In today’s complex trading landscape, one of the most fundamental tools utilized by smart money such as institutions banks, and hedge funds is ICT Liquidity Pools. Retail traders often ignore these hidden zones leading to early entries and continual loss. In this article, we will explain what liquidity means, how to identify bullish and bearish ICT liquidity pools, and how to use them to your advantage once you gain the knowledge of liquidity-based trading strategies.

By the end of this article, you will have a better understanding of how ICT Liquidity Pools can benefit you.

Understanding Liquidity and ICT Liquidity Pool?

What is Liquidity?

Liquidity means the ease of accessing an asset to buy or sell it in a marketplace without affecting its prices. A highly liquid market would have a large number of buyers and sellers in it, so entering or exiting would not be difficult. Low liquidity may lead to slippage along with wider bid/ask spreads.

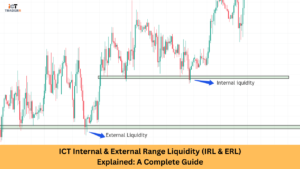

What is an ICT Liquidity Pool?

ICT Liquidity Pools represent areas in the market where large institutions (essentially, smart money) place their orders. These pools are zones of high liquidity where the price may reverse or run through.

“If traders understand these pools, it will give them a sizable advantage, as they will be able to predict where the price is most likely headed next.”

How to Identify Liquidity Pools Like a Pro?

Identifying ICT liquidity pools requires a very keen eye for market structure and price action. Here are some important steps to help in identifying these pools of liquidity:

Step 1: Look for High Volume Nodes

Areas in which large amounts of transaction volume have happened. Price tends to revisit these areas, as they are zones of interest to institutional buy and sell players.

Step 2: Identify Swing Highs and Lows

Swing highs and lows act as hard reversal levels. These levels tend to function as liquidity pools.

Step 3: Use Order Flow Analysis

Through order flow analyses you would know where large orders are placed. Thus, you can rightly assume the creation of liquidity pools.

Step 4: Market Depth

Market depth/bid-ask volume shows areas with sitting larger buy and sell orders. These areas are likely to be liquidity pools.

Step 5: Recognize Fair Value Gaps (FVGs)

A Fair Value Gap comes into being when a price movement skips certain levels on account of an imbalance between buyers and sellers. such gaps mostly represent institutional activities, where acts of buying and selling can be expected.

Step 6: Identify Order Blocks

Order blocks represent an area where institutional traders enter their positions. Usually formed by strong momentum candles followed by a retracement, the area of the following moves usually constitutes a liquidity pool.

