In technical analysis, it is sometimes the difference between consistent profit and missed opportunities to identify a reliable chart pattern. One such pattern that radiates strength as a bullish continuation pattern is called the Rally Base Rally (RBR). This RBR is accepted by professionals, especially by supply and demand trading, and is considered one of the most valid tools for signaling the continuation of an uptrend.

In this article, we will discuss the Rally Base Rally pattern, how to identify it like a pro, and how to properly make trades with it. In addition, you will discover what common mistakes to avoid while trading the pattern and the answers to some frequently asked questions related to it.

What Is the Rally Base Rally Pattern?

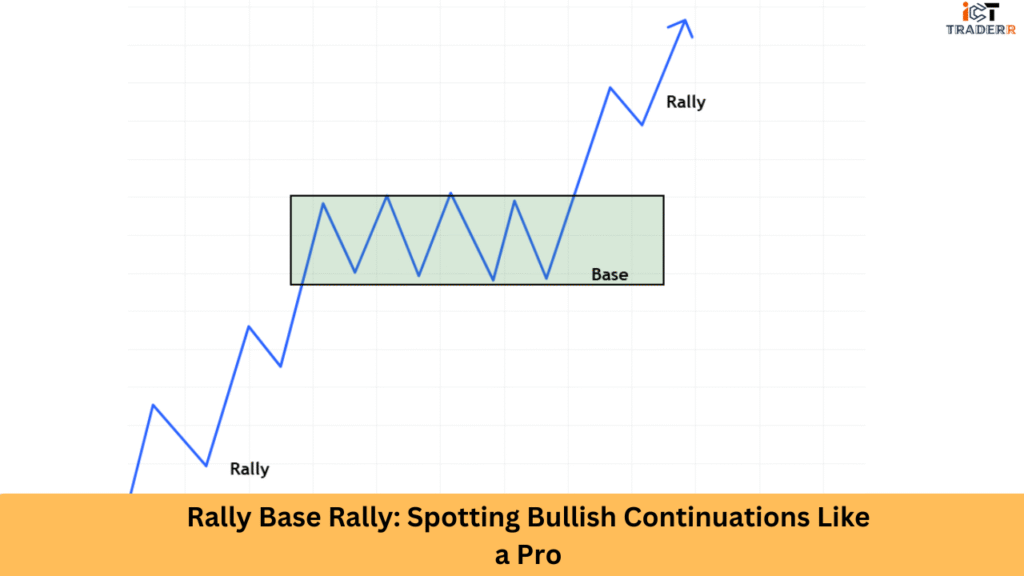

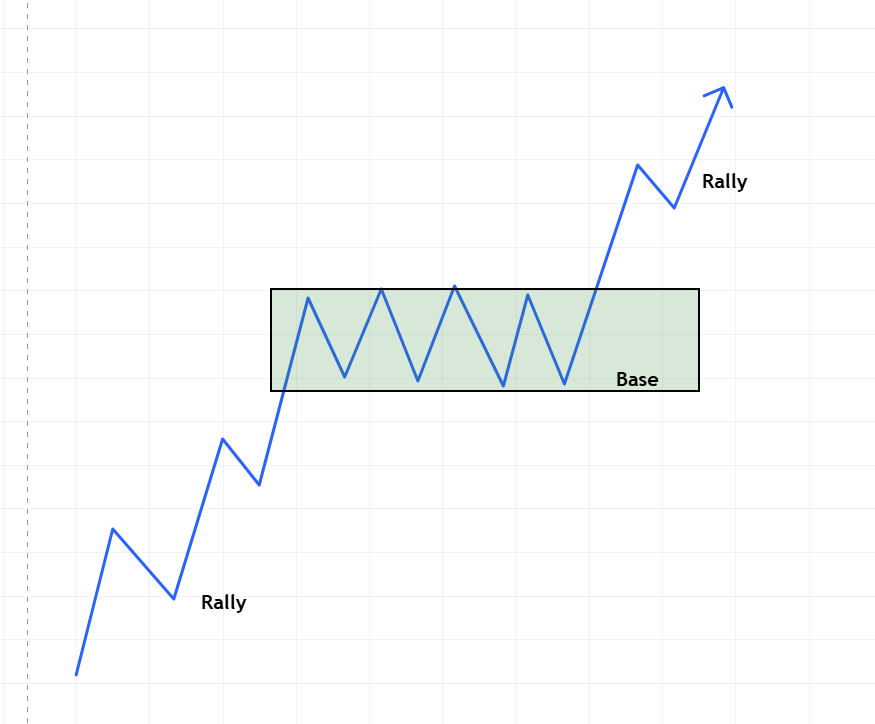

A Rally Base Rally, or RBR for short, is a price action pattern that appears most often on candlestick charts and indicates the continuation of a bullish move.

