If you have been exploring smart money concepts and ICT strategies, then you have probably heard the term “order block.” But what if there was a way to spot those powerful institutional footprints with just a single candle? That’s exactly what the Single Candle Order Block (SCOB) offers—a high-precision price action signal that reveals where the big players are likely entering or exiting the market.

In this article, we will break down exactly what a SCOB is, how you can identify it, when to trade it (and when to avoid it), and how to master this smart money setup like a pro.

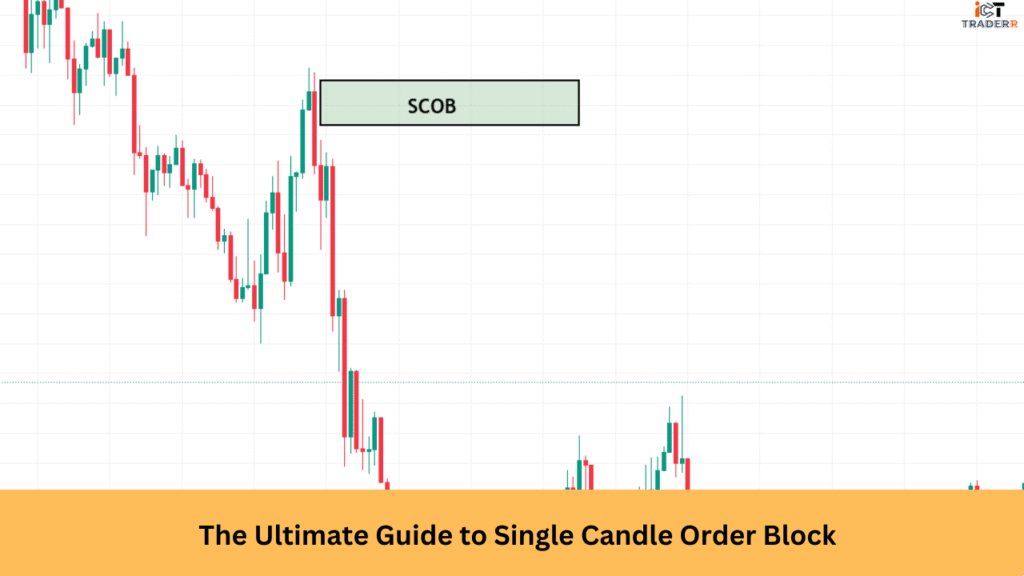

What Is a Single Candle Order Block (SCOB)?

A SCOB is a single candlestick that appears at a point where market sentiment is about to flip, typically at a supply or demand zone. It indicates strong rejection, typically resulting from institutional order flow. When the price returnsproviding to this area later, it often reacts aggressively, giving you a powerful opportunity to enter the market.

Characteristics of a Valid SCOB

Not every candle qualifies as an SCOB. For it to be valid:

- It should have a strong wick, indicating a liquidity sweep.

- It must form in a key area, such as a fair value gap, previous support/resistance, or order block zone.

- The next candle should confirm the reversal (by breaking the high or low of the SCOB).

These traits help you identify only high-probability setups.

How to Identify SCOB on Charts

Bullish SCOB

You’ll often see a bearish candle that dips below previous lows and then gets followed by a bullish engulfing candle. The candle that sweeps the low and causes the reversal becomes the SCOB.

Bearish SCOB

In a bearish scenario, look for a bullish candle that spikes above previous highs, followed by a strong bearish reversal. The candle that triggered the sweep becomes your SCOB.

Once identified, draw a zone around the high and low of that candle. Wait for the price to return to this zone for your entry.

Entry Model Using SCOB (With ICT Style)

Here’s how you can use SCOB to enter like a pro:

- Wait for the retracement – Don’t rush in. Let the price come back to the SCOB zone.

- Look for confirmation – On a lower time frame, wait for market structure to shift (e.g., a break of structure).

- Enter the trade – Once the structure confirms, enter with minimal risk.

- Stop loss – Just outside the SCOB zone.

- Take profit – Aim for the next liquidity pool or previous highs/lows.

This strategy is highly effective if you stay patient and disciplined.

When to Avoid Trading SCOB

There are some scenarios where trading SCOB can lead to losses:

- Sideways markets: Avoid using SCOB in choppy or consolidating zones.

- Already mitigated zones: If the price has already reacted to the SCOB multiple times, the setup weakens.

- During high-impact news: Big announcements can easily break through technical levels, even valid SCOBs.

Recognizing these moments can help you avoid unnecessary losses.

Advanced Tips for SCOB Mastery

Want to take your SCOB skills to the next level? Here are some expert tips:

- Use higher time frames for confirmation: A 4H or Daily SCOB has more power than a 5-minute one.

- Combine with market structure: Align your SCOB trade with the overall trend for better results.

- Look for confluence: If a SCOB aligns with a fair value gap, breaker block, or key Fibonacci level, it becomes much stronger.

- Avoid forcing trades: Not every day will give you a valid SCOB. Wait for clear, clean setups.

- Journal every trade: Track your success rate, entry, and exit conditions to learn what works best for you.

This approach sharpens your edge and keeps your trading rule-based.

Conclusion

The Single Candle Order Block is more than just another trading concept—it’s a hidden gem that gives you direct insight into where institutions place their orders. With proper identification, a solid entry model, and the discipline to wait for ideal conditions, you can turn this strategy into a powerful tool in your trading arsenal.

Practice with demo accounts, master the method step by step, and soon enough, you’ll spot these high-probability zones like a pro.

FAQs

Can I use SCOB on all timeframes?

Yes! But higher timeframes like H1, H4, or Daily provide stronger and more reliable setups.

How tight should my stop loss be?

Place your stop just outside the SCOB zone—this allows you to protect your trade without giving it too much room to fail.

Can I trade only with SCOB?

It’s best used as part of a broader strategy. Combine SCOB with liquidity concepts, structure shifts, and volume for better accuracy.

What is the biggest mistake traders make with SCOB?

Jumping in without confirmation or trading during news events. Always wait for the price to confirm before entering.

How do I become consistent with SCOB trading?

Backtest, follow a set plan, and review your trades regularly. Consistency comes from process, not luck.