The ICT (Inner Circle Trader) Market Maker Sell Model is one of the most widely followed institutional trading concepts in forex and crypto trading. If you are just starting and want to learn how professional traders identify key selling opportunities using smart money principles, then this beginner’s guide is exactly what you need.

In this article, we will guide you through the ICT Market Maker Sell Model step by step — from understanding its foundation to executing trades effectively using it.

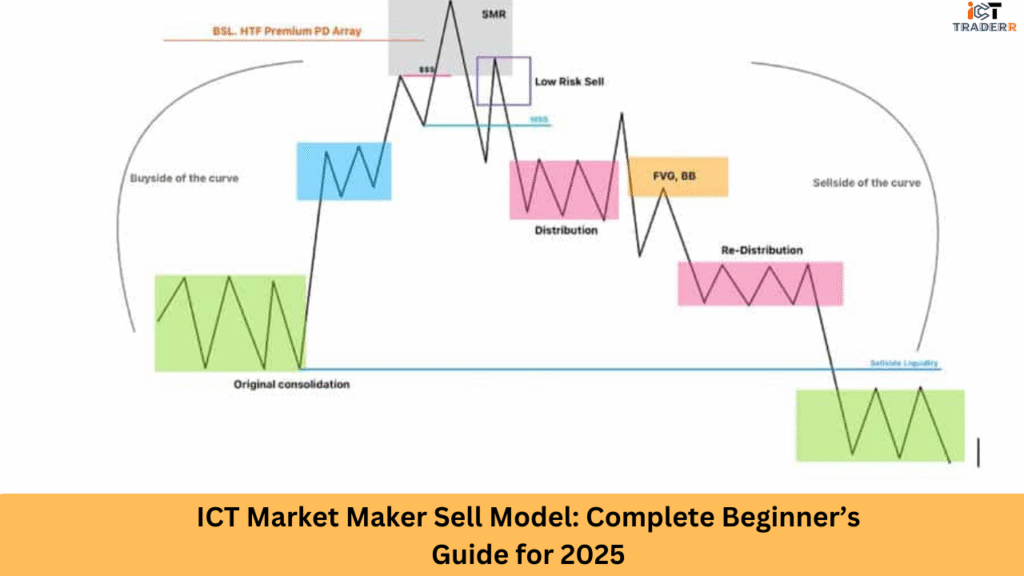

What is the ICT Market Maker Sell Model?

The ICT Market Maker Sell Model is a price action-based trading strategy that focuses on how institutional traders (market makers or smart money) manipulate prices to create ideal sell conditions.

In simple words, the model shows how big players push the price higher to induce buying from retail traders, only to reverse the market and start a sell-off. This reversal typically happens after a liquidity grab, when the market sweeps recent highs to trap buyers before dropping.

Key Characteristics:

- Price makes a false breakout to trap retail traders.

- Followed by a market structure shift (MSS).

- Smart money then enters short positions.

- Price drops sharply toward an area of imbalance or fair value gap (FVG).

Core Concepts Behind the Sell Model

To fully grasp the ICT Sell Model, understanding a few technical terms is crucial:

Liquidity Grab

A stop hunt above previous highs, which triggers the stop-losses of retail traders. This move is engineered by smart money to fill their larger sell orders.

Market Structure Shift (MSS)

The price breaks a recent higher low following the grab of liquidity. This shift indicates a change in trend from bullish to bearish.

Order Block

The last bullish candle before the market drops — this is often used by ICT traders as a key entry zone for sell trades.

Fair Value Gap (FVG)

A price imbalance zone between a bullish and bearish candle. Price often returns to this area before continuing the downtrend.

These core ideas help you identify entry and exit points with precision, reducing risk and improving accuracy.

How to Trade the ICT Market Maker Sell Model

Here’s a simplified step-by-step guide to trading the ICT Sell Model in real time:

Step 1: Identify the Liquidity Zone

Mark recent swing highs. Wait for price to break above these highs — this is the liquidity grab phase.

Step 2: Look for the Market Structure Shift

After the false breakout, the price should drop below a recent low, showing that momentum has shifted. This confirms the potential for a reversal.

Step 3: Draw the Order Block

Highlight the last up candle before the market dropped (preferably on the 15M or 1H chart). This becomes your entry area for a short trade.

Step 4: Use the Fair Value Gap for Confirmation

Look for an FVG near the order block. If price returns to this zone and shows rejection, it’s your go signal to enter.

Step 5: Place Your Stop Loss and Take Profit

- Stop Loss: Just above the liquidity grab’s peak.

- Take Profit: At the next imbalance zone or major support level.

Pro Tips for Beginners Using This Model

Starting with smart money concepts can feel overwhelming. Here are a few practical tips for beginners using the ICT Market Maker Sell Model:

✔ Start on Higher Time Frames

Focus on the 1H or 4H chart for a clearer market structure. Smaller time frames often show false signals.

✔ Avoid Overtrading

Don’t force setups. Wait for the full model to develop, including liquidity grab, MSS, and FVG return.

✔ Backtest Your Strategy

Use tools like TradingView’s bar replay to practice identifying the model in past price action. It sharpens your recognition skills.

✔ Use Journaling

Track every trade. Make a note of the market’s structure, entry and exit points, and your rationale. It helps improve your understanding of the model.

✔ Combine with Session Timing

This model works best during London or New York sessions when liquidity is highest.

Conclusion

The ICT Market Maker Sell Model is a powerful tool that gives retail traders insight into how institutional money moves the market. By understanding liquidity sweeps, order blocks, FVGs, and structure shifts, even beginners can enter high-probability trades and avoid common traps.

Consistency and discipline are key. Don’t rush to master everything overnight — instead, focus on one concept at a time and practice regularly.

This 2025 guide aims to help you build a solid foundation in smart money trading so you can trade with clarity, not confusion.

FAQs

Is the ICT Sell Model only for forex?

No, it works well in crypto, indices, and commodities too — anywhere price manipulation by big players is visible.

How long does it take to master the ICT method?

It depends on your effort. For most traders, a period of three to six months is attainable with regular backtesting and research.

Do I need indicators for this model?

Not necessarily. The ICT model is price action-based. However, some traders use volume or session indicators for extra confirmation.

Is it suitable for day trading?

Yes. The model fits scalping, intraday, and swing trading styles, especially when aligned with higher-timeframe bias.