Change of Character (ChoCh) is a technical trading term. It helps traders determine if a market will reverse a possible trend or not. The expression refers to a change in the market’s typical behavior, indicating possible changes between bullish and bearish trends. By understanding Choch, you can decide to enter or exit at optimal positions. While analyzing market shifts such as Change of Character (ChoCh), it’s essential to understand the Break of Structure as both work closely in market structure transitions.

In this guide, we will explore the Definition of Change of Character (ChoCh) and the Importance of ChoCh for traders, Different kinds of ChoCh (Bullish & Bearish), how to identify ChoCh on charts, Ideal time frames for using ChoCh, and the best way of trading with ChoCh.

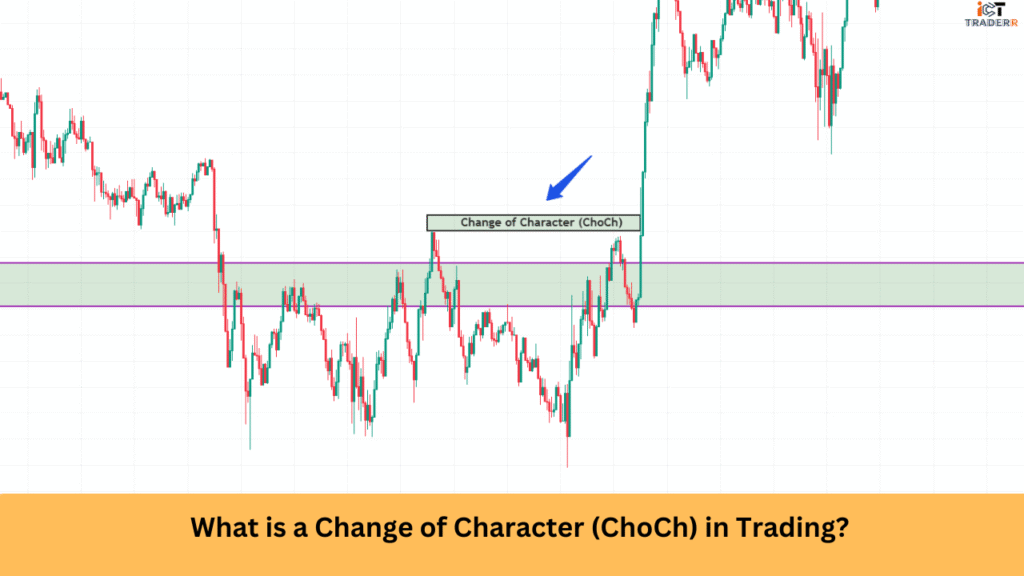

What is a Change of Character (ChoCh)?

Change of character tracks a big shift in bias for the trading world. It shows the passage from a current trend to a possible new trend and therefore also serves as an early potential signal for reversals or trend continuations for traders. Choch is confirmed through price action characteristics, such as breaking previous highs or lows that alter the dynamics of supply and demand.

Traders use ChoCh to anticipate trend changes and align their strategies accordingly. This concept is particularly useful in smart money trading and Wyckoff methodology, where institutional movements influence market structure shifts.

Why is ChoCh Important for Traders?

Understanding ChoCh is essential because:

Early Trend Reversal Detection: Identifying ChoCh early helps traders enter or exit trades before major moves.

Better Risk Management: An understanding of the market’s psychology enables a trader to best rearrange his stop-loss and take-profit orders.

Enhanced Market Timing: ChoCh allows traders to refine their entry and exit points based on market structure changes.

Works with Multiple Strategies: It complements various trading strategies, including support and resistance trading, the Wyckoff method, and smart money concepts.

Types of Change of Character (ChoCh)

ChoCh can be categorized into two main types:

