In the world of forex trading and smart money concepts (SMC), the ICT Propulsion Block is a powerful price action tool that helps you identify market direction and make precise entries.

Before we get into ICT Propulsion Blocks, we need to understand what ICT order blocks are.

In this article, we will explain what an ICT Propulsion Block is, how it’s formed, the difference between bullish and bearish blocks, and how you can trade it effectively while avoiding common mistakes.

What is an ICT Propulsion Block?

An ICT Propulsion Block is a specific type of price action structure within institutional trading concepts (ICT). It signals a strong continuation of price movement after a minor pullback. Propulsion blocks are often used by professional traders to confirm entries in the direction of the trend. These blocks show areas where smart money (institutions, hedge funds) have made aggressive moves, indicating their commitment to a trend.

In simple words, a propulsion block is a small retracement or consolidation area in a trending market that precedes a powerful move in the same direction. It acts as a launchpad for price, much like a rocket propelling forward.

Formation of an ICT Propulsion Block

The formation of an ICT Propulsion Block follows a specific sequence of price movements:

Initial Base Formation: The market establishes a consolidation area where price moves sideways within a defined range.

Liquidity Engineering: Smart money positions itself by manipulating price to trigger retail stop losses and limit orders, creating liquidity for larger institutional positions.

Breaker Block Creation: A strong candle breaks through the previous structure, showing commitment in a particular direction.

Mitigation Phase: In the mitigation block, Price retraces partially back into the breaker block, often testing the midpoint of the initial movement.

Propulsion Movement: After the mitigation, price aggressively moves in the intended direction, creating the actual “propulsion” effect.

This pattern represents smart money operations in the market, where institutional traders accumulate or distribute positions before a significant market move.

Bullish ICT Propulsion Block

A Bullish ICT Propulsion Block signals a potential upward price movement and displays these key characteristics:

- Forms after a downtrend or a consolidation period

- Shows a strong bullish candle breaking above recent resistance

- Creates a clear higher high in the market structure

- Often accompanied by increased volume during the breakout

- Subsequent retracement respects the midpoint of the breaker block

- Price maintains position above key moving averages

You look for confirmation signals such as bullish divergences on momentum indicators, institutional order flow imbalances favoring buyers, and clean breaks above significant swing highs. When trading bullish propulsion blocks, entry positions are typically placed after the mitigation phase completes and price action confirms the continuation of the upward movement.

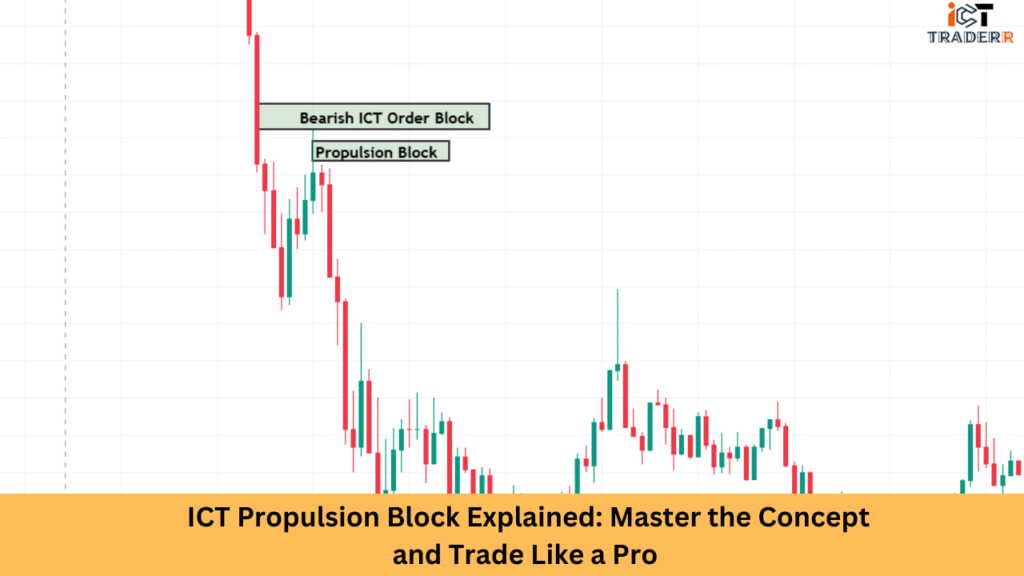

Bearish ICT Propulsion Block

Conversely, a Bearish ICT Propulsion Block indicates a potential downward price movement with these distinguishing features:

