If you have ever looked at the market and felt confused about where it might go next, you’re not alone. In 2025, with rapid changes in Forex trends and increased volatility, traders like you need more than just guesswork. You need structure, clarity, and a proven method to decode the markets.

That’s where Elliott Wave Theory comes in.

This is not just another strategy—it’s a powerful framework that shows how price movements follow specific patterns based on crowd psychology. Once you understand these patterns, you can predict where the market might go and trade with more confidence.

Whether you’re trading major pairs like EUR/USD or experimenting with gold, crypto, or indices, this guide will help you master Elliott Wave Theory step by step in today’s fast-moving markets.

Core Concept of Elliott Wave Theory

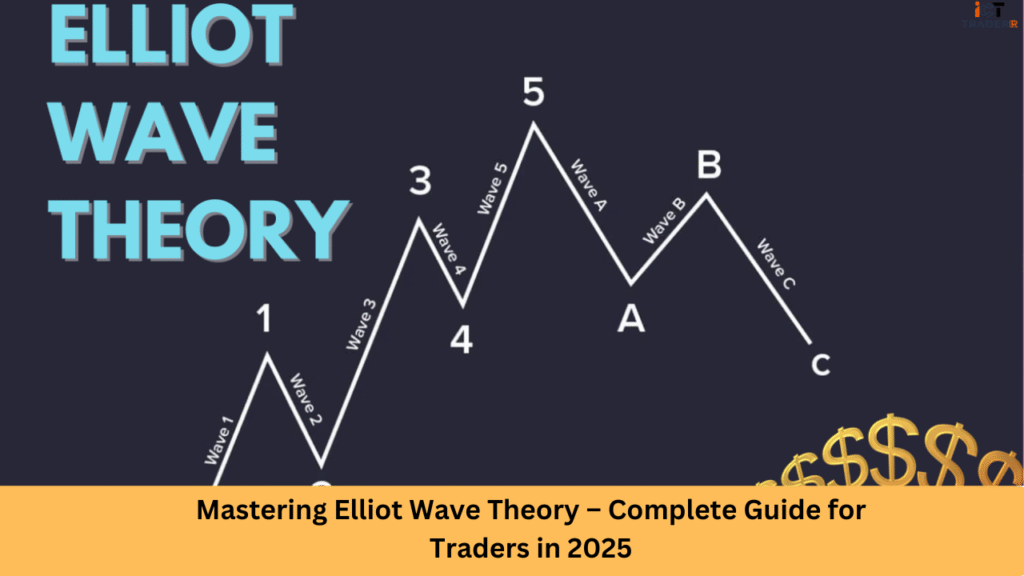

Elliott Wave Theory is based on the idea that markets move in repetitive cycles. These cycles are formed by the emotions of traders: optimism, fear, excitement, and doubt. The price moves in 5 waves in the direction of the trend, followed by 3 waves in the opposite direction.

These waves are not random. They are predictable once you learn how to recognize them.

The 5-wave structure is called the impulse phase, and the 3-wave move is called the corrective phase. These waves appear across all timeframes—daily, hourly, or even 5-minute charts.

Once you know what to look for, Elliott Waves can give you an edge that most traders simply don’t have.

The 5 Impulse Waves (Motive Phase)

Let’s talk about the five waves that make up the main trend. These are known as the impulse waves.

- Wave 1 – The market starts to move. At this point, most people are still unsure whether it’s a real trend or not.

- Wave 2 – A pullback occurs. Traders think the market was faking it. But this is just a pause.

- Wave 3 – The strongest and longest wave. Momentum kicks in, and smart traders like you are already riding the trend.

- Wave 4 – Another correction. It’s not as deep as Wave 2 and usually goes sideways.

- Wave 5 – The final move. This wave is driven by late buyers who are just entering. Smart money is usually preparing to exit here.

This 5-wave structure forms the backbone of most bullish or bearish moves you’ll see. Once you master this, your entries and exits will become much more accurate.

The 3 Corrective Waves (ABC Phase)

After five waves, the market needs to take a break, and that’s where the corrective phase comes in.

These are known as A-B-C waves:

- Wave A – The first reaction against the trend.

- Wave B – A fake recovery. It often looks like the trend is coming back, but it’s not.

- Wave C – The final move, usually as big or bigger than Wave A.

This pattern shows up again and again after every strong move. If you learn to identify corrections early, you can either avoid bad trades or prepare to enter the next impulse at the perfect moment.

Elliott Wave Rules & Guidelines

To avoid confusion, Elliott Wave Theory comes with a few simple but strict rules that you must follow:

- Wave 2 can never go below the start of Wave 1

- Wave 3 is never the shortest wave among 1, 3, and 5

- Wave 4 does not enter the price range of Wave 1

Along with these rules, there are helpful guidelines:

- Alternation Rule – If Wave 2 is sharp, Wave 4 will usually be flat, and vice versa.

- Channeling Technique – You can draw trendlines connecting Waves 1–3 and 2–4 to help visualize future targets.

