Do you know that within contemporary price action trading, one of the most influential concepts is the ICT Displacement Move? This strategic approach, designed and developed by the Inner Circle Trader methodology, enables traders to define when the market is about to undergo significant reversals.

In this article, we will provide a step-by-step breakdown of what this is, how to identify it on a chart, and how to apply it to your advantage, whether the market is bullish or bearish.

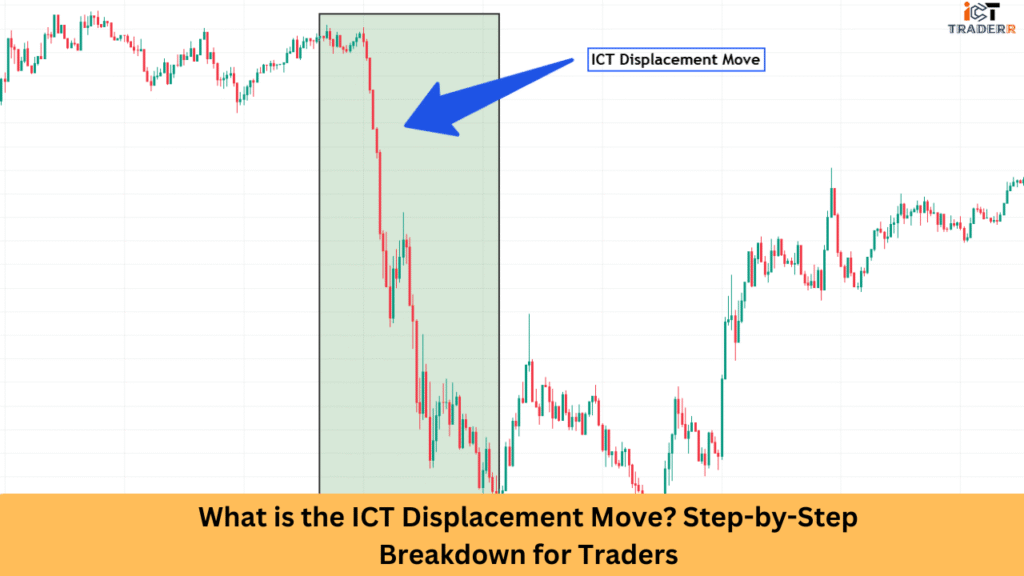

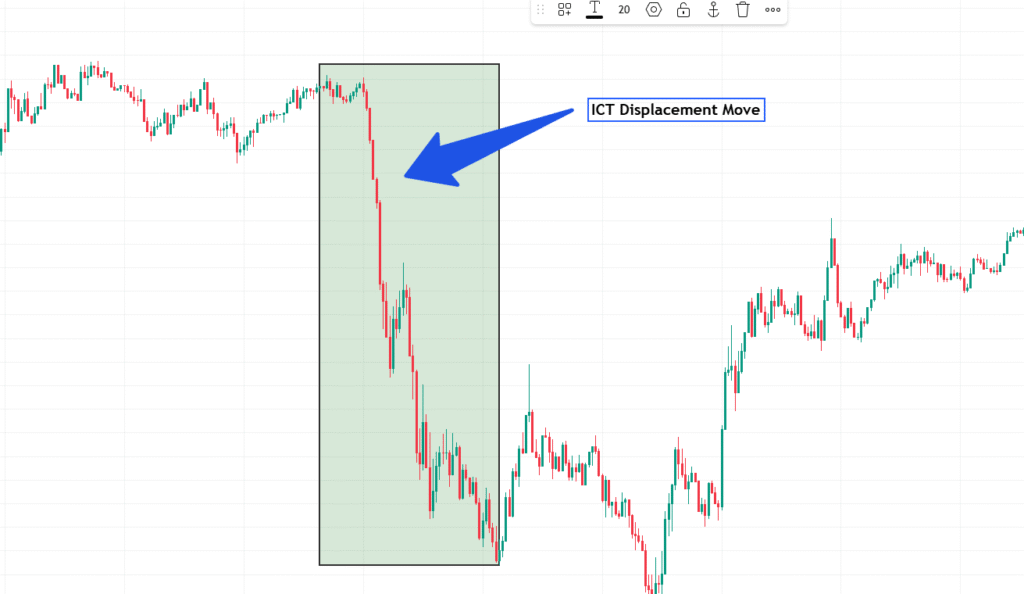

What is the ICT Displacement Move?

The ICT Displacement Move is a sharp and sudden price movement in one direction, signaling a significant shift in market structure. This move is often caused by institutional traders or large volumes entering the market, thereby “displacing” the price from its current range or equilibrium.