- Forms after an uptrend or a consolidation period

- Displays a strong bearish candle breaking below recent support

- Creates a clear lower low in the market structure

- Often shows increased selling volume during the breakdown

- Retracement typically stays below the midpoint of the breaker block

- Price remains below key moving averages

Confirmation signals include bearish divergences on oscillators, selling pressure from institutional participants, and decisive breaks below significant swing lows. Trading bearish propulsion blocks involves entering short positions after the mitigation phase when price action confirms the continuation of the downward movement.

Look for Reclaimed Order Blocks for confluence with Propulsion Blocks during strong trend setups.

How to Trade Using ICT Propulsion Blocks

Successfully trading with ICT Propulsion Blocks requires a systematic approach:

- Identify Market Context: Determine whether you are in a trending or ranging market. Propulsion blocks work best when aligned with the broader market direction.

- Spot the Block Formation: Look for strong moves breaking previous structure, followed by a retracement into the breaker area.

- Confirm with Order Flow: Use order flow analysis to verify institutional participation, checking for absorption of buying/selling pressure.

- Set Entry Triggers: Place orders at strategic levels after the mitigation phase completes, waiting for confirmation candles that suggest continuation.

- Implement Risk Management: Set stop losses beyond the opposite side of the propulsion block, as breaching this level invalidates the setup.

- Define Take Profit Targets: Use equal legs projection, Fibonacci extensions, or previous swing points to establish realistic profit targets.

Pro Tip: Propulsion blocks work best on higher timeframes (H1, H4, or Daily) for swing trading and on M15/M5 for intraday setups.

Common Mistakes to Avoid

Even experienced traders can make errors when implementing ICT Propulsion Block strategies:

- Ignoring Market Context: Failing to consider the broader market environment can lead to trading against the dominant trend.

- Premature Entries: Entering before proper mitigation can result in being caught in further retractions.

- Neglecting Order Flow Confirmation: Relying solely on price action without verifying institutional participation increases the risk of false signals.

- Improper Stop Placement: Setting stops too tight or without consideration of market volatility can lead to premature exits.

- Overlooking Significant Support/Resistance: Not accounting for major levels that might interfere with the propulsion movement.

- Psychological Biases: Letting emotions drive decisions rather than sticking to the predetermined trading plan.

By understanding these common mistakes, you can refine your approach and improve your success rate when trading ICT Propulsion Blocks.

Conclusion

ICT Propulsion Blocks represent a sophisticated trading concept that, when properly understood and applied, can significantly enhance your trading performance. By identifying these blocks, you gain insight into potential market directions driven by institutional money flow.

The power of propulsion blocks lies in their ability to reveal market participants’ intentions before major price movements occur. As with any trading strategy, success depends on thorough analysis, disciplined execution, and consistent risk management.

“Remember — it’s not just about spotting the block, it’s about waiting for confirmation and following a solid trading plan.”

FAQs

Are ICT propulsion blocks the same as order blocks?

Not exactly. While similar, propulsion blocks are more focused on continuation after retracements, whereas order blocks often indicate reversal zones.

Which timeframe is best for trading propulsion blocks?

H1 and H4 are reliable for swing trading, while M5 and M15 work for intraday scalping.

Can I use propulsion blocks in crypto or indices?

Yes, this concept is not limited to forex. It works well in crypto, indices, and commodities — anywhere price action and institutional behavior exist.

Do propulsion blocks always work?

No strategy is 100% accurate. Use confluences and risk management for the best results.