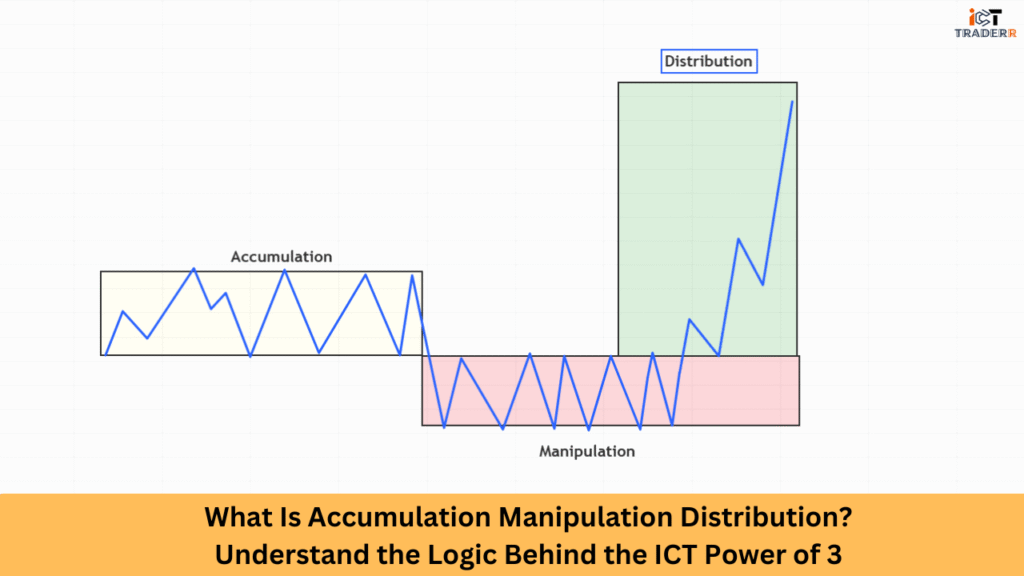

In the world of smart money trading, understanding market structure is key to executing profitable trades. One of the most powerful frameworks under the Inner Circle Trader (ICT) methodology is the Power of 3. This model is built upon a price behavior pattern known as Accumulation, Manipulation, and Distribution (AMD).

The ICT 3-Day Cycle relies heavily on understanding Daily Bias, which guides price delivery during each phase.

In this article, we will explain what AMD is, how it forms the core of the ICT Power of 3, and how traders can use this knowledge to identify high-probability trade setups.

What is ICT Power of 3?

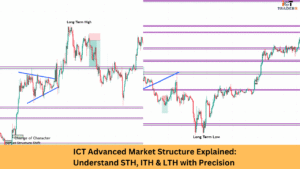

The ICT Power of 3 is a trading concept developed by Michael J. Huddleston, popularly known as the Inner Circle Trader. It suggests that price action during a daily session typically follows a three-phase cycle:

Accumulation: Where liquidity builds and price consolidates.

Manipulation: Where smart money induces retail traders into false positions.

Distribution: Where the actual move unfolds, usually aligned with the higher-timeframe bias.

This model reflects how institutional players, or “smart money”, operate to trap retail you and then profit from their mistakes. The Power of 3 forms the backbone of ICT’s day trading and swing trading strategies, integrating with concepts like order blocks, liquidity grabs, and market structure shifts.

What Is Accumulation Manipulation Distribution (AMD)?

Accumulation Manipulation Distribution (AMD) is the logical sequence of price movement caused by institutional trading activities. It reflects how big players like banks and hedge funds accumulate orders, manipulate prices to shake out weak hands, and finally distribute their positions for profit.

It’s closely related to Wyckoff’s methodology, where accumulation represents the stealthy buildup of long positions, manipulation mirrors the shakeout phase, and distribution reflects the mark-up or mark-down move.

Understanding this cycle helps you avoid getting caught on the wrong side of the market and instead trade with the smart money.

How AMD Forms the Core of ICT Power of 3

The AMD model and ICT Power of 3 are essentially two sides of the same coin. ICT’s Power of 3 is a refined and practical application of AMD tailored for real-time forex and index trading.

- Accumulation is the range or consolidation before a session opens.