Rally: A sharp move upwards showing strong buyer interest.

Base: A short consolidation or sideways movement, usually within a narrow range, indicating balance between buyers and sellers.

Rally: Another sharp move upward, breaking out of the base.

This pattern typically forms in demand zones, where institutional or “smart money” you are placing large buy orders. The base acts as a key area where the market pauses before continuing its upward movement.

How to Identify Rally Base Rally Patterns Like a Pro

To spot RBR patterns with confidence, follow these key steps:

1. Use Multi-Timeframe Analysis

Always start by analyzing higher timeframes to identify the dominant bullish trend. Then zoom into lower timeframes to spot precise entries.

2. Look for a Clean Structure

A textbook RBR will have a strong initial rally, a tight and narrow base with small-bodied candles, followed by another impulsive bullish move. Avoid patterns with too much noise or wicks.

3. Mark the Base Zone

Draw a rectangle around the base using the high and low of the consolidation area. This is your demand zone, and it’s where price is likely to react in the future.

4. Volume Confirmation

Look for increased volume during the rallies and reduced volume during the base. This indicates that the market is pausing, not reversing.

By mastering this identification process, you’ll start to see RBR setups all over your charts, especially in trending markets.

Why Rally Base Rally is a Reliable Bullish Continuation Pattern

The RBR pattern is popular among institutional traders because it reveals the market’s intent to continue a move higher after a healthy pause. Here’s why it works so well:

- Smart Money Footprints: The base is often where big players enter their trades. Retail traders may miss it, but professionals know it’s a clue.

- Clear Entry & Stop Loss Placement: You can enter at the base retest and place your stop just below it.

- High Risk-Reward: Because of its strong continuation potential, RBR patterns offer excellent reward-to-risk ratios.

- Works in All Markets: Whether you’re trading forex, stocks, crypto, or commodities, this pattern applies universally.

The psychology of trading also supports this pattern. The pause in price action allows weaker hands to exit and fresh buyers to enter before the trend resumes.

Trading Strategies for Rally Base Rally Pattern

Here are some RBR trading strategies used by professionals:

1. Base Retest Entry

Wait for the price to return to the demand zone (base) and show confirmation (like bullish engulfing or pin bar). Enter at the retest, set a stop loss below the base, and target the next level of resistance.

2. Breakout Pullback Entry

Enter on a break above the base, followed by a pullback. This provides added confirmation that the trend is continuing.

3. Fibonacci Confluence

Combine the base with Fibonacci retracement levels. A base near the 61.8% or 50% level gives stronger confluence.

4. Trendline Support

If a trendline supports the rally, the RBR pattern becomes even more reliable. This technique helps you stay aligned with the overall market structure.

Common Mistakes Traders Make with RBR

Even simple patterns like RBR can trip up traders. Here are the biggest mistakes I see people make:

Ignoring Volume: Volume is your best friend in confirming RBR patterns. Low volume breakouts usually fail, so don’t ignore this crucial signal.

Wrong Timeframes: Day trading RBR patterns on 1-minute charts rarely works. Stick to hourly charts or higher for better results.

Poor Risk Management: Overleveraging can ruin even a perfect setup.

Not Waiting for Confirmation: Jumping in without confirmation often leads to losses.

Misidentifying the Base: If the base is too wide or contains large candles, it’s not valid.

Always remember: patience and discipline are key when trading RBR patterns.

Conclusion

The Rally Base Rally pattern is a powerful tool in any trader’s arsenal. When identified correctly, it serves as a high-probability bullish continuation setup that aligns well with smart money concepts and the principles of supply and demand trading.

Start practicing on paper trades first. Once you can consistently identify good RBR setups, gradually increase your position sizes. The market will always provide new opportunities, so there’s no rush to risk real money until you’re confident.

Keep it simple, follow the rules, and let the pattern do the heavy lifting. Your trading account will thank you.

FAQs

What timeframes work best for RBR patterns?

RBR patterns can form on any timeframe, but they are most reliable on 1-hour, 4-hour, and daily charts.

Can RBR patterns fail?

Yes, like any setup, RBRs can fail, especially if formed against the trend or in low liquidity markets. Always use stop-losses.

How do I differentiate between a Rally Base Rally and a consolidation?

A true base has small-bodied candles and a tight range. Consolidations are broader and can indicate indecision rather than continuation.

Is the RBR pattern suitable for beginners?

Yes, it is a clear, logical pattern with a straightforward entry and exit rule, and can therefore be used at the disposal of any aspiring trader.