The model includes specific rules for entries, stops, and targets, which helps reduce emotional decision-making—a common pitfall for traders.

- Versatility Across Markets: The Unicorn Model works across various financial instruments, including forex pairs, cryptocurrencies, indices, and commodities, making it a versatile approach for diversified traders.

- Multiple Timeframe Confirmation: By incorporating analysis across multiple timeframes, the model provides stronger confirmation signals than single-timeframe approaches.

- Education on Market Mechanics: Beyond just providing trade setups, the ICT methodology educates traders on the underlying mechanics of markets, including order flow, liquidity, and institutional trading practices.

Conclusion

The ICT Unicorn Model is a game-changing concept in modern trading. By combining liquidity theory, market structure, and price imbalances, it offers a logical, powerful, and repeatable framework for traders.

For those who want to break away from inconsistent retail strategies and step into institutional-level trading, mastering the ICT Unicorn Model is a must. With proper practice, risk management, and patience, this model can significantly enhance trading performance.

FAQs

Is the ICT Unicorn Model suitable for beginners?

While the model requires some understanding of ICT concepts, beginners can learn it with practice and chart time. It’s recommended to backtest thoroughly before going live.

Can this model be used in crypto trading?

Yes, the ICT Unicorn Model works well with crypto pairs like BTC/USD or ETH/USD, especially during high-liquidity sessions.

How much time does it take to master this model?

With focused study and backtesting, you can start identifying Unicorn setups within a few weeks. Full mastery may take months, depending on experience.

Are indicators required for the Unicorn Model?

No, the model is indicator-free and purely based on price action, market structure, and liquidity.

What tools or platforms are best to practice this model?

Trading platforms like TradingView or MetaTrader with replay/backtesting features are ideal to practice and refine your strategy.