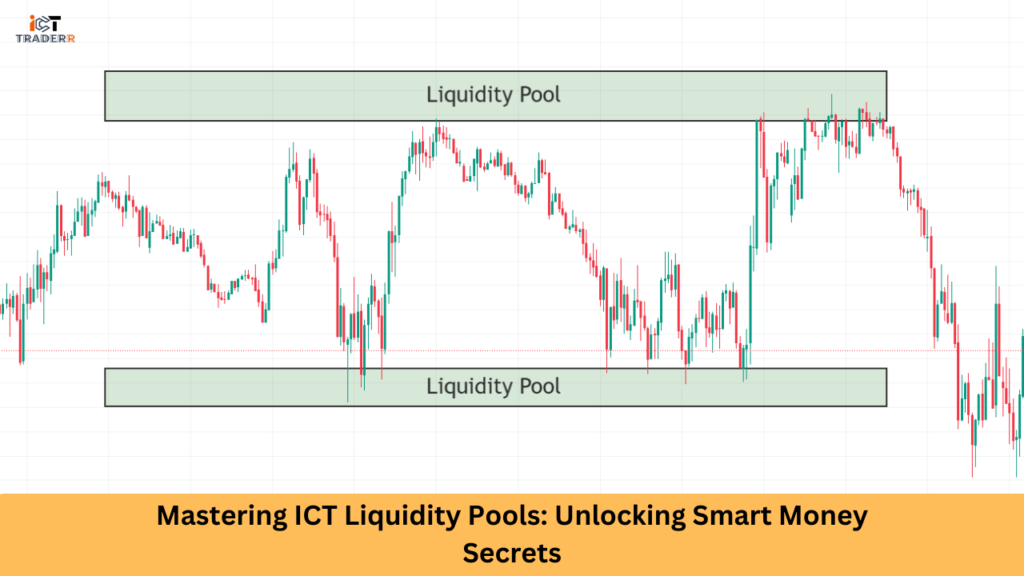

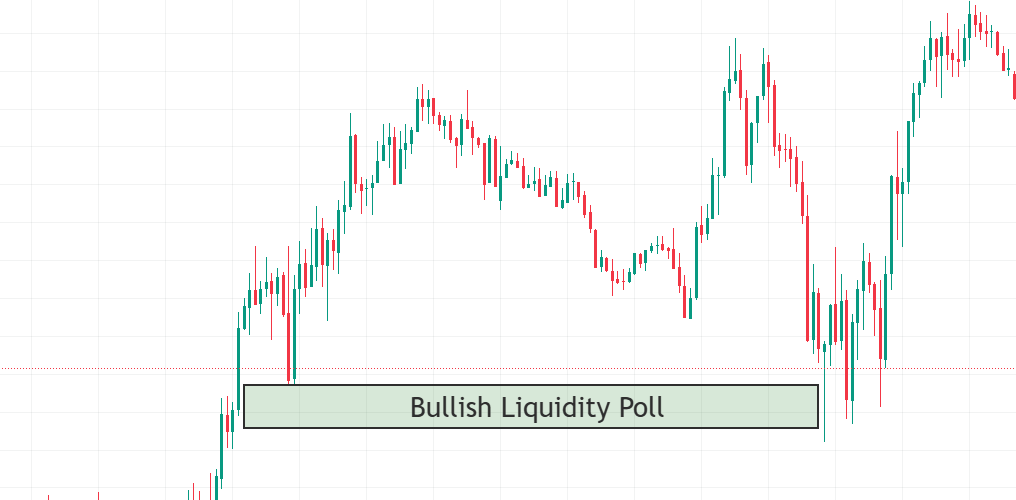

Bullish ICT Liquidity Pool

A Bullish ICT Liquidity Pool is a zone where price is likely to reverse to the upside. This happens when the price drops to a liquidity pool, which prompts buy orders from institutional players and causes the price to rise back up.

Trading Strategies for Bullish ICT Liquidity Pools

Here are some given below strategies that will you help to understand bullish ICT liquidity pools

- Identify the Pool: Look for a previous swing low or a high volume node where the price is likely to reverse.

- Wait for Confirmation: Wait for the price to reach the liquidity pool and exhibit reversal-related signs, such as a bullish engulfing candle or a pin bar.

- Enter the Trade: Enter a long position once you have confirmation of a reversal.

- Set Stop Loss and Take Profit: Place your stop loss below the liquidity pool and set your take profit at the next key resistance level.

Bearish ICT Liquidity Pool

A Bearish ICT Liquidity Pool is a zone where the price is likely to reverse to the downside. This occurs when the price moves up to a liquidity pool, triggering sell orders from institutional players, and causing the price to reverse and move lower.

Trading Strategies for Bearish ICT Liquidity Pools

Here are some given below strategies that will you help to understand bullish ICT liquidity pools

- Identify the Pool: Look for a previous swing high or a high volume node where the price is likely to reverse.

- Wait for Confirmation: Looking for confirmations entails the requirement of waiting for the price to come into the liquidity pool, showing signs of reversal via bearish engulfing candle formation or pin bar.

- Trade Entry: Enter the trade at the moment you discover the confirmation of reversal by entering a short position.

- Place Stop Loss and Take Profit Order: Place stop loss just above the liquidity pool and then take your profit at the next key support level.

Liquidity Pools vs. Retail Strategies: Why Most Traders Lose?

Retail traders follow indicators and lagging tools for making trading decisions. These strategies are mostly based on past data and do not connect to the real-time movement of institutional buying and selling. On the other hand, ICT Liquidity Pools focus on understanding where smart money is placing their orders giving traders a real-time edge.

Why Most Traders Lose?

Most traders lose because they are not aware of where liquidity is concentrated. They often enter trades based on retail strategies that do not account for the actions of institutional players. By understanding and trading ICT Liquidity Pools you can align yourself with smart money and increase your chances of success.

Conclusion

Mastering ICT Liquidity Pools is a powerful way to gain an edge in the market. You can join the smart money and increase your chances of success by knowing where liquidity is concentrated and how to trade these areas. Always wait for confirmation before entering a trade and check your risk management.

FAQs

What is the ICT Liquidity Pool?

An ICT liquidity pool is a price area where smart money can use these retail stop-loses to execute large orders efficiently.

How do I discover a liquidity pool?

Search for equal highs/lows and current swing points, as well as price consolidation areas; liquidity pools are often located above or below those areas.

Is liquidity trading suitable for beginners?

Yes, but deserves time and chart practice. Start learning about market structure, then go stepwise towards learning liquidity concepts.

What is the difference between a Bullish and Bearish ICT Liquidity Pool?

A bullish ICT Liquidity Pool is a zone where the price will reverse to the upside, while a Bearish ICT Liquidity Pool is where the price is likely to reverse downward.

Why do most traders fail?

The major reason why most traders fail is they use retail strategies that do not consider what institutional players are doing to make profits. By understanding and trading ICT Liquidity Pools, you are aligned with the smart money, thereby increasing your chances of success.