In the world of forex trading, prices don’t always trend in a single direction. Most of the time, markets move sideways. While many traders find this frustrating, professionals using the ICT (Inner Circle Trader) consolidation trading strategy know this is where the real opportunities lie.

Let’s explore how ICT consolidation trading works, how to identify these zones, and how to make consistent profits in ranging markets.

What Is ICT Consolidation Trading Strategy?

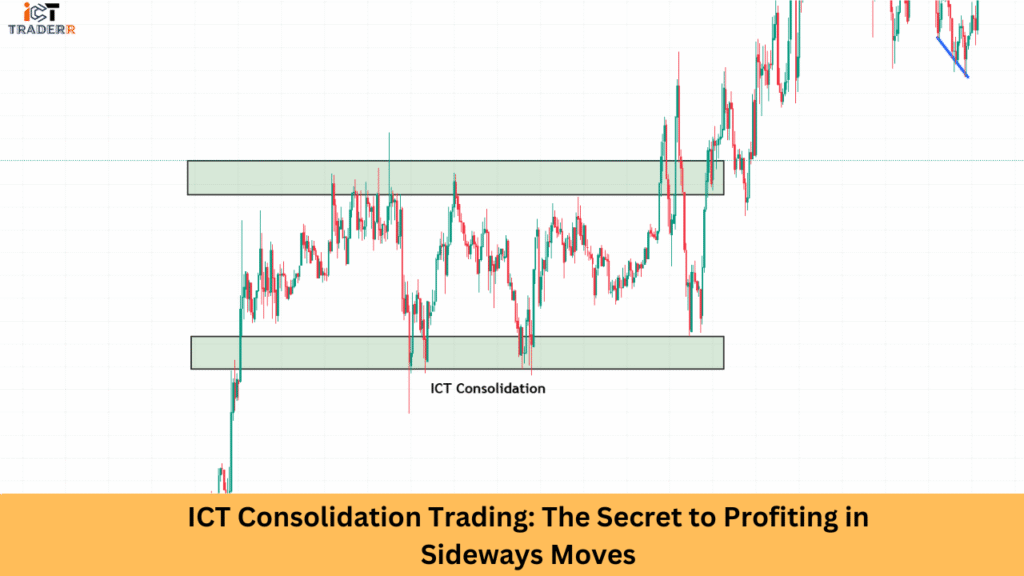

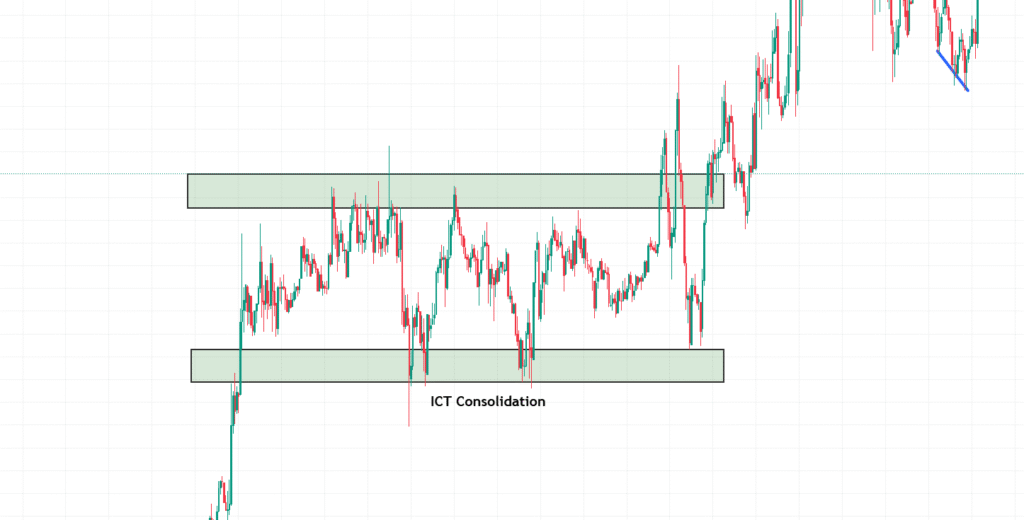

The ICT Consolidation Trading Strategy focuses on identifying areas where price is temporarily range-bound — also called consolidation zones — before a significant breakout. In ICT methodology, these zones reflect periods where institutional traders (also known as smart money) accumulate or distribute positions.

ICT traders wait for prices to move within a predetermined range rather than following trends. They anticipate that a breakout from this range will offer a high-probability trading setup in line with smart money intentions.

