These words are highly condensed. Forex standards for advanced trade concepts, which can greatly intimidate new traders. Among such advanced trading techniques that must be recognized is the ICT Judas Swing. This powerful trading tool is ultimately used to recognize market manipulation and potential points of reversal.

In this article, we will describe the Judas Swing strategy in its entirety, and by the end of this guide, you will also develop the conviction that will allow you to spot such market traps just like a pro trader.

What Is the ICT Judas Swing?

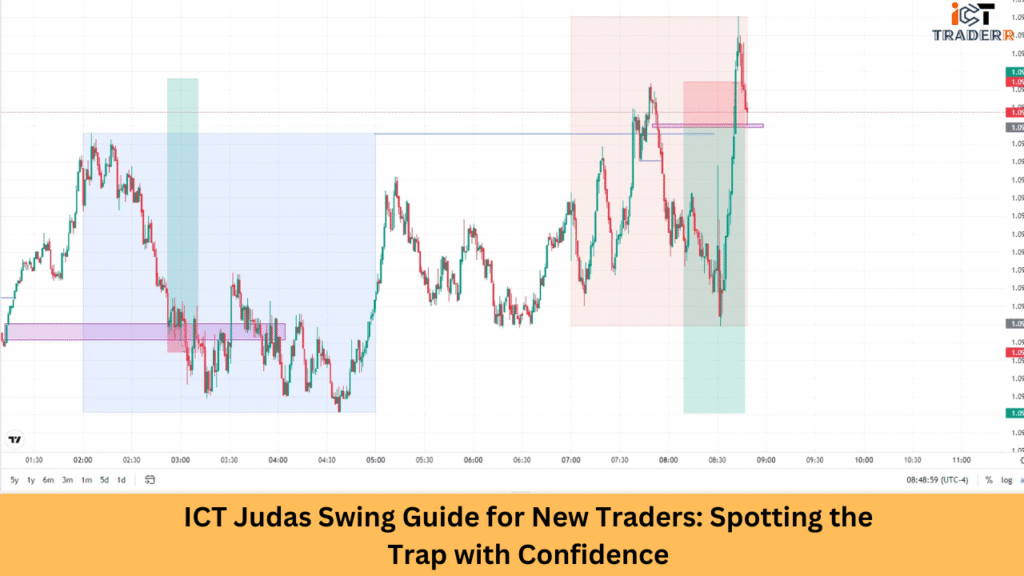

The ICT Judas Swing is a deceptive market move that traps impatient traders. It is often seen at the start of the London trading session, where the price appears to break out in one direction, only to reverse sharply. The term originates from ICT (Inner Circle Trader) concepts, specifically those focusing on sophisticated money manipulation.

The swing encourages the retail trader to take a false position, known as a “false breakout” or something similar, and then usually gives a strong move in the opposite direction. Learning this is imperative for traders who might feel the need to trade their way into institutional trading strategies rather than falling victim to market manipulation.

When and Where Judas Swing Happens

The Judas Swing most commonly occurs:

- During the London open (2 AM- 5 AM EST)

- After a period of accumulation or consolidation

- Near significant liquidity zones or support/resistance levels

Typically, during the Asian session, the market builds a tiny little range, which acts as a zone of entrapment, then, during the London opening, the price starts to move out of this range for a short break before the actual target of stop losses or persuading breakout traders is quickly turned around.

This is a classic behavior seen in ICT concepts, especially when smart money seeks liquidity before initiating a major move.

Structure and Logic Behind the Move

Understanding the underlying structure helps traders recognize the pattern’s formation and the psychological warfare involved in these market manipulations

The Setup Phase: Price typically consolidates near a significant level, creating an obvious breakout scenario that attracts retail attention. During this phase, institutional traders observe order flow and identify where retail stops are likely positioned.

The Trap Phase: A sudden, aggressive move breaks through the identified level, triggering retail entries and stop losses. This creates the liquidity needed for institutional orders while temporarily moving the price in the “obvious” direction.

