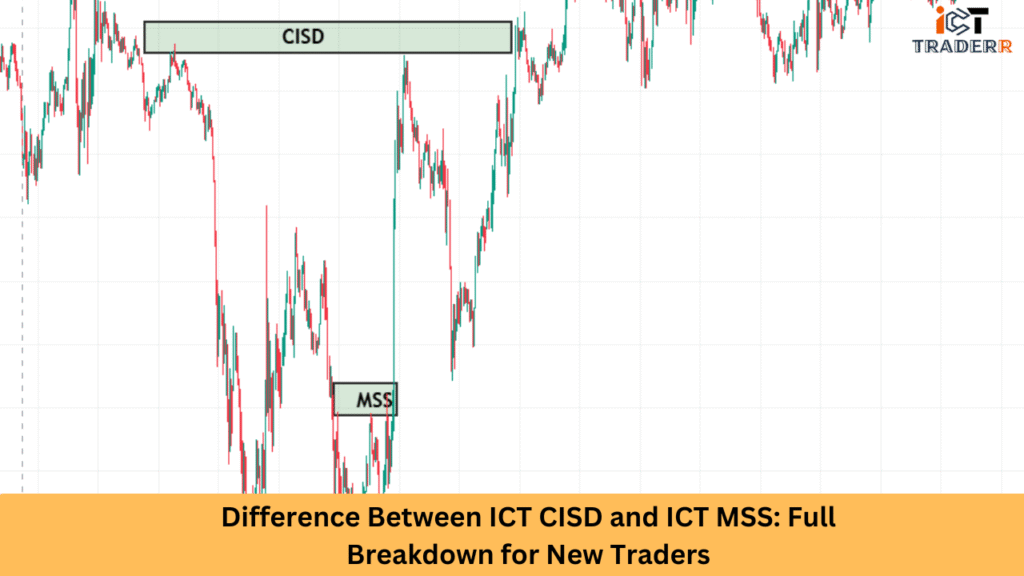

The distinction between ICT CISD and ICT MSS is highly significant for beginner traders who want to become proficient in understanding how ICT approaches trading. These two approaches, at a high level, would help you understand price behavior, trend reversals, and entry of high-probability setups.

So, let’s define what both ICT CISD (standing for Change in State of Delivery) and ICT MSS (meaning Market Structure Shift) mean. Outline their differences and check which is more appropriate for a beginner in forex or any price action-based trading system.

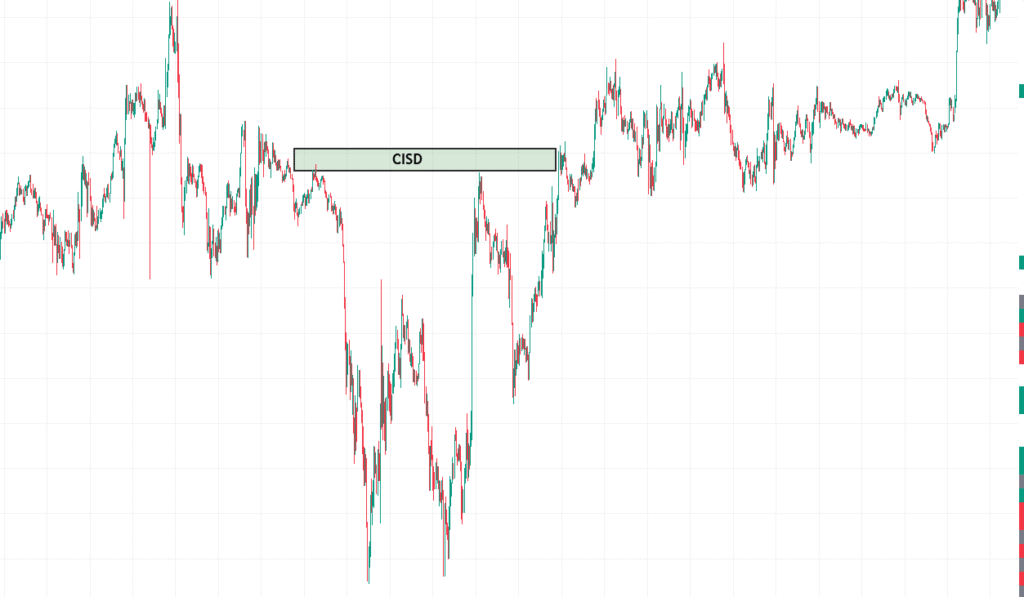

What is ICT CISD (Change in State of Delivery)?

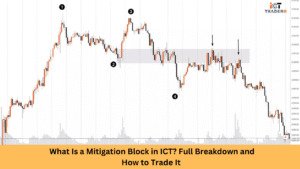

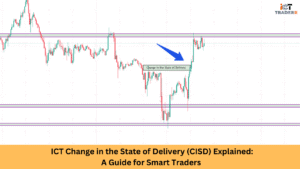

ICT CISD stands for Change in State of Delivery, a concept introduced by Michael J. Huddleston (ICT) that refers to a significant shift in how price is delivered from one market phase to another.

In simple terms, CISD indicates when the market changes its delivery mechanism — transitioning from accumulation to expansion, or from distribution to retracement.

Key Characteristics of ICT CISD:

- It reflects a shift in smart money behavior.

- Usually occurs around liquidity pools and institutional price levels.

- Involves a sequence of false breakouts, stop hunts, and aggressive order flow.

- Best seen when the price starts delivering in the opposite direction after grabbing liquidity.

Use in Trading:

You use ICT CISD to identify potential reversal zones. It helps them anticipate a move before the classic market structure shift is visible. It’s more about how the price is delivered than where it turns.

