If you have a glance at the price graph and feel confused about the direction in which the market is heading, you are not alone. This is precisely why ICT’s STL, ITL, and LTL concepts can work wonders for you. It helps you view the market just like the smart money does, with the ability to discern structure, momentum shifts, and hidden opportunities usually skipped by retail traders. Whether as a starter or already trading live with other people’s money, learning this tool on how to spot these levels will bring you more confidence, clarity, and control over your trades. Certainly, let’s decode this powerful scheme stepwise.

What Is STL, ITL & LTL in ICT?

The market moves like a wave—ups, downs, and then back again. ICT breaks those lows into three layers:

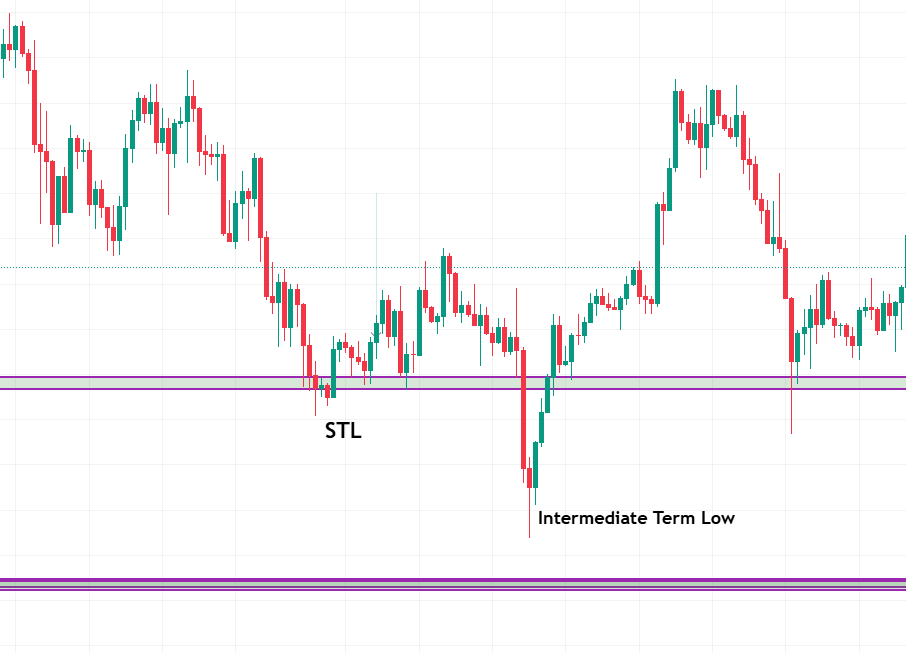

- Short‑Term Low (STL): A mini valley formed when a candle’s low wick dips below the candles immediately before and after it, like a pothole on your chart.

- Intermediate‑Term Low (ITL): A slightly deeper dip—an STL nestled between two higher STLs. Kind of a bigger trough showing more market hesitation.

