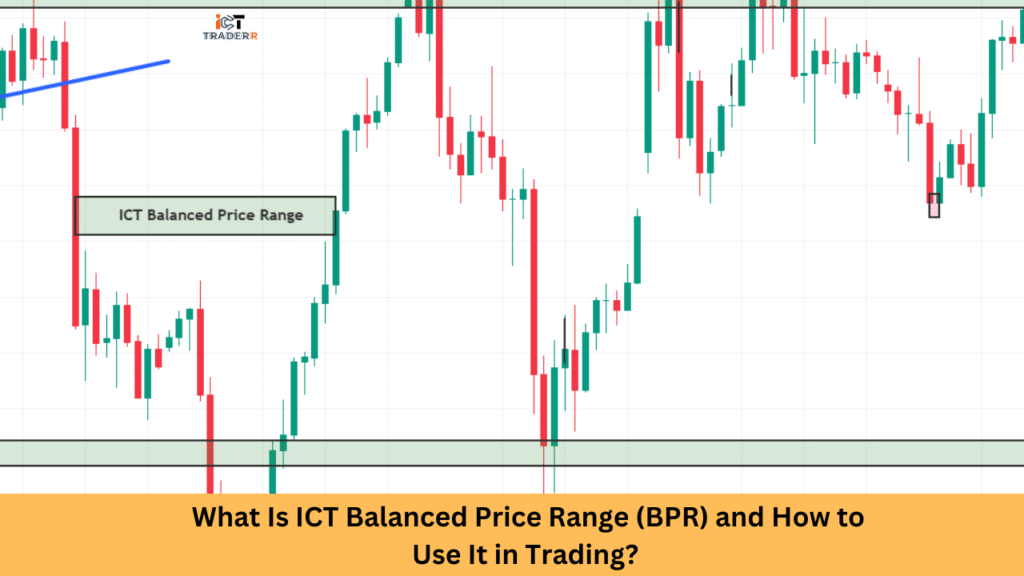

The concept of ICT Balanced Price Range is at the core of the Inner Circle Trader (ICT) methodology, which helps in identifying the best price levels for entering and exiting the market. It indicates a point of consolidation, buying and selling pressure, and often has a break or reversal following it.

In this article, we will discuss ICT BPR, its significance in trading, how to spot it on your charts, and effective strategies for trading it. We will also discuss the psychology behind BPR and answer common FAQs.

What Is ICT Balanced Price Range (BPR)?

In the world of trading, especially in smart money concepts, the ICT Balanced Price Range (BPR) plays a critical role. Developed by the Inner Circle Trader (ICT) community, the BPR represents a price range where the market finds temporary balance between buyers and sellers. It occurs after a strong displacement in price action, followed by a partial retracement.

The BPR is usually formed between two significant highs and lows. You use this area to predict probable support and resistance zones and entry points, as well as market reversals. Knowledge of the BPR allows traders to ride with the market instead of chasing after price movements. Some related terms include order blocks, fair value gaps (FVG), and liquidity grabs, all part of the ICT trading philosophy.

A Balanced Price Range often occurs after rebalancing a Liquidity Void or Fair Value Gap.

Why is ICT BPR important in Trading?

The ICT Balanced Price Range is not just another fancy term it’s a powerful tool for any trader aiming to move with smart money. Here’s why it matters:

- Identifies Key Price Levels: BPR shows you where the market previously found balance. These areas frequently attract future price movement.

- Entry and Exit Opportunities: When price revisits the BPR, it frequently offers high-probability setups for entries or exits.

- Supports Risk Management: Trading around a well-defined BPR can help set tighter stop losses and clearer take profit targets.

- Enhances Market Structure Analysis: It complements the analysis of breakers, premium/discount zones, and liquidity pools.

How to Identify the ICT Balanced Price Range (BPR) on the Chart

Spotting a BPR on your chart is not as complicated as it sounds. Follow these steps:

- Identify a Sharp Movement: First, look for a sharp upward or downward movement. This move should break structure (BOS) or grab liquidity.

