Do you have any idea how ICT trading can help you formulate the mastery of analysis and be a better trader? ICT Trading intends to approach the financial markets by understanding factors instigated by institutions, namely liquidity zones, market structure, and order blocks. Smart retail traders, who have been following the concept, have become aware of how institutional players operate in the financial markets.

This article will provide you with everything you want to know about ICT trading. Explain key concepts of ICT trading, How to Start with ICT Trading, trading methods, and how to avoid common mistakes.

What Is ICT Trading?

ICT Trading, or Inner Circle Trader methodology, was created or founded by Michael J. Huddleston, a former institutional trader who intended to change how retail traders look at the market. After years of watching how the big institutions trade, Mr. Huddleston recognized a huge gap between institutional trading practices and those taught to retail traders.

Huddleston developed this approach after observing that most retail traders were fighting a losing battle by following conventional trading wisdom. He noticed that banks, hedge funds, and other major institutions trade differently than what’s commonly taught in trading courses. This led him to create a methodology that helps regular traders understand and align with institutional trading patterns.

What makes ICT Trading unique is its emphasis on order flow, market structure, and institutional price manipulation tactics. Instead of following retail-focused indicators, traders learn to identify key price levels where institutions place their orders and how they engineer market movements to maximize profits.

Key Concepts of ICT Trading

These are the fundamental concepts that form the backbone of ICT Trading methodology. Understanding these key elements will help you trade like institutional players and identify high-probability trading opportunities.

Market Structure

In ICT Trading, market structure is the foundation of price movement analysis. It involves identifying how prices move from higher to lower lows or vice versa, creating a clear map of market behavior. Traders learn to spot key swing points where institutions place their orders and understand how these levels influence future price action. By analyzing market structure, you can identify whether a market is trending, ranging, or about to reverse, helping you make more informed trading decisions.

Liquidity

Liquidity is where institutional orders are filled and where smart money operates. ICT traders focus on liquidity zones, large stop losses, and pending orders accumulate. These zones often exist above major swing highs and below significant swing lows. Understanding liquidity helps you anticipate where institutions might push prices to trigger your stop losses or fill their large orders, creating trading opportunities.

Order Blocks

Order blocks are specific candlesticks or price zones where institutional orders lead to significant market moves. They represent areas where smart money initiated its positions before a major move. ICT traders identify these blocks by looking for sharp price movements and a strong trend. Trading order blocks involves entering positions when the price returns to these zones, anticipating that institutions might defend these levels again.

How to Identify and Trade Using Order Blocks

To identify order blocks, traders look for large bullish or bearish candles followed by a retracement. They use these areas to plan trades, expecting the market to respect or break these levels.

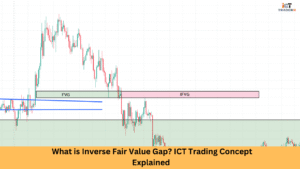

Fair Value Gaps (FVGs)

Fair Value Gaps occur when the price suddenly jumps, leaving an imbalance in the market. These gaps represent areas where the price moved so quickly that normal price discovery was skipped. In ICT Trading, FVGs are seen as areas where the price will likely return to establish “fair value.” Traders look for these gaps on higher timeframes and use them as potential target areas or trade entry zones.

Breakers and Mitigation Blocks

Breakers are former support or resistance levels that have been broken and retested. These areas often become powerful reversal zones as institutional traders use them to trap retail traders. Mitigation blocks are similar but specifically represent areas where smart money needs to fill their orders. Understanding these concepts helps traders identify potential reversal points and high-probability trading opportunities.

Kill Zones

Kill Zones are specific times when institutional activity is highest during the trading day. These periods typically align with major financial centers like London, New York, and Tokyo opening and closing. Trading during kill zones can increase the probability of catching significant moves as this is when institutions are most active in placing orders and moving the market.

