Do you know professional traders pretty much know their business–they make winning trades regularly and rarely rely on luck. Following the smart-money crowd and institutional order flow is what traders are smart enough to do. One powerful strategy among traders is the ICT Institutional Order Flow Entry Drill (IOFED). High Resistance Liquidity often builds above Swing Highs, serving as magnet zones for smart money.

In this article, we will explore what ICT IOFED is, its types, how to trade with it, and tips to master this pro-level entry strategy. This article is a complete guide for the beginner or an advanced trader who wants to polish and refine their edge.

Understanding Institutional Order Flow

The knowledge of institutional order flow will be discussed before delving into IOFED for a better understanding. Let us see what an institutional order flow means. Institutional order flow means the movement of large volumes of trades by very heavy players like hedge funds, banks, and financial institutions. These traders exert a lot of influence on price action due to the sheer size of their orders.

Unlike retail traders, institutions don’t just randomly enter the market. They wait for optimal conditions—liquidity zones, imbalances, order blocks, and key support and resistance levels. Recognizing their patterns can give you a serious trading edge.

ICT IOFED is suitable for Advance, but beginners should first understand basic concepts like market structure, order blocks, and liquidity.

What is ICT Institutional Order Flow Entry Drill (IOFED)?

The ICT Institutional Order Flow Entry Drill, developed by Inner Circle Trader (ICT), is a systematic approach to identifying high-probability entries in alignment with institutional trading behavior. It’s not just about finding setups, it’s about understanding why those setups occur and how institutions build positions in the market.

At its core, IOFED combines:

- Market structure analysis

- Liquidity engineering

- Order block theory

- Fair value gaps (FVGs)

Using this drill, you learn to anticipate market reversals, continuations, and entry confirmations with high accuracy.

Types of ICT IOFED

There are two types of IOFED patterns: Bullish and Bearish. Each pattern is used depending on the prevailing market bias.

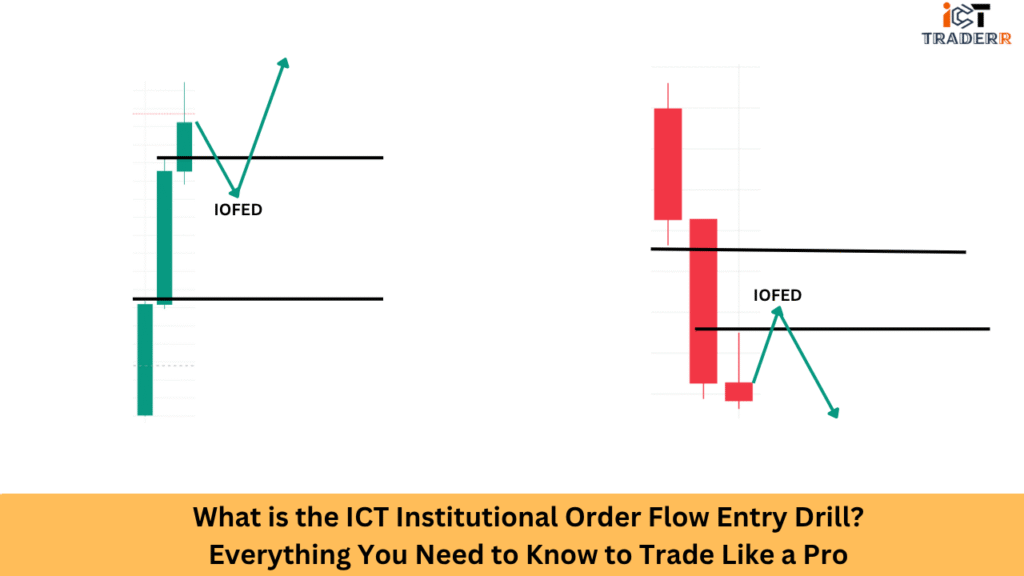

Bullish ICT IOFED

A Bullish IOFED signals a possible long entry (buy trade). It occurs after price sweeps a liquidity pool beneath a previous low and shows a shift in market structure to the upside. Typically, this involves:

- A liquidity grab (stop hunt)

- A break in structure (BOS)

- Entry at a fair value gap or order block

Example: Price sweeps the Asian session low, breaks above a recent high, retraces to an FVG, and continues upward.