- Identify Two Significant Points: After displacement, find two clear highs (in a bearish move) or two clear lows (in a bullish move).

- Mark the Range: Picture the box or highlight the area between these two points. This is your BPR zone.

- Wait for Price to Return: Price will often retrace back to this balanced range before continuing in the original direction.

A useful tip is to combine BPR analysis with fair value gaps, imbalance zones, or order block confirmations for even stronger setups.

How to Use ICT Balanced Price Range (BPR) for Trading

Once you have identified a valid BPR, you can implement several trading strategies:

Breakout Trading Strategy

By far, one of the best ways to enter a trade would be to do so when the price of the asset breaks out of the BPR with strong conviction. Here’s how to execute this strategy:

- Hold off until a decisive candle closes outside the BPR boundary

- Enter in the direction of the breakout

- Place your stop-loss on the opposite side of the BPR

- Target a minimum distance equal to the height of the BPR

Retest Trading Strategy

After a breakout occurs, the price often returns to test the broken BPR boundary. This retest provides an excellent entry opportunity:

- Identify a clear breakout from the BPR

- Wait patiently for the price to return to the broken boundary

- Enter when the price shows rejection from the retested level

- Set a tight stop-loss beyond the retested level

- Target the next significant market structure level

Range Trading Strategy

For traders comfortable with range-bound markets, trading within the BPR can be profitable:

- Buy near the base of the BPR when the price shows rejection

- Sell near the ceiling when the price stalls

- Use the midpoint as a potential profit-taking level

- Keep stop-losses tight outside the range boundaries

Liquidity Grab Strategy

- Look for quick spikes beyond BPR boundaries that swiftly reverse

- Enter the reversal back into the range

- Target the opposite boundary or midpoint

- Place stops beyond the false breakout point

The Psychology Behind ICT BPR

Understanding the psychological aspects of BPR enhances your trading decisions:

Market Participant Behavior

The BPR represents a temporary agreement about fair value between buyers and sellers. As price approaches range extremes, opposing forces become more active, creating predictable behavior patterns.

Institutional Manipulation

They may create false breakouts to trigger retail stop-losses before moving the price in the intended direction. Recognizing these manipulation tactics provides a significant advantage.

FOMO and Fear Management

Retail traders often experience FOMO (Fear Of Missing Out) during breakouts or fear during deep retracements within BPRs. Maintaining discipline and adhering to your trading plan is easier when you know that these reactions are normal.

Patience Development

Enhancement of Patience To trade with BPR, you need to wait for the best setups. This patience builds trading discipline and helps avoid impulsive decisions based on emotions rather than market structure.

Conclusion

The ICT Balanced Price Range represents a powerful framework for understanding market structure and institutional intent. By identifying and correctly using BPR zones, you can unlock better trade entries, manage risk more effectively, and stay aligned with the market’s true intentions. This approach significantly improves your probability of success and enhances risk management.

Remember that mastering BPR analysis requires practice and screen time. Start by identifying these ranges on historical charts before implementing them in live trading.

FAQs

Is the ICT Balanced Price Range (BPR) only useful for forex trading?

No, BPR can be used in any market, forex, crypto, stocks, indices, wherever institutional smart money techniques apply.

How accurate is BPR in trading?

While no setup is 100% accurate, BPR offers high-probability zones when combined with confluences like order blocks, FVGs, and liquidity areas.

Can beginners use BPR effectively?

Yes! Beginners can benefit from BPR by practicing its identification on demo accounts before applying it in live trading.

How to combine BPR with other ICT concepts?

You can blend BPR with tools like FVG (Fair Value Gap), liquidity sweeps, and order blocks to build powerful trading strategies.

Does BPR work in scalping and swing trading?

Absolutely. On lower timeframes (like M1, M5), BPRs help scalpers, while higher timeframe BPRs (like H1, H4, Daily) are excellent for swing traders.