Do You Know the Hidden Sweet Spot Smart Money Watches? If you are diving into ICT (Inner Circle Trader) concepts, you’ve likely heard about Consequent Encroachment, or CE. But do you understand how to use it like smart money does? If not, don’t worry — you are not alone.

In this article, we will walk you through:

- What Consequent Encroachment is

- How to calculate it precisely

- Why it matters in real setups

- How to use it to enter or reject trades

- Common beginner mistakes and how to avoid them

- Pro tips to master it for better trade accuracy

Let’s dive right in.

What is ICT Consequent Encroachment?

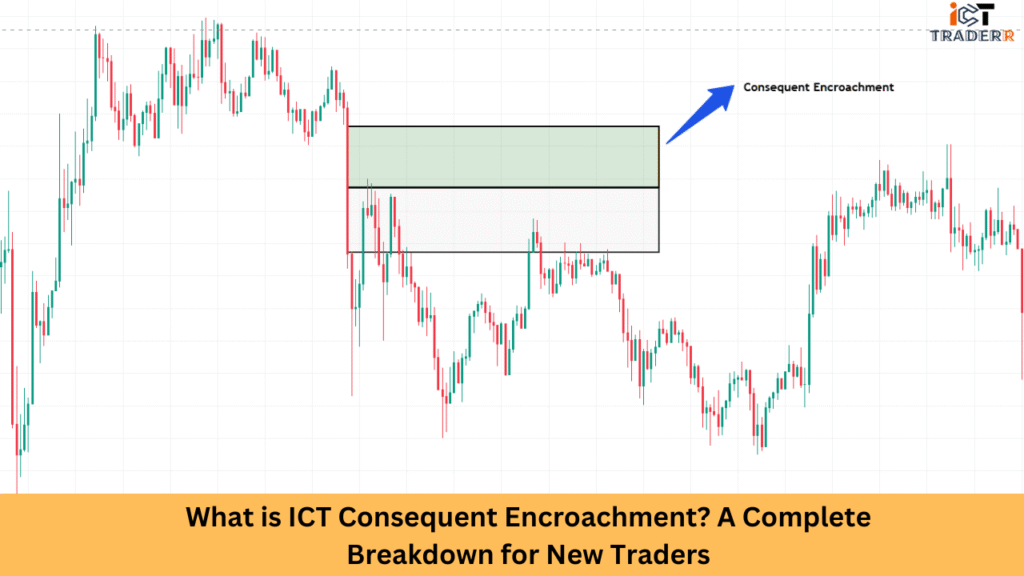

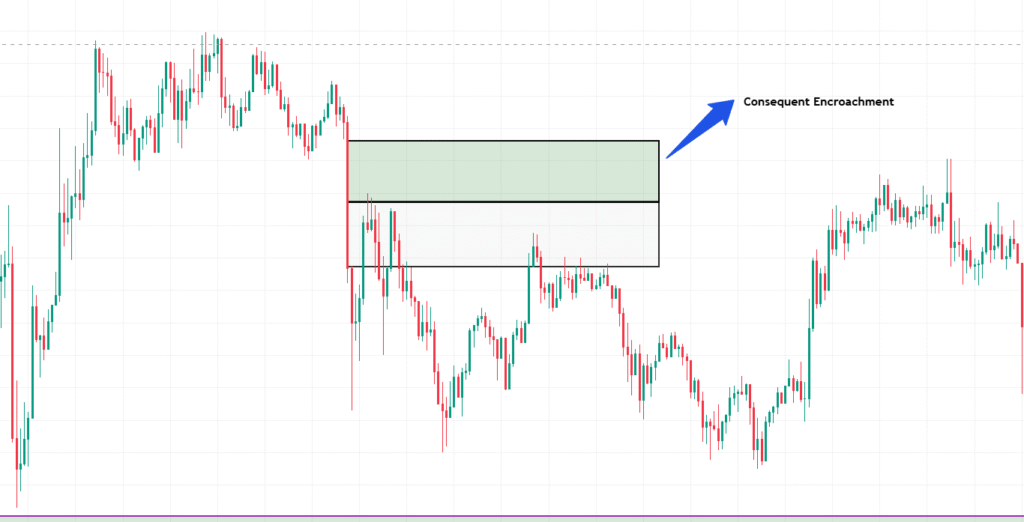

To lay it down simply, Consequent encroachments denote the mid-point of the fair value gap, the void created after an impulsive price move.

