Candlestick patterns are powerful tools for technical analysis to assess the market’s probable reversing or continuing actions. The Gravestone Doji pattern is a strong bearish reversal signal among these patterns. If you know how this candlestick is formed, what it indicates, and how to trade with it, then enhancing your trading decisions in the market will improve.

In this article, we will provide insight into possible points of market reversal, especially where prices have been in an upward trend.

What Is a Gravestone Doji?

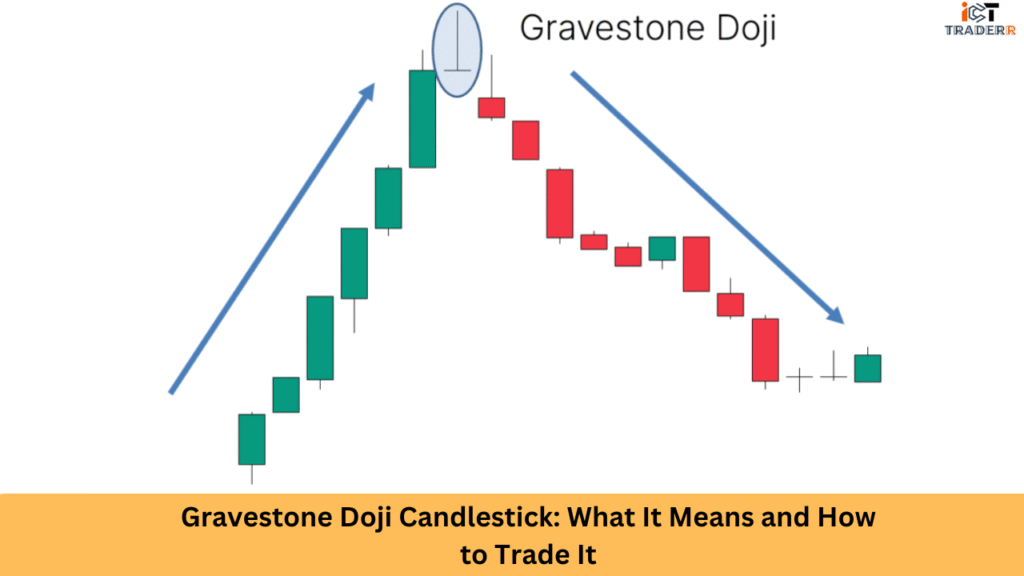

In candlestick chart patterns, the Gravestone Doji is a significant reversal indicator. This formation signifies the potential for strong bearish reversal signals following an upward trend. This pattern represents the close of buyers unsuccessfully attempting to lift prices above the selling pressure.

In simple terms, a gravestone doji suggests that although the bulls tried hard to dominate the candle, the price was still taken down by the bears in the end. This candlestick tends to occur near the top of an uptrend and indicates likely price drops.

How to Identify a Gravestone Doji on the Chart

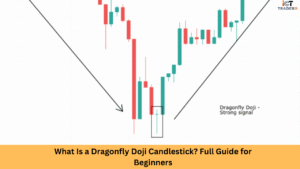

Spotting a Gravestone Doji requires understanding its structure and market context:

Long upper shadow, indicating that prices moved up significantly but then fell.

There is almost no bottom shadow because all prices are pretty close to the opening, closing, and low being nearly equal.

Typically found after an uptrend or near resistance levels.

This pattern can be found on any timeframe, whether daily, weekly, or intraday charts. In essence, confirmations are required, which should look the same therefore, the pattern must be double-checked with other technical analysis tools like trendlines or support and resistance.

Why Is the Gravestone Doji Important for Traders?

The Gravestone Doji is significant because:

Trend Reversal Signal:

It warns that a bearish reversal may occur as bullish momentum weakens.

Risk management:

In recognizing the Gravestone Doji, traders can set their stop-loss levels to protect their profits.

Confirmation for Short Positions:

The Gravestone Doji is used by many traders to determine when to enter a short position.