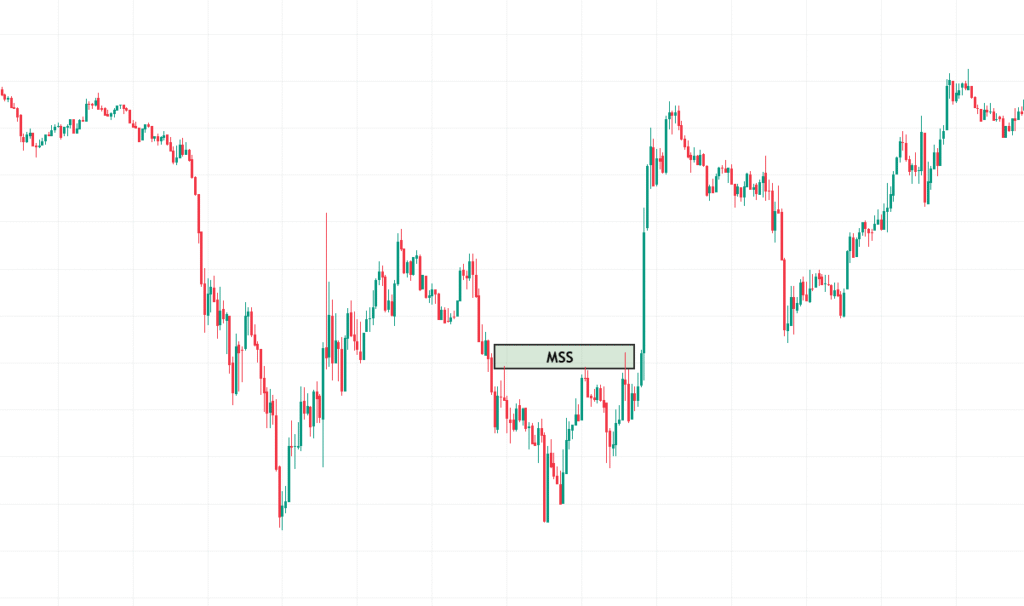

What is ICT MSS (Market Structure Shift)?

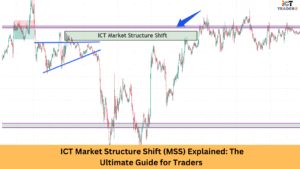

ICT MSS stands for Market Structure Shift, another core concept in ICT methodology. MSS refers to a change in the direction of trend, often used to confirm that a new trend is beginning.

Key Characteristics of ICT MSS:

- MSS occurs when price breaks a previous swing high or low, indicating a shift in market intent.

- Used to define trend reversal points.

- Easier to spot on charts than CISD.

- Highly effective in conjunction with order blocks, FVG (Fair Value Gaps), and liquidity voids.

Use in Trading:

Traders use MSS to find entry and exit points and to confirm when the market has officially changed direction. It’s often used with price action and technical analysis tools to manage risk and improve accuracy.

Key Differences Between ICT CISD and ICT MSS

Understanding the distinctions between these two concepts is crucial for proper implementation in your trading strategy. Here are the primary differences:

| Feature | ICT CISD (Change in State of Delivery) | ICT MSS (Market Structure Shift) |

| Definition | Shift in how the price is being delivered | Shift in the direction of market structure |

| Complexity | Advanced concept | Relatively easy to identify |

| Focus | Behavior and intent of smart money | Break of structure |

| Detection | Based on the delivery change post-liquidity | Based on swing high/low breaks |

| Best Used For | Early reversal detection | Confirmation of a new trend |

| Time Sensitivity | It can appear subtly before trend changes | Usually seen after structure breaks |

| Trader Type | Best for experienced ICT users | Great for beginners and intermediate users |

Which One is Better for New Traders?

If you’re a new trader, understanding ICT MSS is a better starting point.

Here’s why:

- Simplicity: MSS is visual and straightforward. Once you learn how to identify swing highs and lows, you can easily recognize a shift.

- Confirmation-Based: It offers more confirmatory signals, making it less risky for newbies.

- Combines Well with Other Tools: You can combine MSS with ICT order blocks, FVGs, and liquidity zones for a well-rounded trading plan.

When Should You Learn CISD?

Once you’re comfortable with market structure, price action patterns, and how institutional traders move the market, you can progress to ICT CISD. It offers a deeper insight into smart money manipulation, but it requires more screen time and market experience.

Conclusion

Both ICT CISD and ICT MSS are powerful tools in the ICT framework. While CISD reveals the behavior behind price movement, MSS gives you structure-based entry signals. For new traders, MSS is more accessible and less ambiguous, making it the ideal starting point.

As your trading skills evolve, integrating CISD can enhance your ability to catch early trend reversals and understand smart money dynamics more intuitively.

In summary:

- Start with MSS for safer, clearer trades.

- Graduate to CISD for advanced insights.

- Combine both for maximum edge.

FAQs

Can I use both CISD and MSS in my trading strategy?

Yes. Many experienced ICT traders combine both for a more comprehensive analysis. MSS can confirm what CISD initially hints at.

Is MSS only used in forex trading?

No. MSS can be used in crypto, stocks, indices, and commodities — anywhere market structure is observable.

How can I practice identifying CISD?

Use replay mode on platforms like TradingView. Look for sudden shifts in delivery style, especially after liquidity grabs near key levels.

What are some LSI keywords related to ICT MSS and CISD?

Some useful related terms are: liquidity grab, trend reversal, smart money trading, order block strategy, price action signals, technical trend change, and break of structure.

How long does it take to master these concepts?

Most traders take several months to a year, depending on consistency and dedication. Learning ICT-style trading is a marathon, not a sprint.