Imagine you see a three-candle formation with a gap between candle 1 and candle 3. That gap is called an FVG. So basically, the center line of that fair value gap is the consequent encroachment. This level often acts as a critical decision point where smart money might enter trades or where the price might reject.

In trader-friendly terms:

- FVG = imbalance

- CE = the center of that imbalance = smart money’s “reaction zone”

How to Calculate Consequent Encroachment

Calculating CE is pretty simple. You just take the high and low of the FVG and find the midpoint:

Formula:

ini

CopyEdit

CE = (High of Candle 1 + Low of Candle 3) / 2

Example:

Let’s say:

- Candle 1 has a high of 1.2750

- Candle 3 has a low of 1.2700

Then:

ini

CopyEdit

CE = (1.2750 + 1.2700) / 2 = 1.2725

Now 1.2725 is your CE level.

When price returns to this CE level, it’s a key area to watch. Price may bounce (reject) or break through (confirm continuation).

Why is Consequent Encroachment Important in Trading?

CE gives you precision and context, two things beginners often lack.

Here’s why it matters:

- 🔹 Entry Confirmation: If price taps CE and rejects, you have a potential sniper entry.

- 🔹 Smart Money Clue: Institutions often manipulate prices in these zones before moving in their intended direction.

- 🔹 Stop-loss Management: Using CE allows you to keep stops tight while increasing RR ratio.

- 🔹 Trend Confirmation: If price breaks through CE, it can indicate deeper liquidity grab or shift in bias.

Bottom line? CE is not just a line — it’s a behavioral indicator showing you how the market reacts to imbalance.

How to Use CE in Your Strategy (Entry & Rejection Examples)

Let’s break it down with some simple strategies:

1. Entry Strategy Using CE

- Wait for a Fair Value Gap to form.

- Mark it CE.

- When price returns to CE:

- Check lower timeframes for confirmation (e.g., break of structure or shift).

- Then the rejection is taken to enter with a tight stop below or above CE.

- Check lower timeframes for confirmation (e.g., break of structure or shift).

🔁 Best Timeframes: Use CE on 1H or 15M for macro setups and 5M or 1M for entries.

2. Rejection Setup Using CE

- If price approaches CE but fails to break above or below it, it’s a rejection.

- Use this as a confirmation to enter the opposite.

Real-life Example:

Let’s say price creates a bearish FVG. CE lies at 1.3120. Price retraces to 1.3119, wicks into it, but closes below. That’s your bearish confirmation — a signal that smart money may be selling.

Common Mistakes Beginners Make with CE

Even though CE is a simple concept, new traders often misuse it. Avoid these mistakes:

- ❌Using CE on its own is not a good idea; instead, it should always be used in conjunction with concepts of liquidity or structure.

- ❌ Marking wrong FVG: Make sure you’re identifying clean gaps from strong impulsive moves.

- ❌ Assuming all CE levels will reject: Sometimes price blasts through — that’s okay. Use confirmation.

- ❌ Overloading charts with CE: Don’t mark every FVG — focus on the most recent and relevant ones.

Pro Tips for Mastering ICT CE

Here’s how to get better results using CE:

- Use Time of Day Logic

Focus on CE setups during London or New York session highs/lows. That’s when most liquidity runs happen. - Stack Bias

Combine CE with other ICT tools like daily bias, liquidity pools, or order blocks for higher accuracy. - Use Replay Mode

Mark CE zones once more on the charts. Watch how the price reacts. This builds your pattern recognition. - Look for Confluence

When CE aligns with previous support/resistance or OB levels, that’s a high-probability trade. - Practice Patience

Don’t force CE trades. Let price come to you. If it respects CE with structure, you strike.

Conclusion

Mastering ICT’s Consequent Encroachment is like adding a high-precision tool to your trading toolkit. When used in conjunction with structure, liquidity, and session timing, CE can provide you with sniper-like entries and risk-controlled exits.

So next time you see a Fair Value Gap, don’t just mark it — find the CE and wait for the price to react. It’s in that moment where you either join smart money or get out of their way.

FAQs

Is CE only useful in Forex trading?

No, CE works across all markets — Forex, crypto, indices — wherever you find Fair Value Gaps and institutional behavior.

Can I use CE on the 1-minute chart?

Yes, but it’s best used on higher timeframes for key levels.

What’s the difference between CE and Equilibrium?

Equilibrium is 50% of the range (high to low), while CE is 50% of the imbalance or FVG. Both are used differently, but sometimes align.

Is CE reliable for entries?

When used in conjunction with confirmations like BOS (Break of Structure) or MSS (Market Structure Shift), CE becomes a high-accuracy entry-level.