The Reversal Phase: Once sufficient liquidity is captured, institutional traders reverse their positions, causing the price to quickly return through the breakout level and continue in the opposite direction. This phase often occurs with increased volume and momentum.

Psychological Elements: The strategy exploits common retail trading psychology, including FOMO (fear of missing out), breakout trading mentality, and the tendency to place stops at obvious technical levels. Traders can avoid being manipulated by having a better understanding of these patterns of behavior.

Market Structure Context: Judas Swings frequently occur near the edges of larger formations in the market structure, such as consolidation ranges and trend line breaks, or when volatility is high around significant economic news releases.

How to Spot the Judas Swing with Confidence

Identifying the Judas Swing requires careful observation of time, structure, and liquidity:

- Time of Day: Focus on the first 1–2 hours of the London session

- Price Action: Look for a breakout from the Asian range that quickly reverses

- Liquidity Zones: Note where clusters of stop-losses may be resting (above highs or below lows)

- Volume or Volatility Spike: An abnormal surge in volume or speed can signal manipulation

- Re-entry Candle: Wait for a strong engulfing candle or rejection wick that confirms a reversal

Use tools like horizontal lines for range marking, and consider overlays like previous daily highs/lows to improve accuracy.

A Simple Judas Swing Trading Strategy for Beginners

Here’s a beginner-friendly Judas Swing trading strategy based on ICT methodology:

Step 1: Mark the Asian Range

During the Asian session (7 PM–2 AM EST), draw horizontal lines at the high and low.

Step 2: Wait for the London Open

Avoid entering the market immediately. Let the market show its hand with a possible false breakout.

Step 3: Identify the Swing

If price breaks above the Asian range and quickly gets rejected with a bearish engulfing candle, it may be a bearish Judas Swing (vice versa for bullish).

Step 4: Confirm Entry

Enter the trade once the price closes back inside the Asian range, targeting the opposite end or daily liquidity level.

Step 5: Manage Risk

- Use a tight stop-loss just outside the Judas swing wick

- Aim for a 2:1 or 3:1 reward-to-risk ratio

- Avoid trading on low volatility days or before high-impact news.

This strategy works best when paired with market structure knowledge, liquidity analysis, and strict risk management.

Tips for New Traders Using the Judas Swing Strategy

- Avoid emotional trading: Don’t chase the breakout. Let the trap complete.

- Use a demo account: Backtest the Judas swing on past London sessions.

- Keep a trading journal: Record outcomes to refine your strategy.

- Focus on quality over quantity: Concentrate on quality rather than quantity because not every day yields a valid Judas Swing.

- Combine with ICT tools, Lilikerder blocks, fair value gaps, and liquidity pools for higher confluence.

Most importantly, be patient and disciplined. The Judas swing is a powerful pattern, but only when used correctly and consistently.

Conclusion

The ICT Judas Swing is a smart money tactic designed to mislead and trap unsuspecting retail traders. By learning to identify its structure and timing, new traders can transform this trap into an opportunity. Focus on the Asian range, monitor price action during the London open, and wait for strong confirmation before entering trades.

By mastering this one setup, you can align with institutional flow and reduce the noise of random trades—a crucial step for anyone serious about trading success.

FAQs

Is the Judas Swing only for Forex trading?

Primarily, yes, but it can also occur in other markets like indices and crypto during overlapping trading sessions.

How often does the Judas Swing happen?

Not daily, but it appears frequently—especially on high liquidity days and when major news follows the London open.

Can I use indicators to spot Judas Swing?

It’s mostly a price action-based strategy, but volume indicators or session separators can help provide additional clues.

What’s the best time to trade the Judas Swing?

Between 2AM–5AM EST during the first 2 hours of the London session.

Is it beginner-friendly?

Yes, especially with proper backtesting, risk management, and patience. Always start on a demo account before going live.