In the ever-changing world of financial trading, knowledge itself is power, and knowledge of the right terminology can mean clarity or confusion. So if you have ever come across abbreviations such as OTE, SMT, or SMC while learning about price action or trading strategies, then you’ve grazed on the surface of ICT. Inner Circle Trader, or ICT for short, is a rather popular trading methodology using smart money concepts and institutional-level analysis.

In this article, we will explain the essentials of ICT terminologies every trader should know, the relevance of the abbreviations, and tips for memorizing and applying these in the context of your trading journey.

What is ICT in Trading?

In-fact ICT stands for Inner Circle Trader, which is a trading framework founded by Michael J. Huddleston, or in other words “The Inner Circle Trader.” Such a program majorly bases and focuses on the institutional trading behavior, better known as Smart Money Concepts (SMC) which is the doctrine that teaches traders to align with big financial institutions rather than the retail herd mentality model of trade.

The ICT method uses a combination of technical analysis with liquidity zones and order blocks and market structures to find high-probability entries and exits in Forex, Crypto, Stocks, and Indices.

No matter how one defines his/her way of trading-as a day trader, scalper, or even a swing trader-understanding ICT terminology becomes very important in following the trading system.

Why Understanding ICT Abbreviations is Essential for Traders

The financial markets operate on high-speed data and precise decision-making. ICT traders use a specific set of abbreviations and terminologies to interpret market behavior. Here’s why you need to learn them:

- 🧠 Better Understanding of Market Structure: Abbreviations help you quickly grasp complex concepts like liquidity pools, breaker blocks, or PD arrays.

- ⚡ Faster Analysis: Time-sensitive opportunities require fast interpretation. Abbreviations simplify your workflow.

- 🎯 Improved Trading Precision: By mastering ICT lingo, you can better identify entry/exit points and manage risk like an institutional trader.

- 📘 Streamlined Learning: Instead of reading lengthy definitions, you’ll internalize concepts that boost your strategic thinking.

Common ICT Abbreviations Every Trader Should Know

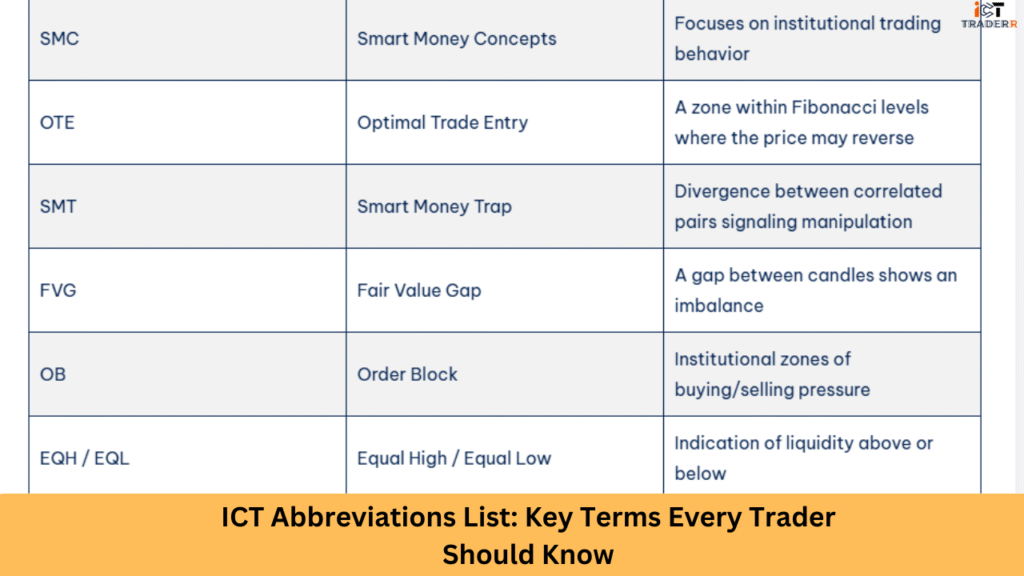

Here are some must-know abbreviations for anyone diving into ICT trading strategies:

| Abbreviation | Meaning | Purpose in Trading |

| SMC | Smart Money Concepts | Focuses on institutional trading behavior |

| OTE | Optimal Trade Entry | A zone within Fibonacci levels where the price may reverse |

| SMT | Smart Money Trap | Divergence between correlated pairs signaling manipulation |

| FVG | Fair Value Gap | A gap between candles shows an imbalance |

| OB | Order Block | Institutional zones of buying/selling pressure |

| EQH / EQL | Equal High / Equal Low | Indication of liquidity above or below |

| LQ | Liquidity | Refers to stops and money resting above/below price levels |

| PD Array | Price Delivery Array | Three phases of price movement: Accumulation, Manipulation, Distribution |

| BMS | Break in Market Structure | Signals trend shift |

| ICT Killzones | Specific time sessions with high volatility | Used to time entries, especially in London and NY sessions |

These are just a few examples, but they form the foundation of any ICT-based analysis.

Top 5 ICT Concepts

Mastering ICT trading strategies means diving deeper into core concepts. Here are the top five that rely heavily on abbreviations:

1. Liquidity Grabs (LQ / EQH / EQL)

Markets often “grab” liquidity by breaching equal highs or lows before reversing. Recognizing this tactic helps traders avoid being trapped.

2. Order Blocks (OB)

These are zones where institutions placed large orders. Once identified, they act as strong support or resistance areas.

3. Optimal Trade Entry (OTE)

Using Fibonacci retracement levels (typically 61.8–79%), traders look for optimal entry points aligning with the larger trend.

4. Market Structure Shifts (BMS)

ICT emphasizes the importance of identifying when the market shifts from a bullish to a bearish structure, or vice versa.

5. Fair Value Gaps (FVG)

These imbalances between candles are often “filled” by price later. Traders use this gap for predicting reversals or continuations.

How to Effectively Memorize and Use These Abbreviations

Understanding ICT terms is only half the battle. Here’s how to make them part of your trading vocabulary:

✅ Create a Flashcard Deck

Use tools like Anki or Quizlet to build digital flashcards of abbreviations and their meanings.

✅ Practice Chart Markups

Draw and label ICT concepts directly on trading charts (e.g., TradingView). Visual learning reinforces memorization.

✅ Join ICT Communities

Telegram and Discord groups focused on ICT trading allow you to learn from others, get feedback, and stay updated.

✅ Watch ICT Videos

Michael Huddleston’s YouTube channel and similar educational content help you see the application of abbreviations in real time.

✅ Daily Repetition

Daily exposure makes you acquire the naturally internalized abbreviation just as learning a new language.

Conclusion

The ICT trading framework could be termed as a mindset from where traders get to understand how institutional money operates in the market. With proper understanding and application of key abbreviations used in ICT, like OTE, SMT, OB, and FVG, traders can greatly refine their technical analysis, market timing, and trading performance.

Practice and repetition are the secrets to mastering these abbreviations. Integrate them into your trading style, and you’ll level up your skillset much quicker.

FAQs

What is ICT in simple terms?

ICT, in its simplest form, refers to Inner Circle Trader. Just as Michael Huddleston developed this trading methodology for exhibiting price behavior based on institutions and market players.

Are the ICT strategic concepts good for beginners?

Yes, but they require discipline and practice. Many beginner traders find the concepts challenging at first but rewarding over time.

Is ICT only used in Forex?

No. While it’s popular in Forex, ICT methods also work well in Crypto, Indices, and even Commodities trading.

Do I need paid courses to learn ICT?

Not necessarily. Many free resources (like ICT’s official YouTube channel) provide valuable insights to start learning.

How long does it take to master ICT abbreviations?

With consistent practice, most traders can grasp the basics in 2–4 weeks and master application within a few months.