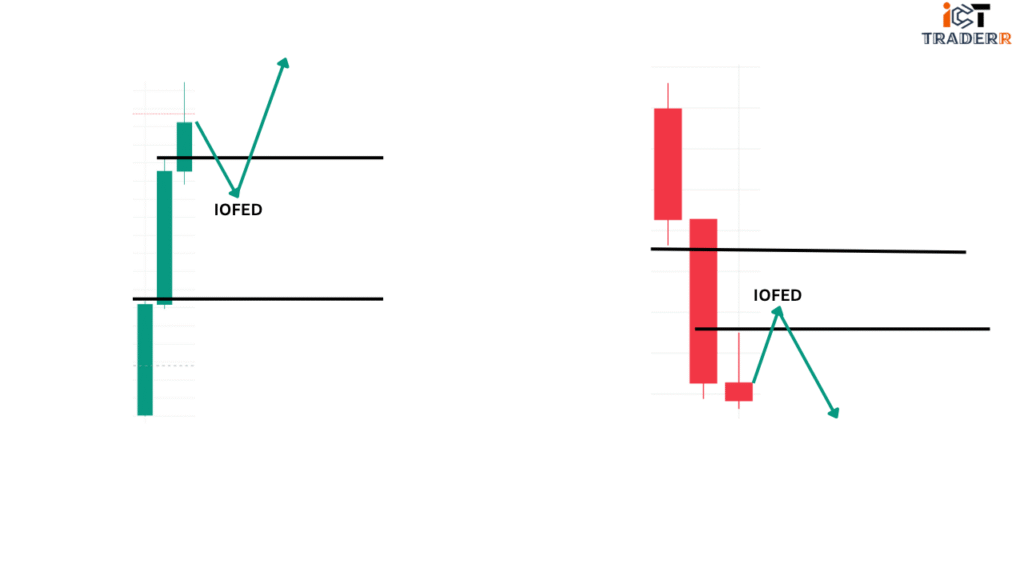

Bearish ICT IOFED

A Bearish IOFED indicates a potential short entry (sell trade). The pattern follows a similar process in the opposite direction:

- Price grabs liquidity above a recent high

- Market structure breaks to the downside

- Entry is made at a retracement point, like an FVG or bearish order block

Both setups rely on timing, especially during optimal trade entry windows such as the New York or London session opens.

How to Trade Using ICT IOFED

Here’s a step-by-step guide on how to apply the ICT IOFED in your trading strategy:

- Identify Market Bias: Is the market trending bullish or bearish on a higher timeframe?

- Look for Liquidity Pools: These are areas where your stop-losses are resting (recent highs/lows).

- Wait for a Liquidity Grab: Price should sweep the liquidity to trap retail traders.

- Look for Break of Structure (BOS): A clear change in market direction confirms intent.

- Locate Entry Zone: Find an order block or fair value gap between the BOS and liquidity sweep.

- Place Your Entry and Stop: Entry at the FVG or OB, stop below/above the swing, and aim for 2–3R minimum.

This drill helps you avoid false breakouts and trade with the smart money, not against it.

Benefits of Using the IOFED Strategy

Here’s why you swear by this method:

- High Accuracy: You enter trades backed by institutional logic, not guesswork.

- Better Risk Management: Entry zones are precise, allowing tight stop-losses and better risk-to-reward ratios.

- Improved Discipline: You only enter when all conditions align—no FOMO trading.

- Scalability: Works across different timeframes and market conditions.

- Institutional Mindset: With a rules-based approach, you begin to trade like a professional.

This concept is best applied in conjunction with Liquidity Sweep to anticipate false breakouts.

Tips to Master ICT IOFED

To truly become skilled with the ICT IOFED, follow these practical tips:

- Backtest the strategy on historical charts before going live.

- Use replay mode in platforms like TradingView to practice real-time reactions.

- Stick to the major trading sessions, New York open and London open, for better liquidity.

- Avoid overtrading—IOFED setups are powerful, but don’t happen every minute.

- Journal your trades to refine and track progress.

- Stay updated with macroeconomic news, because sometimes fundamentals can force the price action faster than expected.

Conclusion

The ICT Institutional Order Flow Entry Drill is more than just a setup—it’s a professional-level trading strategy grounded in institutional principles. If you are tired of trading blindly and want to understand why prices move, this strategy is your gateway to real improvement.

It teaches you to follow the footprints of smart money, understand liquidity manipulation, and enter trades with confidence and precision.

By studying and applying IOFED diligently, you will be equipped to trade like a pro, not a gambler.

FAQs

What timeframe is best for using ICT IOFED?

15-minute and 1-hour charts are commonly used, with higher timeframes (like H4 or daily) for bias.

Does ICT IOFED work on all markets?

Yes, you can apply it to Forex, indices, crypto, and even commodities, as long as there’s sufficient liquidity.

How long does it take to master ICT IOFED?

It depends on your dedication. With consistent study and practice, you Often start seeing results within 2–3 months.

Can I use indicators with IOFED?

While IOFED is price action-based, some traders use volume or liquidity indicators for added confirmation.