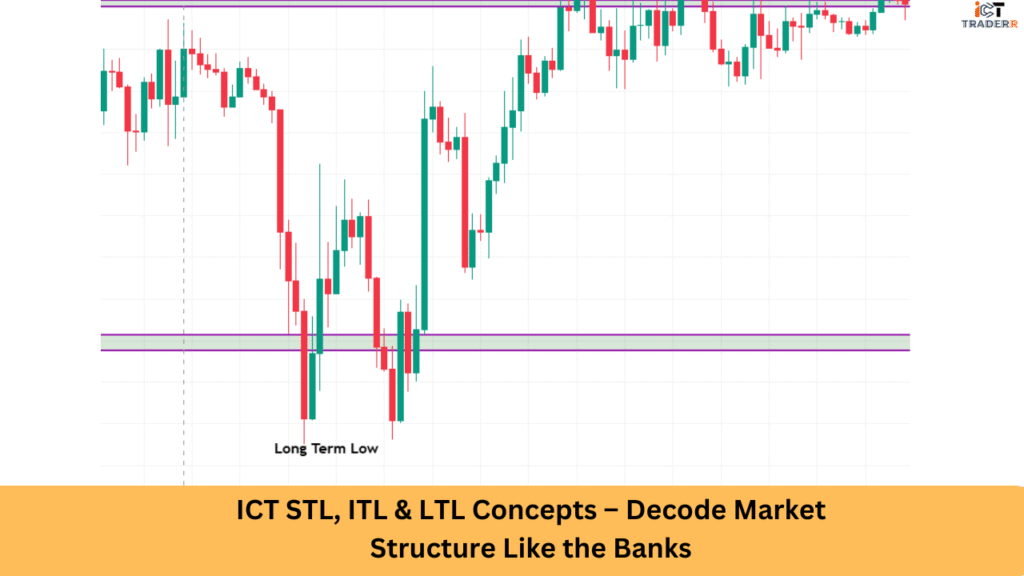

- Long‑Term Low (LTL): A major turning point—a low among lows. It’s an ITL that sits lower than the ITLs on either side, often tied to reactions at significantly higher time-frame levels.

How These Levels Help You Read Market Structure

Why care about these? Because they show you where big money is hiding—those institutional traders shaping market moves.

- STLs help you spot minor pullbacks in your ongoing trend. These are useful for short‑term entries or fine‑tuning.

- ITLs reveal deeper retracements. They can signal areas to add positions or to be cautious—you’re seeing more than just noise here.

- LTLs are the big picture. They mark major support levels or trend shifts that even the smartest banks watch closely.

When the market makes lower LTLs and lower Long‑Term Highs, it’s telling you the downtrend is real, unless it breaks that last Long‑Term High.

How to Identify STL, ITL & LTL on the Chart

Let’s walk through this like you are scanning your chart now:

- Find STLs: Look for any single candle whose low is lower than the candle to its left and right. Label those.

- Spot ITLs: Now connect them—if an STL sits between two higher STLs, you’ve got an ITL. Mark it.

- Mark LTLs: Finally, if an ITL sits lower than the ITLs on both sides, that’s your LTL—a key turning point.

On a clean chart, use a fresh candle color or indicator as a visual aid (many modern MT5 indicators even mark these automatically).

Tip for you: Use a higher‑time‑frame view to confirm LTLs. If that lines up with a reaction at a major level, you are onto something big.

Conclusion

By mastering STL, ITL, and LTL, you begin thinking like institutional traders. You will see the structure they see. You will confidently spot small dips (STL), depth points (ITL), and major turning zones (LTL). This leads to smarter entries, better risk control, and stronger trades.

By shifting from candle‑watching to structure reading—through STL, ITL, and LTL—you graduate into the mindset of smart‑money trading. You start interpreting the market’s story in real time. And once you see it, you can trade it.

FAQS

Can you share a simple chart example?

Sure! First, mark a candle whose low is lower than its neighbors—that’s an STL. Then, if that STL is lower than the STLs next to it, you have an ITL. If that ITL is the lowest among the three ITLs, that’s your LTL—your anchor.

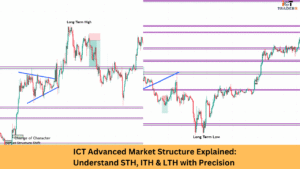

Do these apply to upward trends, too?

Absolutely. Just flip the concept: look for Short‑Term Highs (STH), Intermediate-Term Highs (ITH), and Long-Term Highs (LTH).

How can I use this for trend confirmation?

In a confirmed uptrend, you should see rising LTHs and LTLs. If your price breaks below an LTL, that could signal a trend change—time to reassess.

Should you trade every STL or ITL?

Not necessarily. Think of STLs as fine-tuning tools, ITLs as anchor points, and LTLs as key decisions—ideal for major positioning.

How can you integrate this with other ICT concepts?

Combine it with Order Blocks, Fair Value Gaps, and liquidity zones. For instance, if an LTL aligns with an institutional order block, you’ll likely see a powerful reaction.