When you trade Forex, spotting a strong reversal signal can be a game‑changer. And that’s exactly what the pin bar strategy helps you do: spot where the price might flip direction, giving you the edge to enter smart, ride the move, and exit cleanly. Let’s dive in.

What Is a Pin Bar?

A pin bar is a powerful single‑candlestick signal showing rejection. Picture a candle with a long tail—or wick—and a small body at one end. This tail indicates that the market attempted to push the price in one direction but was sharply rejected, suggesting that buyers or sellers intervened forcefully. When you see a pin bar, it signals that your reversal strategy could be ready to roll—look out for those trend change clues.

Key Characteristics of a Valid PIN Bar

Not every pin bar is worth your attention. Here’s what you should look for:

A long wick compared to the candle body, usually at least twice as long, showing strong rejection.

The body should sit at one end of the candle; if it’s dead center, avoid it.

This candle appears in a specific context—look for support and resistance, or near a swing high or low. Context is king.

You want lower trading volume during the pin bar itself, and higher volume before it—this tells you there was a real battle, not a random spike.

Best Locations to Trade Pin Bars

Where you find your pin bars matters just as much as spotting them. These prime locations increase your odds:

At major support or resistance zones, the price tends to bounce or flip here.

On a daily, 4‑hour, or 1‑hour chart—using higher timeframes gives more reliable signals.

Near round numbers or pivot levels—big players often target these for reversals, so your pin bar stands out.

After a clear trend, when prices rush one way, a reversal candle at the edge of that trend can be powerful.

Entry & Exit Strategy Using Pin Bars

Once you have spotted a strong pin bar in a top spot, follow this step‑by‑step guide:

- Entry: Enter the trade a few pips above (for bullish) or below (for bearish) the pin bar’s high/low. This confirms you’re jumping in with momentum, not fading against it.

- Stop‑loss: Place it just beyond the opposite end of the wick. This protects you if the signal fails.

- Target/Exit: Aim for at least a 1:2 risk‑to‑reward ratio. You can also scale out in parts or trail your stop to lock in gains as the trade moves.

By combining pin bar entries with sound risk management, you stay in control of your trade outcomes.

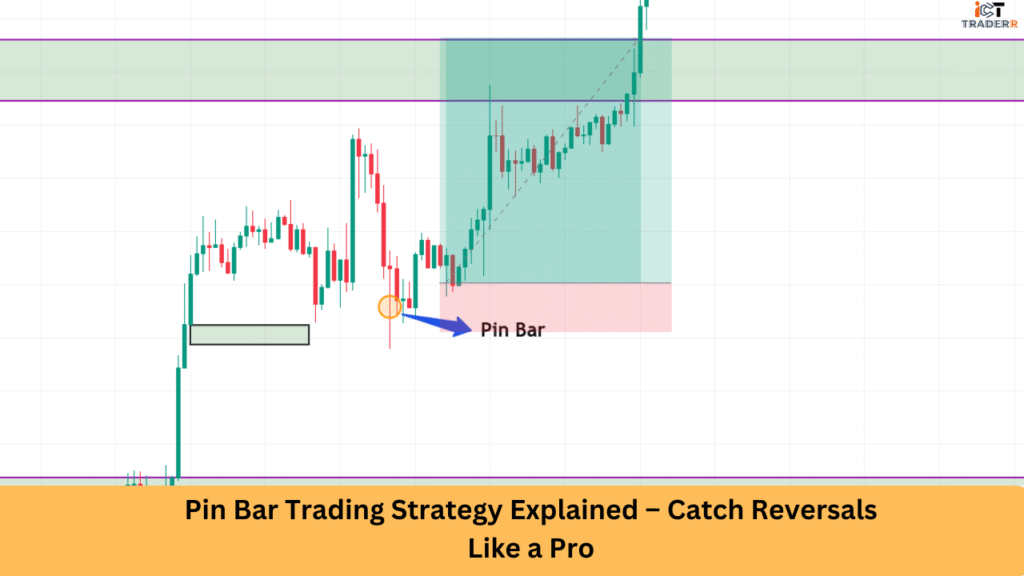

Real Chart Example Breakdown

Let me walk you through a live Forex example. Picture EUR/USD on a 4‑hour chart: price approaches a key support zone. A bullish pin bar appears—long lower wick, compact body near the top end. Volume before the pin bar drops, then rebounds afterward. You enter a few pips above the wick’s high, with a stop just under it. As the pair climbs toward the next resistance, you trail your stop or take partial profits. Result? A clean, smart reversal trade with disciplined execution.

Common Mistakes to Avoid

If you want to trade pin bars like a pro, avoid these errors:

Don’t trade every pin bar. Many fail—look only for ones in strong zones.

Ignoring the overall market structure is a big mistake. If the trend is sharply against you, a pin bar may get crushed.

Avoid using the entry without confirmation. Small delays or confirming wicks help avoid fake‑out trades.

Poor risk management kills accounts. Never risk more than a couple of percent of your account per trade.

Bonus Tip: Combine Pin Bars with Other

Confirmations

Want an edge? Layer in other signals to improve your odds:

Pair pin bars with moving‑average crossovers, RSI divergence, or MACD signals—when these align, your reversal chances go way up.

Look for price action around Fibonacci retracements or trend lines. A pin bar at a 61.8% retrace level? Very powerful.

Multiple time frame alignment? Even better. A pin bar on your 1‑hour chart that matches a daily trendline bounce boosts confidence in the signal.

Conclusion

The pin bar strategy is simple yet powerful when used correctly. By focusing on key locations, clear rejection signals, smart entries and exits, and strong risk management, you can catch reversals like a pro. Treat it as one tool in your Forex toolkit, backed with market context and emotional discipline—and watch your trades improve.

FAQs

Can pin bars be used in any market?

Yes! Whether Forex, stocks, or commodities, pin bars work in all instrument types—on any chart timeframe you prefer.

How big should the pin bar wick be?

Aim for wicks at least twice as long as the candle body. Bigger wicks often mean stronger rejection.

Should I trade pin bars in sideways markets?

Mostly avoid that. Pin bars are strongest in trending or clearly defined trading zones. In choppy markets, false signals are more likely.

What if price breaks my stop‑loss quickly?

That happens sometimes. If multiple stops occur, review your signal quality. Were you ignoring the trend? Did you place your stop too tightly?

Hope this gives you a clear, modern view of pin bar trading. Now you have the tools—go sharpen your entry skills, protect your capital, and make your audience’s Forex journey even more successful!