- Manipulation typically occurs during the London or New York open, where false breakouts happen.

- Distribution is the sustained directional move that provides the actual opportunity for profit.

By identifying these three phases correctly, you can align their entries with the optimal trade entry (OTE) point, a key principle in ICT strategy. This leads to you with higher reward-to-risk ratios and improved consistency.

Key Characteristics of Each AMD Phase

Each phase of the AMD cycle exhibits distinctive characteristics that you can learn to recognize. Let’s explore the unique attributes of each stage:

Accumulation Phase

The accumulation phase represents the period when institutional traders begin building positions. During this stage:

- Price action typically consolidates in a range-bound pattern

- Volume may appear relatively low despite increasing institutional activity

- Volatility decreases as large players carefully avoid disrupting prices

- False breakouts quickly return to the range, trapping retail traders

- Market noise increases as institutions disguise their true intentions

Institutional traders use the accumulation phase to build positions at favorable prices before the next significant price move. This phase often appears as a period of indecision to uninformed traders, creating an opportunity for those who can correctly identify it.

Manipulation Phase

The manipulation phase occurs when institutions create price movements designed to trigger retail stop-losses and generate liquidity. Key characteristics include:

- Sharp, unexpected price moves that violate previous support/resistance

- Increased volatility that shakes out weak positions

- Volume spikes as stop-losses are triggered and retail traders exit positions

- False breakouts or breakdowns that quickly reverse

- Price movements that appear to contradict recent market sentiment

During manipulation, institutions engineer price movements specifically to create liquidity pools where they can later distribute their accumulated positions. These moves often trap you on the wrong side of the market, setting up the final phase.

Distribution Phase

The distribution phase represents the period when institutions unload their positions into the liquidity created during manipulation. During distribution:

- Trading volume increases significantly

- Price begins to move steadily in the intended direction

- Media attention and retail enthusiasm often peak

- Market narratives emerge to explain the “obvious” price direction

- Early signs of exhaustion appear as the distribution nears completion

Distribution often coincides with maximum public interest, allowing institutions to transfer their positions to retail you at favorable prices. Understanding this phase helps you avoid buying tops or selling bottoms.

Types of Accumulation, Manipulation Distribution in Trading

The AMD framework manifests in various market scenarios, with two primary setups that you should recognize:

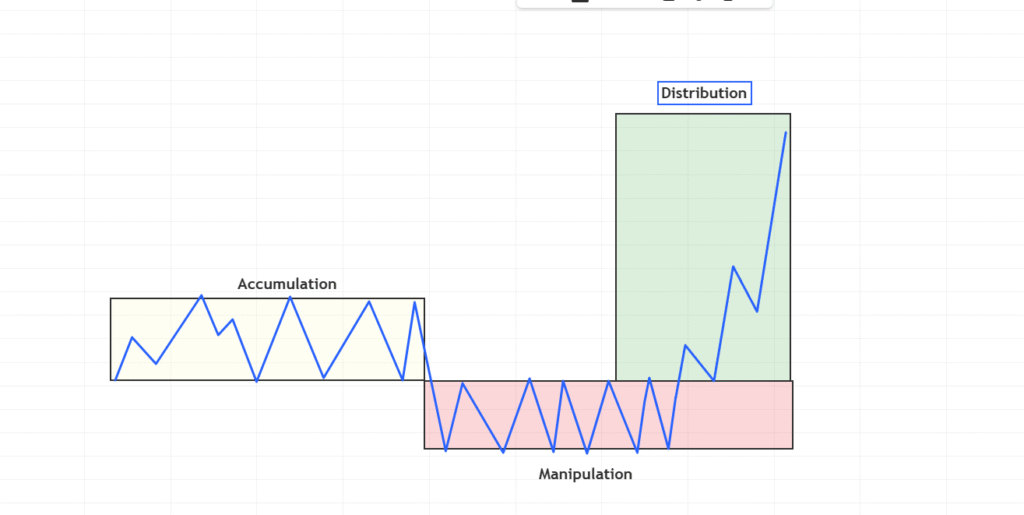

Bullish AMD Setup

In a bullish AMD setup, institutions accumulate positions during a period of price consolidation after a downtrend. The sequence typically unfolds as:

- Accumulation: Price stabilizes after a decline, forming a base as institutions quietly buy

- Manipulation: A final push lower triggers stop-losses and creates fear among retail traders

- Distribution: After the manipulation, price reverses and begins trending higher as institutions distribute into retail buying

This pattern often creates what technical analysts call a “double bottom” or “inverse head and shoulders” formation. However, the ICT methodology interprets these patterns through the lens of institutional intent rather than just chart patterns.