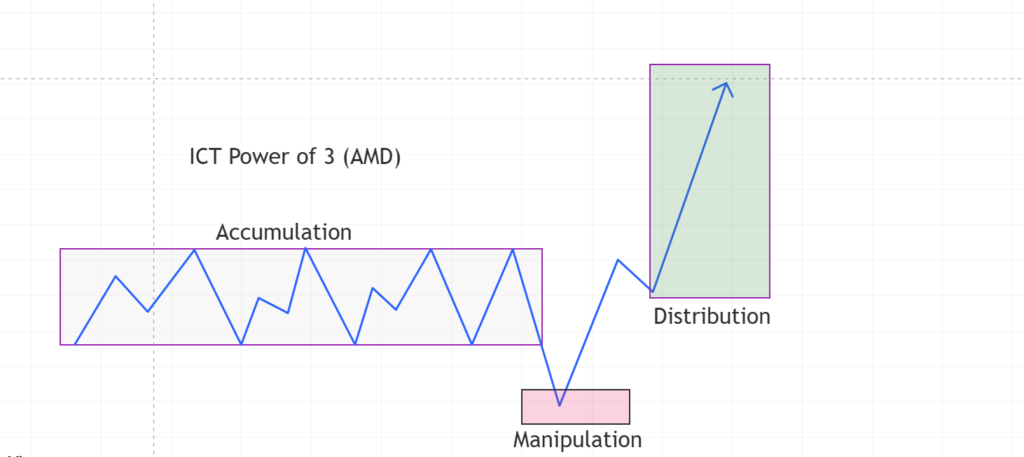

Power of Three (Accumulation, Manipulation, Distribution)

This concept explains how institutions operate in three phases. During accumulation, they quietly build positions at favorable prices. In the manipulation phase, they move prices to trigger retail traders’ stop losses and create liquidity. Finally, in distribution, they offload their positions at a profit to retail traders buying at higher prices. Understanding this cycle helps traders align their positions with institutional activity rather than falling victim to it.

For example, you might see sideways price action with subtle buying pressure during accumulation. This is followed by manipulation, where sharp moves shake out weak hands. Finally, distribution often occurs during strong trends when retail traders are most confident about the market direction.

Pros and Cons of ICT Trading

ICT trading has proven to be beneficial for multiple traders, but it also has its limitations.

Pros of ICT Trading:

- Better Market Understanding: It teaches traders how markets move and why.

- Focuses on Big Players Strategies: It teaches how banks and other institutions operate.

- Less Emotion: Certain rules get traded logically instead of emotionally.

- High Accuracy: Behind the method are concepts such as liquidity zones and order blocks, which help identify strong setups for trade.

- For Everyone: Works for any trader-from initiates to well-experienced.

Cons of ICT Trading:

- Time-Consuming: Sometimes, these concepts could be hard for initiates.

- No Quick Profit: It requires patience and practice for results.

- Very Technical: The whole approach is based on charts and patterns, which may not sit well with everybody.

- Too Strict: Any deviation from one of the ICT concepts can seem very limiting to traders.

How to Start with ICT Trading

Getting started in ICT trading requires a commitment to learning, discipline, patience, and persistence. Things need to focus on some basic concepts and constant practice to make it into the big leagues. So start studying price action and market structure, for they are the foundations of ICT trading. Besides, learning some key concepts regarding liquidity zones, order blocks, and kill zones will better your overall approach to trading.

Writing down your trading plan will ensure another level of accountability in tracking your trade progress. Use demo trading before going into the live market, where you must exercise risk mitigation. Finally, after every trade, check yourself and analyze for improvement these topics are explained on their website, offering you directions that will help you refine your ICT trading skills.

Common Trading Mistakes to Avoid for ICT Analysts

There are some common trading mistakes, but if you avoid them, you can succeed quickly. These are listed below:

Jumping into the Complex: Advanced concepts without a basic understanding of price action and market structure are less likely to succeed.

Overtrading: Trading any and every setup without proper analysis and allowing for more losses in the process.

Risk Management Rejected: Without a stop-loss in the game plan and risking too much for each trade.

Impatience: Expectation of an overnight success without going through a conscious learning and practical process.

Misreading Liquidity Zones: Misjudging areas with deep liquidity could create disastrous entry points for trades.