- Volume Analysis – Wave 3 often has the highest volume; Wave 5 usually has lower volume despite rising prices.

By keeping these rules and guidelines in mind, you will be more consistent in identifying the correct wave count.

How to Label Elliott Waves Accurately

Labeling waves correctly is one of the most important parts of using Elliott Wave Theory. Here’s how you can get it right:

- Start with a higher timeframe, like the daily or 4-hour chart. This helps you spot the bigger structure.

- Mark the trend – Look for clear highs and lows. Try to spot where Wave 1 begins.

- Apply the 5-wave structure – Check whether the moves fit the impulse wave rules.

- Zoom into lower timeframes – Find the sub-waves within the main trend to confirm your labeling.

- Use Fibonacci tools – This will help you measure wave lengths and validate corrections.

- Keep adjusting – If something doesn’t make sense, be flexible. Relabel if needed.

Good labeling leads to better entries. Once you know where the market is in the wave cycle, you can trade with more confidence and clarity.

Elliott Wave and Fibonacci – Perfect Combo

Elliott Wave and Fibonacci go hand-in-hand like a lock and key.

Here’s how you can use them together:

- Wave 2 retracement often ends around the 61.8% Fibonacci level

- Wave 3 extension commonly reaches 161.8% of Wave 1

- Wave 4 may pull back to the 38.2% or 50% level

- Wave 5 can extend to the same height as Wave 1 or to a 123.6% or 161.8% extension

By applying Fibonacci levels to your Elliott Wave counts, you can improve your trade entries, stop-loss placements, and take-profit targets.

It helps you set rules for yourself rather than trading on gut feeling.

Practical Use of Elliott Wave in Modern Trading

Now let’s talk about how you can use Elliott Waves in today’s trading environment:

- Start with the daily or 4H chart – Get a sense of the trend and where the market is in the wave cycle.

- Mark impulse and corrective waves – Use the 5-3 pattern to define trend direction.

- Zoom in to a 1H or 15M chart – Plan your entry after identifying Wave 2 or Wave 4 pullbacks.

- Confirm using RSI or MACD – Divergences often appear during Wave 5 or corrections.

- Place stop-loss below Wave 2 or Wave 4 – These areas act as invalidation levels.

- Target Wave 3 or Wave 5 extensions – Use Fibonacci projections to set your targets.

With practice, you’ll start seeing these patterns clearly and naturally, just like recognizing a familiar face in a crowd.

Elliott Wave in Different Markets

One of the best things about Elliott Wave Theory is that you can apply it to multiple asset classes.

- Forex – Works beautifully on pairs like EUR/USD, GBP/JPY, USD/CAD.

- Crypto – Bitcoin and Ethereum follow Elliott Waves closely due to high emotional trading.

- Stocks – Especially trending stocks, tech sector, and index funds.

- Commodities – Gold, oil, and silver often show clean wave structures in volatile phases.

No matter what market you trade, Elliott Wave helps you understand market structure and plan better trades.

Limitations of Elliott Wave Theory

While Elliott Wave is powerful, it’s not a magic wand. Here are some limitations you should know:

- Subjectivity – Different traders may label the same chart differently.

- Complex Corrections – ABC waves can combine and confuse even experienced traders.

- No Fixed Timing – The market may take longer or shorter than expected to complete a wave.

- Choppy Markets – In sideways markets, waves are harder to read.

That’s why it’s important to combine Elliott Wave with other tools like price action, Fibonacci, and risk management. This way, you reduce the chance of error.

Conclusion

Elliott Wave Theory is more than just a theory—it’s a trading method that helps you understand the market’s natural rhythm. By mastering impulse and corrective waves, combining them with Fibonacci, and using clear labeling, you can step into each trade with confidence.

In 2025, as markets become faster and more unpredictable, using Elliott Wave will give you the structure and edge needed to survive—and thrive.

Remember:

- Follow the wave rules

- Label from higher to lower timeframes

- Use confirmations

- Be flexible and keep learning

With time and practice, this approach will become second nature. Start small, stay consistent, and Elliott Wave will become one of your most powerful trading tools.

FAQs

Can I use Elliott Wave on short timeframes?

Yes, absolutely. It works on 15-minute, 1-hour, 4-hour, and even daily charts. Just adjust your wave counts to match the timeframe.

How do I know if I labeled waves correctly?

Check the rules: Wave 2 must not go below Wave 1, Wave 3 can’t be the shortest, and Wave 4 must not enter Wave 1’s area. If that’s all correct, your labeling is likely good.

Which wave is best for entry?

Wave 3 is usually the strongest and safest for entry. Try to enter after Wave 2 completes.

Can Elliott Wave be automated?

Some tools try, but human interpretation still plays a big role. With experience, you can spot wave patterns better than bots in many cases.

How do I start learning?

Pick a currency pair, open a demo account, and start practicing wave labeling on higher timeframes. The more charts you label, the more confident you’ll become.