In simple terms, displacement is a strong move that breaks market structure, indicating that smart money has made its presence known. It typically results in liquidity grabs, stop hunts, or market manipulation, all of which are essential concepts in ICT trading.

Traders use this move to:

- Confirm direction of smart money

- Plan entries and exits with precision

- Avoid false breakouts and traps

How to Spot a Displacement Move on the Chart

Identifying a displacement move is crucial for ICT-based strategies. Here’s what to look for:

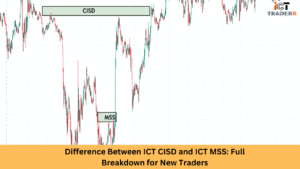

- Break of Structure (BoS): A displacement move usually breaks a previous high or low with a powerful candle.

- Imbalance or Fair Value Gap (FVG): Often, a displacement move leaves behind a fair value gap — a zone of price inefficiency that the price may return to later.

- Volume Spike: An increase in volume typically accompanies displacement, confirming institutional involvement.

- Momentum Candles: Look for large-bodied candles with minimal wicks, indicating strong directional momentum.

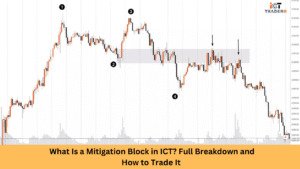

Using indicators like volume profiles, liquidity pools, and order blocks can further validate whether a movement is truly a displacement or just market noise.

Bullish ICT Displacement Move

A bullish displacement move happens when the price aggressively moves upward, breaking a previous swing high and showing clear intent from buyers or institutions.

Key Characteristics:

- Breaks a significant swing high

- Leaves behind a bullish fair value gap

- Volume confirms upward pressure

- Forms a new higher high, initiating a bullish market structure

How to Trade It:

- Wait for a retracement into the FVG zone.

- Confirm the bullish order block below the displacement.

- Enter long positions with a tight stop loss just below the order block.

- Target the next liquidity level or equal highs.

This strategy works best when aligned with higher timeframe trends, such as the 1H or 4H charts.

Bearish ICT Displacement Move

On the flip side, a bearish displacement shows aggressive downward momentum, breaking a prior swing low.

Key Characteristics:

- Breaks a key swing low

- Leaves behind a bearish fair value gap

- Strong bearish candles with low wicks

- Shift in structure from lower lows and lower highs

How to Trade It:

- Identify the FVG left behind by the bearish move.

- Wait for a retracement into the FVG or bearish order block.

- Enter short positions with stops above the recent high.

- Target the next sell-side liquidity zones.

Bearish displacements are often seen before major market downturns or after news-based spikes that reverse direction.

Real vs Fake Displacement – How to Stay Safe

One of the biggest challenges that you face is distinguishing real displacement moves from fakeouts.

How to Identify Real Displacement:

- Confirm with volume: Real displacement is usually supported by high volume.

- Look for FVG or imbalance zones.

- Align with liquidity raids or order block reactions.

Avoiding Fakeouts:

- Don’t trade just one candle. Wait for confirmation via market structure.

- Combine displacement with time-based analysis

- Watch out for manipulation during low-volume hours.

Learning to differentiate between manipulation and momentum is key to becoming a successful ICT trader.

Best Timeframes to Use ICT Displacement Move

Timeframe selection plays a vital role in how effective the displacement strategy will be.

Recommended Timeframes:

- 1-Minute to 15-Minute: Best for intraday scalping strategies. Offers precise entries.

- 1H to 4H: Ideal for swing traders, helps confirm larger market direction.

- Daily: Useful for identifying macro-level displacement that aligns with institutional order flow.

The most effective approach often combines multiple time frame analysis, using higher timeframes to identify the displacement move and lower timeframes to fine-tune entry points.

Conclusion

The ICT Displacement Move represents a powerful trading concept that provides insight into how smart money operates in financial markets. By understanding displacement moves, you can position yourself alongside institutional players rather than becoming victims of their strategies.

Remember that successful trading with displacement moves requires practice, patience, and disciplined risk management. Start by identifying these patterns on historical charts before attempting to trade them in live markets. With experience, you’ll develop an intuition for genuine displacement opportunities.

FAQs

What is the purpose of the ICT Displacement Move?

It helps you recognize shifts in market structure caused by institutional activity, allowing better trade setups.

Can beginners use this strategy?

Yes, but it’s essential to practice on a demo account first and combine it with proper risk management.

Is the Fair Value Gap (FVG) always filled?

Not always, but in many cases, price revisits the FVG to create balanced price action.

Which trading platform is best for spotting displacement?

Platforms like TradingView and MetaTrader 4/5 allow for detailed chart analysis using custom indicators.

Can displacement moves fail?

Yes. Like any strategy, displacement moves are not 100% accurate. Using confluences like volume and time-of-day analysis increases reliability.