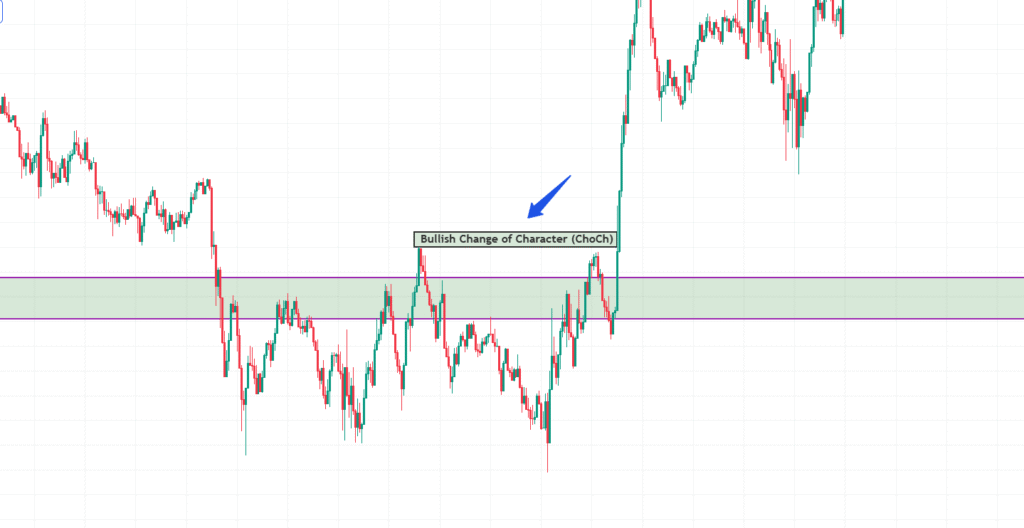

1. Bullish Change of Character

A bullish ChoCh occurs when a downtrend shows signs of reversal into an uptrend. This typically happens when:

- A lower high is broken, signaling bullish momentum.

- Price moves above a key resistance level.

- Volume increases on upward moves, confirming buying interest.

Example: In a downtrend, if price continuously forms lower highs and lower lows but then breaks above the most recent lower high, it signals a bullish ChoCh, indicating that buyers are gaining control.

2. Bearish Change of Character

A bearish ChoCh signifies a transition from an uptrend to a downtrend. It occurs when:

- A higher low is broken, indicating a weakening trend.

- The price drops below a major support level.

- Selling pressure increases, evident through high-volume downward moves.

Example: In an uptrend, if price forms higher highs and higher lows but suddenly breaks below the last higher low, a bearish ChoCh is confirmed, suggesting that sellers are taking control.

How to Identify ChoCh on Charts

Traders can identify ChoCh using the following methods:

- Trendline Breaks: Draw trendlines connecting highs and lows. A break of these trendlines indicates ChoCh.

- Support & Resistance Breaks: If price breaks a significant support in an uptrend or resistance in a downtrend, it signals a potential ChoCh.

- Candle Patterns: Look for strong engulfing candles, pin bars, or order blocks forming at key levels.

- Volume Confirmation: A genuine ChoCh is often accompanied by an increase in volume, confirming the shift in market sentiment.

Best Time Frames to Use ChoCh

The effectiveness of ChoCh depends on the time frame you trade:

- Low Time Frames (1M, 5M, 15M) – Good for scalping and intraday trading.

- Mid-Time Frames (1H, 4H) – Good for swing trading, thus, big moves.

- Higher Time Frames (Daily, Weekly) – Best for long-term trend identification and confirmation.

How to Use Change of Character in Your Trades?

1. Entry Strategy

- Wait for a clear ChoCh confirmation before entering a trade.

- Confirmation signals like bullish engulfing or bearish engulfing candles can be used.

- Enter trades near strong support/resistances for a better risk-to-reward ratio.

2. Stop-Loss Placement

- Place stop-loss below the last swing low (for bullish ChoCh) or above the last swing high (for bearish ChoCh).

- Adjust stops as the trend develops to lock in profits.

3. Take-Profit Strategy

- Set take-profit levels according to Fibonacci retracement, any previous high or low, or moving average.

- If the trend continues, use trailing stops to lock in profit.

4. Combining with Other Indicators

- Use RSI or MACD to confirm momentum before entering trades.

- Combine ChoCh with moving averages to gauge trend direction.

- Apply volume analysis to validate price action signals.

Conclusion

The change of character (ChoCh) concept helps you determine possible trend reversals or continuations. Bullish and bearish ChoCh create potential refinements for trading strategy, risk management, and trade execution. By understanding ChoCh in trading, along with its markers, volumetric analysis, and stop-loss mechanisms, you can increase your luck in trading.

“By mastering ChoCh, you can gain a strategic edge and improve your market timing and trade execution.”

FAQs

Is ChoCh applicable to all markets?

Yes, ChoCh can be applied to forex, stocks, crypto, and commodities trading.

Can ChoCh be used as a standalone strategy?

While ChoCh is useful, it works best when combined with other technical indicators and analysis methods.

How often does ChoCh occur?

ChoCh occurrences depend on market conditions and time frames. Lower time frames show frequent ChoCh signals, while higher time frames provide stronger confirmations.

How do I avoid false ChoCh signals?

Confirm ChoCh with volume, candle patterns, and additional technical indicators to filter out false signals.