Key Components:

- Price is trapped in a horizontal range

- Low volatility phase

- Liquidity buildup above and below the consolidation

- Smart money manipulation and breakout expectation

How to Identify a Consolidation Zone in ICT Methodology

Recognizing a consolidation zone is critical in ICT trading. Typically, these zones appear before or after a significant price move.

Steps to Identify:

- Look for equal highs and equal lows — these are signs of engineered liquidity.

- Use the 1-hour and 15-minute timeframes for clear visualization.

- Mark the zone where the price oscillates between a defined support and resistance.

- Watch volume drop and candles become narrow — signs of accumulating orders.

- Pay attention to the time of day (like London or New York session) — ICT emphasizes timing.

Pro Tip: Consolidation zones are traps for retail traders. Smart money uses these to manipulate price and grab liquidity.

How to Trade the Sideways Market Using ICT Strategy

Trading sideways markets using an ICT strategy requires a systematic approach that focuses on buying near support zones and selling near resistance zones while understanding institutional manipulation tactics. The key is recognizing when price is genuinely consolidating versus when it’s building energy for a directional breakout.

Entry strategies in ICT consolidation trading typically involve waiting for the price to reach the extremes of the consolidation range and then looking for specific confirmation signals. These signals include order block formations, fair value gap fills, and institutional footprints that suggest professional money is taking positions.

The strategy also incorporates understanding market manipulation tactics where institutions create false breakouts to trigger retail stop losses before reversing the price back into the consolidation range. Recognizing these manipulation patterns helps traders avoid being caught on the wrong side of these moves.

ICT methodology focuses on specific times when institutional activity is highest, such as during major session overlaps or around economic news releases that might provide the catalyst for breaking from consolidation.

ICT Consolidation Strategy in Bullish Market Conditions

When the broader trend is bullish, consolidation zones act as accumulation phases.

How to Approach:

- Identify consolidation in an uptrend.

- Look for liquidity sweep to the downside (stop-hunt).

- After sweep and confirmation, enter long at the bottom of the range.

- Ride the breakout as price resumes upward momentum.

Key Indicators:

- Higher timeframe bullish trend

- Liquidity fell below the range.

- Bullish order block forming.

This aligns with the smart money concept, where institutions buy from weak hands before pushing the price higher.

ICT Consolidation Strategy in Bearish Market Conditions

In a bearish market, consolidation zones often indicate distribution phases where smart money prepares for another leg down.

Strategy:

- Spot a range within a downtrend

- Wait for the liquidity sweep to the upside.

- Confirmation via bearish market structure

- Enter short on retracement post-sweep

This method minimizes risk while maximizing reward, as you enter just before the next bearish impulse.

Mistakes to Avoid While Trading ICT Consolidation

Most of those mistakes made by traders in ICT consolidation are forcing trades where it is evident that there is no clear setup. However, when consolidation is extended for too long, it becomes increasingly difficult for trend traders to work. They tend to overtrade and make the wrong decisions that erode their capital and profitability.

Another error during the trade consolidation zones is neglecting to look at the larger context of the entire market. What looks like consolidation on a very low timeframe could just be a tiny retracement in the context of a larger moving market trend, so that the study on different timeframes becomes vital before deciding on any consolidation strategy.

Another aspect of folly on the part of many traders during consolidation trade is an inappropriate position sizing. The reduced volatility and smaller profit targets in consolidation zones require adjusted position sizes to maintain consistent risk management principles while still achieving meaningful returns.

Failing to recognize manipulation tactics is another common error that leads to being caught on the wrong side of false breakouts. ICT methodology emphasizes understanding how institutions manipulate price action to trigger retail stops, and traders who ignore these patterns often become victims of such manipulation.

Conclusion

ICT Consolidation Trading is one of the most powerful yet underrated strategies in modern technical analysis. This strategy teaches traders to wait, observe, and strike with precision rather than following trends or noise.

By learning how to spot consolidation zones, understand smart money behavior, and execute with discipline, you can profit even in sideways market conditions — a situation where most retail traders lose.

The key is patience, clarity, and strict adherence to ICT principles.

FAQs

What is ICT in trading?

ICT (Inner Circle Trader) refers to Michael J. Huddleston’s methodology focused on smart money concepts, institutional order flow, and market manipulation techniques.

Why is consolidation important in trading?

Consolidation shows areas where price is gathering momentum for the next move. These zones are ideal for low-risk, high-reward entries.

Can an ICT strategy work for beginners?

Yes, but it requires study and discipline. Beginners should start with backtesting and demo trading.

Is the ICT strategy only for forex?

While it’s popular in forex, ICT principles apply to stocks, crypto, and commodities — anywhere smart money plays a role.