No Trading Plan: Trading without a coherent plan or keeping a journal to check performance.

Risk Management in ICT Trading

Proper risk management would ensure that your trading account is never completely wiped out. Risk management is the soul of any successful ICT trading as it protects the capital even when a trader faces a string of losses. The following are the main features of risk management concerning ICT trading:

Importance of Stop Loss Orders and Take Profits

Stop losses and profit-taking orders act as cushioning in trading. Stop losses limit potential loss by closing trades automatically at a predecided level, and profit-taking locks in your gain before any adverse market movement occurs. Both of these tools inhibit trading driven by emotions, thereby maintaining discipline in executing one’s strategy. Without them, you risk being overexposed to unpredictable market moves, thus jeopardizing your account.

The Right Risk to Reward Ratio

A risk-to-reward ratio preferably in favor of the trader is said to be a key factor in the long-term success of ICT trading. A good one to consider is a ratio of 1:2, which means that within 1 unit of currency risk, a trader expects to earn 2 units in profit. In such a case, your profits greatly exceed your losses even with a small win rate. One must always conduct a good analysis of trades that present high rewards but come with manageable risks for maximum profit potential.

Managing the Trade Size and Position Sizing in ICT

Position sizing concerns how much your capital can be invested in each trade. To protect yourself against severe drawdown, never risk more than 1%- 2% of your account per trade. Use log size calculators or account equity assessments to assign fitting sizes to your trades based on your risk tolerance. Correct positioning sizing allows you to stay in the market long enough to learn from your trades without being chased out by catastrophic losses.

Conclusion

ICT Trading represents a powerful change in how retail traders can approach the markets. By understanding and implementing institutional trading concepts, you’re no longer just another retail trader following the crowd – you’re learning to trade alongside smart money.

Remember, success in ICT Trading doesn’t happen overnight. It requires dedication, patience, and a willingness to unlearn traditional retail trading habits. Focus on mastering market structure, understanding institutional order flow, and practicing proper risk management. Start with a demo account, keep a detailed trading journal, and gradually implement what you learn.

Whether you’re just starting your trading journey or looking to improve your existing strategy, ICT Trading offers a proven framework for understanding how the biggest players move the markets. Take your time to learn, stay consistent, and always trade with a plan.

Ready to start your ICT Trading journey? Begin with the basics and gradually build your knowledge. The path to institutional-level trading awaits!

Frequently Asked Questions About ICT Trading

What is ICT Trading?

ICT Trading is a method by which Michael Huddleston, otherwise known as “The Inner Circle Trader,” tries to understand market behavior via concepts such as liquidity zones, market structure, and institutional trading strategies. The methodology seeks to give the average trader an insight into how large institutions operate in the financial markets.

What makes ICT Trading different from other trading methods?

Unlike traditional trading methods that might rely heavily on indicators or fundamental analysis, ICT Trading emphasizes the study of price action and market mechanics. It works with institutional trading concepts in an attempt to align retail traders with the very strategies employed by major financial institutions.

Where can I learn about ICT Trading?

Michael Huddleston has put forward a range of educational offerings, including the schooling of videos and tutorials, to trade on ICT Trading concepts; the online communities and forums about trading have also discussed ICTs, with some ideas and shared experiences of other retail traders.

Is ICT Trading Profitable?

ICT Trading can be profitable when properly understood and implemented. However, like any trading methodology, success depends on proper education, practice, and risk management. Traders who master ICT concepts and remain patient with their setups typically see better results than those who rush into trades without understanding institutional movements.

Do I Need Indicators for ICT Trading?

No, ICT Trading primarily focuses on raw price action and market structure rather than traditional indicators. While some traders might use basic tools like moving averages for context, the core ICT methodology relies on understanding institutional order flow and price patterns without indicator dependency.

What’s the Minimum Account Size for ICT Trading?

There’s no strict minimum account size for ICT Trading, but most successful practitioners recommend starting with at least $1,000-$2,000 to properly implement risk management principles. However, it’s crucial to practice on a demo account first until you consistently understand and can identify institutional patterns.