Bearish AMD Setup

In a bearish AMD setup, institutions accumulate short positions during consolidation after an uptrend. The pattern typically progresses as:

- Accumulation: Price stabilizes after an advance as institutions begin building short positions

- Manipulation: A final push higher triggers breakout buyers and creates retail FOMO

- Distribution: After the manipulation, price reverses and begins trending lower as institutions distribute their shorts into retail enthusiasm

This often creates what conventional technical analysis might label a “double top” or “head and shoulders” pattern, though the ICT approach focuses more on the institutional activity driving these formations.

This cycle often aligns with Liquidity Pools, especially as price expands into or out of key levels.

How to Enter High-Probability Trades Using AMD Phases

Using the AMD model, traders can develop a strategic approach to timing entries and exits. Here’s how to apply it:

Step 1: Identify the Accumulation Range

Use a session indicator or observe price action between midnight and London open. Mark the highs and lows of this range.

Step 2: Watch for Manipulation

During the London or New York session, look for stop hunts, false breakouts, or liquidity grabs. This is the manipulation phase.

Step 3: Wait for Confirmation

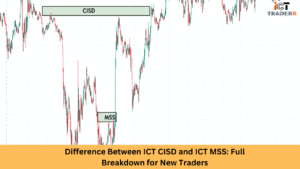

Look for:

- Market structure shift.

- Break of recent high/low.

- FVG (Fair Value Gap) or order block retest.

Step 4: Enter the Distribution Move

Once the direction is clear, enter with Confluence:

- Use Fibonacci retracement.

- Set stop loss below the order block or swing low/high.

- Aim for a 2:1 or 3:1 risk-reward ratio.

Pro Tip: Use the higher-timeframe bias (H1, H4) to align your trades. If a higher timeframe is bullish, favor long entries after a manipulation to the downside.

Why This Model Is So Powerful

The AMD framework and ICT Power of 3 methodology offer several advantages over conventional technical analysis:

- Focus on cause rather than effect: Instead of just identifying patterns, AMD explains why patterns form and how to interpret them

- Alignment with institutional activity: By understanding institutional intent, traders can position themselves with smart money rather than against it

- Fractal application across timeframes: The AMD cycle applies to all timeframes, allowing traders to find confluence between multiple time horizons

- Psychological preparation: Understanding the manipulation phase helps traders maintain composure during volatile price movements

- Clear framework for entries and exits: The phase transitions provide logical points for trade entry and exit

By focusing on the intent behind price movements rather than just the movements themselves, you gain insight into the “why” of market behavior, not just the “what.”

Conclusion

Understanding Accumulation Manipulation Distribution (AMD) and how it relates to the ICT Power of 3 is a game-changer for serious traders. This model provides a clear, logical framework for reading market behavior and positioning trades in harmony with institutional players.

By mastering each phase, Accumulation, Manipulation, and Distribution, you will not only avoid getting trapped by fakeouts but also start trading with confidence and consistency. Whether you’re into forex, crypto, or indices, AMD is a tool worth having in your arsenal.

FAQs

Is AMD the same as Wyckoff’s method?

While both involve similar phases, AMD is a simplified, real-time application of the Wyckoff model, particularly suited for day and swing traders.

Can I use the AMD model in any market?

Yes. AMD works in forex, crypto, stocks, and indices, as institutional behavior is present in all markets.

How long does each AMD phase last?

There’s no fixed duration, but accumulation often happens during the Asian session, manipulation during the London open, and distribution throughout the New York session.

Are indicators needed to trade AMD?

No. AMD relies on price action and market structure. However, tools like session indicators or volume profiles can help with clarity.

Can beginners apply this strategy?

Absolutely. With practice and proper risk management, AMD is beginner-friendly and provides a strong foundation for understanding smart money concepts.