Psychological Insight:

Here’s a peek into the clash between buyers and sellers, suggesting that the sellers have gained greater strength.

However, you should keep in mind that a reversal cannot be predicted by a single candlestick.

How to Trade the Gravestone Doji

Successful trading using the Gravestone Doji pattern requires a systematic approach:

1. Confirmation Strategy: Before taking any action, wait for confirmation. To confirm the reversal signal, bearish movement should occur the day after a Gravestone Doji. This usually looks like a candle that starts below the Doji’s close and goes down from there.

2. Entry Points Optimal entry for short positions often comes on the next candlestick after confirmation, ideally on any minor pullback. Some traders enter the market once the price drops below the low of the Gravestone Doji candle.

3. Setting Stop Losses Place stop-loss orders slightly above the high of the Gravestone Doji’s upper shadow. This level represents the maximum price buyers could achieve during the formation, and a move beyond it invalidates the bearish signal.

4. Establishing Profit Targets: Determine profit targets using technical tools such as:

- Fibonacci retracement levels

- Previous support areas

- Price projections based on the height of the pattern

5. Volume Analysis: Trade volume should be considered during the Gravestone Doji formation. A high volume adds weight to the pattern, implying a higher conviction in terms of price rejection:

Some traders additionally utilize the Gravestone Doji in conjunction with moving averages, the RSI, or the MACD for further confirming their analysis.

When to Avoid Trading the Gravestone Doji

While the Gravestone Doji can be powerful, there are situations where it’s better to avoid trading based on it:

Low Volume: If the Gravestone Doji forms during low-volume periods, it may not be reliable.

No Clear Uptrend: If there’s no strong prior uptrend, the Gravestone Doji might not signify anything meaningful.

No Confirmation: Diving into a trade without waiting for confirmation from a candle may lead to various false signals.

Overbought/Oversold Conditions: Be sure to regularly put the market under scrutiny to check for being heavily extended via the RSI or other indicators.

Common Mistakes Traders Make with the Gravestone Doji

Even experienced traders can fall into these traps when trading the Gravestone Doji:

Taking action as soon as a pattern is observed without waiting for price action to confirm the reversal signal.

Lack of awareness regarding the overall trend of that market, including levels of support and resistance, and other technicalities involved in bringing efficacy to the pattern.

Placing stops that are either too tight or too loose can cause you to lose out on potentially profitable trades or put too much money at risk.

Giving small Gravestone Dojis with minimal upper shadows, which do not truly reflect significant price rejection, too much weight in trading minor instances.

Ignoring Timeframe Implications, you don’t alter the expectations depending on the timeframe; longer timeframes’ patterns indicate weight more than shorter ones.

The best key to success in trading is patience, proper technical analysis, and strong risk management strategies.

Conclusion

The Gravestone Doji candlestick is the strongest setup if it is used in the right way. This indicates a potential change in mood from bullish to bearish, offering an excellent opportunity for valuable trading. However, every trading indicator is not a stand-alone indicator and has to be used with other analysis techniques. The best traders combine the candlestick pattern with other techniques, keep their discipline intact, and always manage their risks.

Gravestone Doji mastery transforms into a weapon of an extremely dependable nature, which strengthens your trading plan further in spotting profitable opportunities while avoiding the many traps.

FAQs

Is a Gravestone Doji bullish or bearish?

A Gravestone Doji is usually considered a bearish reversal pattern, especially after an uptrend.

Can I trade the Gravestone Doji without confirmation?

Traders should wait for a confirmation candle.”

What is the best time frame to find the Gravestone Doji?It can appear on any time frame, but higher time frames like daily or weekly charts tend to produce stronger signals.

How reliable is the Gravestone Doji?

It’s quite reliable when combined with other technical indicators and confirmation signals, but no pattern is 100% foolproof.

Can beginners use the Gravestone Doji pattern?

Yes! With proper education and risk management, beginners can effectively incorporate it into their trading plans.